Introduction

Online gambling in Spain is a thriving industry, with millions of individuals placing bets on various platforms, ranging from sports betting to casino games. With the surge in popularity of online betting comes the essential question of how gambling winnings are taxed. Whether you are a casual bettor, a professional gambler, or a business involved in Betting Software Development or Sports Betting App Development, understanding Spain’s tax regulations concerning gambling winnings is crucial to ensure compliance and avoid any unwanted surprises.

This comprehensive guide will explore the tax implications of online gambling winnings in Spain, providing a detailed breakdown of the rules, obligations, and responsibilities for players and operators. Additionally, we will examine the role of Gambling App Development Agencies and Betting Software Development Agencies in helping gambling platforms remain compliant with Spanish tax laws.

The Legal Landscape of Gambling in Spain

Before diving into the specifics of taxation, it’s important to understand the legal environment surrounding online gambling in Spain. The country has established a robust legal framework for gambling, which covers both land-based and online activities.

Unlock Expert Game Development Services Today!

Game development services offer end-to-end solutions for creating engaging, high-quality games across platforms.

Gambling Laws in Spain

Spain regulates gambling activities at both the national and regional levels. The Spanish Gambling Act (Ley 13/2011) governs online gambling in the country, and it establishes the legal framework for operators offering services to Spanish residents. This act covers online sports betting, casino games, poker, and other forms of online gambling. Additionally, each of Spain’s autonomous communities (regions) can impose specific regulations concerning gambling.

To operate legally in Spain, gambling operators must obtain a license from the Dirección General de Ordenación del Juego (DGOJ), the government body responsible for regulating gambling. This ensures that all online gambling platforms comply with Spanish law, which includes paying taxes on their earnings and ensuring consumer protection.

Legal Online Gambling Platforms

For an online gambling platform to be legal in Spain, it must be licensed by the DGOJ. Unlicensed or offshore platforms are prohibited from offering their services to Spanish residents. If a Spanish player chooses to gamble on an illegal site, they risk not only losing their winnings but also potential legal repercussions.

It is also important to note that Spain has strict advertising laws regarding gambling. Only licensed operators are allowed to advertise their services, and even then, the advertisements must adhere to stringent guidelines that ensure responsible gambling.

Taxation of Online Gambling Winnings in Spain

Spain has a distinct approach when it comes to the taxation of online gambling winnings. Unlike some other countries, where gambling winnings are heavily taxed, Spain has a more player-friendly tax system that distinguishes between professional and recreational gamblers. Understanding this distinction is key to determining how your winnings will b

Taxation of Winnings for Recreational Gamblers

For the majority of recreational gamblers, the good news is that winnings from online gambling are generally not taxed in Spain. Spanish residents do not have to pay taxes on their gambling winnings unless they are classified as professional gamblers.

However, this does not mean that all gambling winnings are exempt from taxation. If a gambler’s winnings are deemed to be part of a business operation or if they earn money consistently and on a regular basis, they may be subject to income tax.

Professional Gamblers and Taxable Income

- Professional gamblers in Spain are those who engage in gambling activities with the intention of making a profit. If a person’s gambling activities are considered a professional business, the winnings will be subject to income tax. This could apply to individuals who earn money consistently by using a system or method for gambling, such as sports betting, poker, or other forms of betting.

- For example, if a gambler has developed or employed a system that consistently generates profits, this might be classified as a professional activity. In such cases, the gambler would need to report their winnings as income and pay the appropriate taxes.

- For professional gamblers, the income tax rates apply just like any other self-employed individual. The income would be subject to Spain’s progressive tax rates, which range from 19% to 47% depending on the amount earned. The more the individual wins, the higher the percentage of tax they will need to pay.

Tax Implications for Gambling Operators

The taxation of gambling winnings is not limited to individual gamblers. Operators who run online gambling platforms, including those offering Soccer Betting App Development Services or other betting-related applications, are also subject to taxes on their earnings. These businesses must pay taxes on their gross revenue, and their activities are closely monitored by the Spanish tax authorities.

Corporate Tax for Gambling Operators

- Gambling operators in Spain, whether they are engaged in sports betting, online casino games, or other types of gambling, must pay corporate income tax on their profits. The standard corporate tax rate in Spain is 25%. This means that any profits made by a gambling business are subject to this tax.

- Additionally, gambling operators may be subject to other taxes, including Value Added Tax (VAT). However, the Spanish VAT rate for gambling activities is often set at 0% or exempt, as it is considered a special category of service under EU law.

Tax on Betting Revenue

- In Spain, online sports betting platforms and other gambling operators are also subject to specific taxes on their betting revenue. The tax rate for sports betting can vary depending on the type of betting and the region where the operator is based. In general, the tax rates for sports betting can range from 15% to 25% of the operator’s revenue.

- For example, a Betting Software Development Agency that creates a platform for online sports betting will need to account for these taxes when calculating its net earnings. The platform operator will also need to ensure that tax is appropriately levied on the bettors’ stakes and winnings.

Hire skilled casino game developers to create engaging, high-quality casino games like slots, poker, and blackjack that captivate players.

Gambling Tax on Winnings from Foreign Platforms

What happens if a Spanish resident wins money from a foreign gambling platform? In most cases, the tax rules governing gambling winnings still apply, even if the platform is based outside of Spain. However, foreign operators that are not licensed in Spain may be less transparent about tax reporting and compliance.

If an individual wins money from an offshore platform, they must still report their winnings to the Spanish tax authorities, especially if the winnings are large or if the gambling activity is deemed to be a professional pursuit. In such cases, the winnings are considered taxable income, and the individual must include them in their annual tax returns.

