Introduction

The objectives of an accounts payable process are multifaceted, encompassing financial accuracy, efficient operations, and strong vendor relationships. One key goal is to ensure the accurate recording of vendor invoices in the accounting system, maintaining a clear and transparent financial record. Timely payment is another crucial objective, ensuring that vendors are paid within agreed-upon terms to avoid late fees and maintain positive relationships. Effective control mechanisms are established to prevent duplicate or unauthorised payments, ensuring that payments are made only for goods or services received. Cash flow management is also a critical focus, balancing the need to pay vendors on time with the need to maintain adequate cash reserves. By meeting these objectives, companies can effectively manage their financial obligations, strengthen vendor partnerships, and maintain a healthy cash flow position.

How can automation be used to set objectives for the accounts payable process?

Automation can be a powerful tool for setting objectives in the accounts payable process. One way is through the use of automated systems to track and analyze key performance indicators (KPIs) related to accounts payable, such as invoice processing time, accuracy of payments, and compliance with payment terms. These systems can provide real-time data and insights, allowing organizations to set specific, measurable, achievable, relevant, and time-bound (SMART) objectives for their accounts payable process.

Additionally, automation can help streamline accounts payable workflows, reducing manual errors and processing times. By setting objectives related to process efficiency and accuracy, organizations can leverage automation to improve overall performance. Automation can also help identify areas for improvement and optimization within the accounts payable process, enabling organizations to continuously refine their objectives and performance targets.

How do objectives drive accounts payable (AP) strategies?

Objectives drive accounts payable (AP) strategies by providing a clear direction and purpose for the AP function. When objectives are set, AP teams can develop strategies to achieve these objectives effectively. For example, if the objective is to improve efficiency, AP strategies may focus on implementing automation technologies to streamline processes. If the objective is to reduce costs, strategies may include renegotiating payment terms with suppliers or optimizing the use of early payment discounts. Objectives also help AP teams prioritize activities and allocate resources accordingly. By aligning strategies with objectives, AP teams can work towards achieving specific, measurable outcomes that contribute to the overall success of the organization.

Optimize accounts payable for timely and accurate payments.

Talk to our experts

How is the role of the accounts payable process evolving?

The role of accounts payable (AP) is evolving significantly as businesses increasingly adopt automation and digital transformation in their financial operations. Some key trends and changes in the AP function include:

- Automation: Automation technologies such as robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML) are being used to streamline AP processes. These technologies can automate invoice processing, payment approvals, and reconciliation, reducing manual effort and errors.

- Digitization: AP is becoming more digitized, with paper-based processes being replaced by electronic invoicing and digital payment methods. This shift improves efficiency, reduces costs, and enables better tracking and management of invoices and payments.

- Data Analytics: AP is increasingly leveraging data analytics to gain insights into spending patterns, identify cost-saving opportunities, and improve decision-making. Advanced analytics can also help detect anomalies or fraud in AP transactions.

- Supplier Relationship Management: AP is playing a more strategic role in managing supplier relationships. By optimizing payment terms, negotiating discounts, and ensuring timely payments, AP can contribute to better supplier partnerships and supply chain efficiency.

- Compliance and Risk Management: AP is becoming more focused on compliance and risk management. With increasing regulatory requirements and the need to prevent fraud, AP teams are implementing stricter controls and monitoring processes.

- Integration with ERP Systems: AP is being integrated more closely with enterprise resource planning (ERP) systems, enabling seamless data sharing and process automation across departments. This integration improves visibility, efficiency, and data accuracy.

- Focus on Cost Savings: AP is increasingly being tasked with finding cost-saving opportunities. By optimizing payment processes, leveraging early payment discounts, and reducing late payment fees, AP can contribute directly to the bottom line.

Overall, the evolving role of accounts payable is becoming more strategic and technology-driven, focusing on efficiency, compliance, cost savings, and supplier relationship management.

Strengthen supplier relationships with efficient payment processing.

Talk to our experts

Why is setting goals for accounts payable crucial?

Setting goals for accounts payable (AP) is crucial for several reasons:

- Performance Measurement: Goals provide a benchmark for measuring the performance of the AP function. They help assess how effectively AP is managing processes, resources, and vendor relationships.

- Focus and Prioritization: Goals help AP teams focus on key priorities and activities that align with the organization’s objectives. They ensure that efforts are directed towards achieving strategic outcomes.

- Continuous Improvement: Goals drive continuous improvement by identifying areas for enhancement in AP processes, such as reducing processing times, improving accuracy, and enhancing controls.

