Introduction

In Austria, online gambling winnings are generally tax-free for players if they come from licensed and regulated platforms within the European Economic Area (EEA), but winnings from unlicensed or illegal gambling platforms may attract taxes and penalties. This article breaks down everything you need to know about the tax treatment of online gambling winnings in Austria to help you understand your obligations and rights.

Online gambling has grown significantly in Austria, offering players the chance to enjoy casino games, sports betting, and lotteries from the comfort of their homes. However, with these opportunities come questions about taxation and compliance with Austrian law. Understanding the tax rules around online gambling winnings is essential for players to avoid unexpected penalties and fully enjoy their earnings.

Build the Ultimate Gambling App Today!

Let SDLC CORP turn your vision into a reality with cutting-edge app development.

Understanding Taxation Laws for Online Gambling in Austria

Austria has a well-defined tax system, and gambling winnings are treated differently depending on their source. The country’s gambling laws distinguish between games of chance and games of skill, which directly impact the taxation rules.

Games of Chance vs. Games of Skill

- Games of Chance: These include activities such as slot machines, online casino games, and lotteries. Since these games are primarily luck-based, winnings from regulated and licensed platforms are tax-free for the players.

- Games of Skill: Activities like professional poker or certain eSports betting could be categorized as games of skill. For these, winnings might be considered taxable if they qualify as a professional income.

Licensed vs. Unlicensed Platforms

- Licensed Platforms: Austria’s government oversees gambling operators to ensure compliance with local laws. Winnings from licensed platforms within the EEA are tax-free for individuals.

- Unlicensed Platforms: Winnings from platforms operating outside the EEA or without a license may require the player to declare them as taxable income.

Tax-Free Online Gambling Winnings in Austria

The Austrian Tax Authority treats online gambling winnings from regulated platforms within the EEA as non-taxable. This policy encourages players to use legal, licensed platforms for their online gambling activities.

Why Are These Winnings Tax-Free?

The government considers gambling as a recreational activity rather than a source of income for individuals. Taxes are already applied to gambling operators in the form of license fees and revenue-based taxes, so players are exempted to avoid double taxation.

What Platforms Qualify?

- Austrian-licensed online casinos

- EU-based online gambling platforms that operate legally within the EEA

By using these platforms, players can confidently enjoy their winnings without worrying about taxation.

Ready to Launch Your Gambling App?

Partner with SDLC CORP for seamless, secure, and engaging app development.

When Are Online Gambling Winnings Taxable in Austria?

While most gambling winnings are tax-free, certain situations may trigger taxation. These include:

Winnings from Unlicensed Platforms

- If you win money on a platform not authorized by the Austrian government or operating outside the EEA, you are legally required to declare the winnings as part of your income.

- Failure to report such earnings can lead to penalties and fines.

Professional Gambling

- If gambling is your primary occupation and generates consistent income, your winnings may be classified as business income.

- In this case, the income is subject to progressive income tax rates, ranging from 20% to 55%.

Other Considerations

- Foreign Winnings: If you gamble on a platform based outside the EEA, consult a tax advisor to determine your liability.

- Additional Income: Large winnings that significantly alter your financial status may require reporting.

How to Declare Taxable Winnings

If your winnings are taxable, it is crucial to follow the proper procedure to avoid legal issues. Here’s a step-by-step guide:

Step 1: Calculate Your Winnings

- Keep a detailed record of your gambling activity, including deposits, bets, and payouts.

- Calculate the net winnings (total winnings minus losses).

Step 2: File Your Income

- Declare the winnings in your annual income tax return under the appropriate section.

- Use Austria’s official tax portal (FinanzOnline) for a convenient filing process.

Step 3: Pay the Applicable Tax

- Pay the tax amount owed based on your declared income and Austria’s progressive tax rates.

Penalties for Failing to Declare Taxable Winnings

The Austrian tax authority takes non-compliance seriously. If you fail to declare taxable winnings, you may face:

- Fines: Monetary penalties based on the amount of unpaid taxes.