Reporting Gambling Winnings to the Spanish Tax Authorities

While Spain does not tax casual gambling winnings, there are instances where winnings must be reported, particularly for professional gamblers. In such cases, the individual must declare their winnings on their annual income tax return (Declaración de la Renta). The Spanish tax authorities expect individuals who earn significant amounts from gambling to accurately report their income, and failure to do so could result in fines or penalties.

For businesses involved in Betting Software Development or Gambling App Development, it’s crucial to maintain accurate financial records and ensure that taxes are paid on the revenue generated from gambling services. In Spain, this also includes complying with advertising regulations and ensuring that no gambling taxes are evaded by misreporting income or under-declaring profits.

The Role of Gambling App Developers and Betting Software Providers

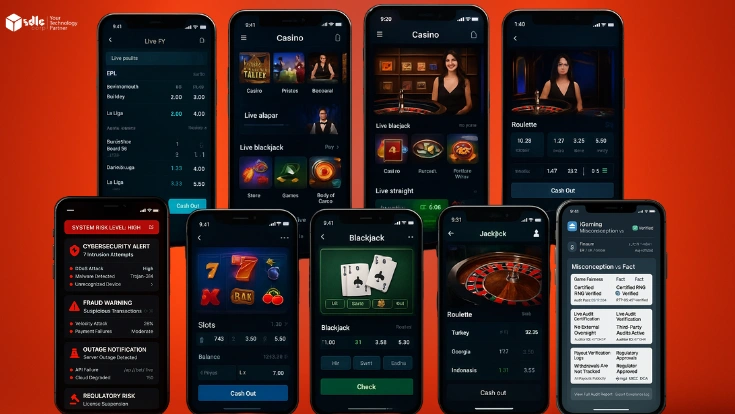

As the gambling industry in Spain expands, so does the need for innovative and user-friendly platforms. Betting Software Development Agencies and Sports Betting App Developers play an essential role in the success of gambling platforms by designing and developing software solutions that ensure a seamless and compliant gambling experience.

Tax Compliance for Developers

For developers working in the gambling space, whether involved in Soccer Betting App Development Services or other forms of gambling app development, it’s important to understand the tax regulations that apply to their business. If a Betting Software Development Agency develops a platform that facilitates gambling, they are responsible for ensuring the platform complies with Spanish tax laws, including any revenue-sharing or commission-based structures with operators.

The revenue generated by these agencies will be subject to corporate tax rates, and any income derived from gambling-related services should be reported as part of the business’s overall income. This makes it essential for software developers to maintain detailed records of their earnings, expenses, and tax liabilities.

Security and Compliance in Gambling Software

Developers who create gambling apps also need to focus on the technical aspects of ensuring compliance with local laws. This includes creating secure payment systems, implementing responsible gambling features, and ensuring that the platform is licensed by the appropriate regulatory bodies. A Gambling App Development Agency must consider these legal and security requirements when developing software for the Spanish market.

Additionally, as gambling becomes more mobile, sports betting apps have become increasingly popular in Spain. Developers specializing in Sports Betting App Development must ensure that these platforms adhere to Spanish laws governing sports betting, including those related to advertising and consumer protection.

The Future of Gambling Taxation in Spain

As online gambling continues to grow in Spain, it’s possible that the Spanish tax authorities will introduce changes to the current tax system. This could include new taxes, adjustments to existing rates, or stricter enforcement of tax reporting requirements. For businesses involved in gambling software development, staying ahead of these changes will be crucial.

Developers will need to ensure that their platforms remain adaptable to any shifts in tax law. This may involve implementing new systems for tax reporting or adjusting the way revenue is shared with operators.

Boost Profits with Expert Betting App Services!

Comprehensive betting app development services for secure, user-friendly apps with real-time odds, analytics, and engaging features.

Conclusion

The tax implications of online gambling winnings in Spain are relatively straightforward for most players. Casual gamblers do not typically face taxes on their winnings, but professional gamblers must report their income and pay taxes accordingly. Gambling operators, including those providing Betting Software Development and Sports Betting App Development services, are subject to corporate taxes and other specific taxes on their betting revenue.

While Spain has a favorable tax regime for casual bettors, businesses in the gambling industry must ensure compliance with a range of taxes and regulatory requirements. By understanding the tax rules and remaining proactive in meeting their obligations, both players and operators can avoid legal.

How can SDLCCORP Help to Online Betting Site ?

SDLCCORP offers comprehensive Betting Software Development Services, ensuring secure and scalable platforms tailored to your needs. With expertise in Sports Betting App Development, they create feature-rich apps for real-time betting experiences. Their Gambling Software Development Services include innovative tools like AI-powered analytics and blockchain integration for transparency. As a leading Betting App Development Company, SDLCCORP delivers customized solutions for niche markets like Football Betting App Development, enhancing user engagement and profitability. From seamless payment systems to robust backend support, SDLCCORP empowers online betting sites to thrive in a competitive industry.

| Service | Description | Link |

|---|---|---|

| Betting Software Development Services | Tailored software solutions for developing secure and scalable betting platforms. | Betting Software Development Services |

| Sports Betting App Development | Custom mobile apps for sports betting with real-time updates, live odds, and smooth user experiences. | Sports Betting App Development |

| Gambling Software Development Services | End-to-end gambling app development for various casino games, sports betting, and online gambling solutions. | Gambling Software Development Services |

| Betting App Development Company | Specialized company for developing betting apps with a focus on seamless UX/UI, high performance, and regulatory compliance. | Betting App Development Company |

| Game Development Company | A full-service game development company offering innovative solutions for creating engaging casino and betting games. | Game Development Company |

| Hire Casino Game Developer | Hire expert casino game developers to create immersive, customizable, and high-performing casino games. | Hire Casino Game Developer |