- Cost Management: Setting goals related to cost reduction and efficiency improvements can help AP contribute to overall cost management efforts within the organization.

- Compliance and Risk Management: Goals related to compliance with regulatory requirements and risk management help ensure that AP processes are conducted ethically and in accordance with legal standards.

- Supplier Relationships: Goals focused on managing supplier relationships can help AP build strong partnerships with vendors, leading to better terms, discounts, and service levels.

- Alignment with Organizational Objectives: Setting goals that align with the organization’s overall objectives ensures that AP is contributing to the company’s success and growth.

Overall, setting goals for accounts payable is essential for driving performance, ensuring alignment with organizational objectives, and supporting continuous improvement in AP processes.

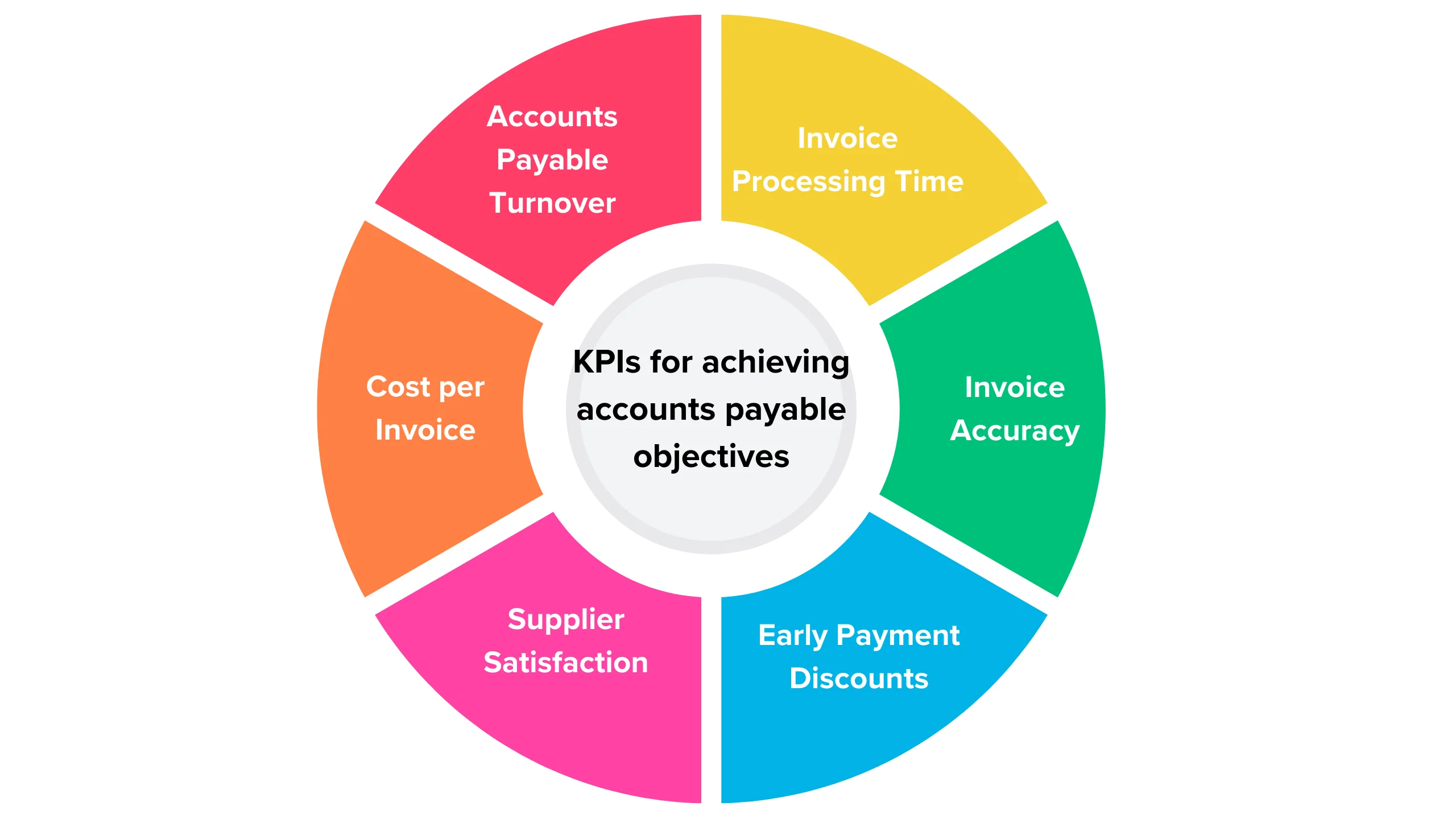

What are the key metrics and KPIs for achieving accounts payable objectives?