- Legal Action: Severe cases of evasion could lead to criminal charges.

- Interest Charges: Additional costs for delayed payments.

To avoid these consequences, ensure you understand and fulfill your tax obligations.

How Gambling Operators Are Taxed in Austria

While players often enjoy tax-free winnings, gambling operators are subject to strict tax regulations. This ensures that the industry contributes to the national economy.

Tax Rates for Operators

- Operators are required to pay a 5% gaming tax on their gross revenue.

- Online platforms must also comply with additional licensing fees and regulations.

Impact on Players

The taxation of operators indirectly benefits players, as it allows governments to maintain tax-free policies for individual winnings.

Tips to Ensure Compliance with Tax Laws

To enjoy a stress-free online gambling experience in Austria, consider these tips:

- Choose Licensed Platforms: Always gamble on platforms that are licensed within Austria or the EEA.

- Keep Records: Maintain clear records of all your gambling activities to ensure transparency.

- Consult a Tax Advisor: For professional or international gambling, seek expert advice to clarify your obligations.

- Stay Updated: Tax laws can change, so stay informed about the latest regulations.

Transform Your Gambling Ideas into Action!

Work with SDLC CORP for expert app development tailored to your needs.

Conclusion

In Austria, most online gambling winnings are tax-free, provided they come from licensed platforms within the EEA. However, winnings from unlicensed or illegal platforms, as well as professional gambling income, may be subject to taxation. By understanding the rules and choosing licensed operators, you can enjoy your online gambling experience without worrying about tax complications.

If you are ever in doubt, consult a tax advisor to ensure compliance with Austrian tax laws. Enjoy your winnings responsibly and securely!

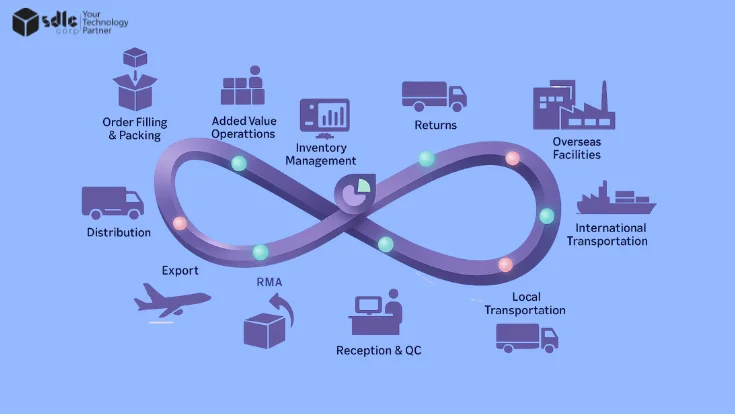

SDLC CORP Gambling App Development Services

SDLC CORP specializes in crafting custom gambling apps that deliver seamless user experiences, high security, and innovative features. From concept to launch, we provide end-to-end development services tailored to meet the unique needs of online gambling platforms. Whether you’re looking to create a casino, sports betting, or lottery app, SDLC CORP ensures your app is optimized for performance, scalability, and compliance with industry regulations.

Service | Description | Link |

Betting Software Development Services | Tailored software solutions for developing secure and scalable betting platforms. | |

Sports Betting App Development | Custom mobile apps for sports betting with real-time updates, live odds, and smooth user experiences. | |

Gambling Software Development Services | End-to-end gambling app development for various casino games, sports betting, and online gambling solutions. | |

Betting App Development Company | Specialized company for developing betting apps with a focus on seamless UX/UI, high performance, and regulatory compliance. | Betting App Development Company |

Game Development Company | A full-service game development company offering innovative solutions for creating engaging casino and betting games. | Game Development Company |

Hire Casino Game Developer | Hire expert casino game developers to create immersive, customizable, and high-performing casino games. | Hire Casino Game Developer |