Key metrics and key performance indicators (KPIs) for achieving accounts payable objectives include:

- Invoice Processing Time: The average time taken to process an invoice from receipt to payment. This metric indicates the efficiency of the AP process.

- Invoice Accuracy: The percentage of invoices processed without errors. This metric measures the accuracy of data entry and processing.

- Early Payment Discounts: The percentage of invoices eligible for early payment discounts that are actually paid early. This metric reflects the effectiveness of cash management practices.

- On-Time Payments: The percentage of invoices paid on or before the due date. This metric indicates how well AP is managing payment terms and avoiding late fees.

- Invoice Cycle Time: The average time it takes for an invoice to be approved for payment. This metric measures the speed of the approval process.

- Duplicate Payments: The percentage of invoices that are paid more than once. This metric indicates the effectiveness of controls to prevent duplicate payments.

- Supplier Satisfaction: Feedback from suppliers on the AP process, including responsiveness, accuracy, and timeliness. This metric reflects the quality of supplier relationships.

- Cost per Invoice: The average cost to process a single invoice. This metric helps identify opportunities to reduce processing costs.

- Discount Capture Rate: The percentage of available early payment discounts that are captured. This metric indicates the effectiveness of discount management practices.

- Accounts Payable Turnover: The ratio of total purchases to average accounts payable. This metric measures how quickly AP is paying off its obligations to suppliers.

These metrics and KPIs provide a comprehensive view of the performance of the accounts payable function and help organisations track progress towards their AP objectives.

What are some examples of industry-specific accounts payable objectives?

Industry-specific accounts payable objectives can vary based on the nature of the business and its specific needs. Here are some examples across different industries:

- Retail: Implementing automated invoice processing to handle a high volume of supplier invoices efficiently, reducing processing time and errors.

- Manufacturing: Streamlining the procurement process to ensure timely delivery of raw materials and components, reducing production delays.

- Healthcare: Ensuring compliance with regulatory requirements, such as HIPAA, in processing invoices from healthcare providers and suppliers.

- Hospitality: Optimising cash flow by negotiating favourable payment terms with suppliers and managing expenses effectively to maintain profitability.

- Construction: Managing subcontractor invoices and payments to ensure timely completion of projects within budget.

- Technology: Implementing electronic invoicing and payment systems to improve efficiency and reduce costs associated with paper-based processes.

- Education: Implementing cost-saving measures, such as bulk purchasing, to reduce expenses related to supplies and services.

- Government: Ensuring transparency and accountability in the procurement process, adhering to strict budgetary constraints and regulations.

- Non-profit: Managing expenses efficiently to maximize the impact of donations and grants, ensuring financial sustainability.

- Financial Services: Implementing robust fraud detection measures to prevent unauthorized payments and protect sensitive financial information.

These examples illustrate how accounts payable objectives can be tailored to meet the unique needs and challenges of different industries, emphasizing efficiency, compliance, and cost management.

Ensure compliance and cost efficiency in your accounts payable process.

Talk to our experts

FAQS

1. How does the accounts payable process contribute to financial management?

The accounts payable process contributes to financial management by ensuring that the company pays its vendors accurately and on time, which helps maintain good relationships with suppliers and manage cash flow effectively.

2. How can accounts payable contribute to cost savings for a company?

Automation plays a significant role in achieving the objectives of the accounts payable process by streamlining processes, reducing errors, and improving efficiency. It helps in accurate recording of invoices, timely payments, and effective cash flow management.

3. How can organizations measure the effectiveness of their accounts payable process?

Organizations can measure the effectiveness of their accounts payable process by tracking key performance indicators (KPIs) such as invoice processing time, accuracy of payments, and compliance with payment terms.

4.What are some best practices for optimizing the accounts payable process?

Some best practices for optimizing the accounts payable process include implementing automation, establishing clear policies and procedures, regularly reviewing and updating vendor information, and conducting regular audits.

5. How can organizations ensure compliance with regulatory requirements in their accounts payable process?

Organizations can ensure compliance with regulatory requirements in their accounts payable process by staying informed about relevant regulations, implementing internal controls, and conducting regular audits to identify and address any compliance issues.

Share a few details about your project, and we’ll get back to you soon.

Let’s Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)