Introduction

An invoice is a document that lists the products or services provided by a seller to a buyer, along with the quantities, prices, and other relevant details of the transaction. It serves as a record of the sale and specifies the terms of payment. In business, invoices are used as a request for payment and as a proof of sale. They typically include information such as the invoice number, date, payment due date, and details of the buyer and seller.

What is the purpose of using an invoice?

The purpose of using an invoice is:

- Record of Transaction: An invoice serves as a formal record of the transaction between a seller and a buyer. It documents the products or services provided, their quantities, prices, and any applicable taxes or discounts.

- Request for Payment: It serves as a request for payment from the buyer to the seller. By issuing an invoice, the seller notifies the buyer of the amount owed and provides the necessary details for making payment.

- Legal Protection: In case of disputes or discrepancies, an invoice can serve as evidence of the agreed-upon terms and conditions of the sale. It helps protect both the buyer and the seller by providing a clear record of the transaction.

- Accounting and Bookkeeping: Invoices play a crucial role in accounting and bookkeeping processes. They are used to track revenue, expenses, and outstanding payments, facilitating accurate financial reporting and analysis.

- Payment Tracking: Invoices help track payments and outstanding balances. They often include payment terms and due dates, allowing both parties to monitor payment status and take appropriate actions, such as sending reminders for overdue payments.

- Inventory Management: Invoices can also be used to track inventory levels, especially for businesses that sell physical products. By recording product quantities sold on invoices, businesses can monitor stock levels and make informed decisions about restocking.

Overall, invoices are essential documents for conducting business transactions efficiently, transparently, and legally.

What are the types of invoices?

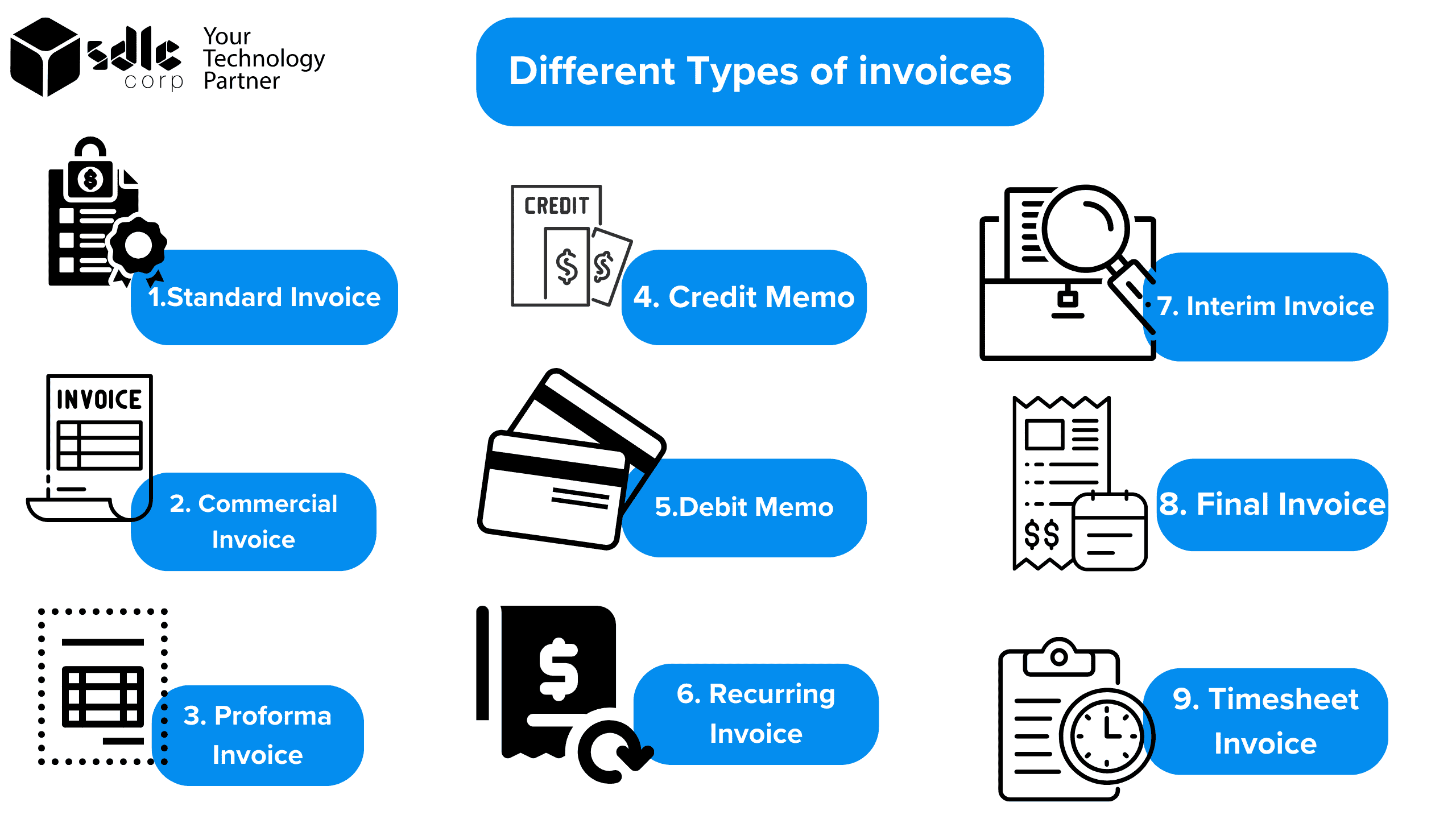

There are several types of invoices that businesses use for different purposes. Here are some common types:

- Standard Invoice: This is the most basic type of invoice, used to request payment for goods or services provided.

- Commercial Invoice: Used in international trade, this document is used to calculate customs duties and taxes.

- Proforma Invoice: Similar to a standard invoice, but used to provide a quote or estimate to a customer before the actual sale occurs.

- Credit Memo: Also known as a credit note, this document is issued by a seller to a buyer, indicating that a credit has been applied to the buyer’s account.

- Debit Memo: Similar to a credit memo, this document is used to notify a buyer of a debit to their account.

- Recurring Invoice: Used for ongoing services or subscriptions, these invoices are generated at regular intervals (e.g., monthly or quarterly).

- Interim Invoice: Used for long-term projects, these invoices are issued periodically to request payment for work completed up to a certain point.

- Final Invoice: Issued at the completion of a project or sale, this invoice requests payment for the remaining balance.

- Timesheet Invoice: Used by service providers to bill clients based on hours worked.

- Expense Report: Used to request reimbursement for expenses incurred by an employee or contractor.

These are just a few examples, and the specific types of invoices used can vary based on the nature of the business and its accounting practices.

What are the essential elements of an invoice?

The essential elements of an invoice include:

- Header: Contains the word “Invoice,” a unique invoice number, the invoice date, and the due date for payment.

- Sender Information: Includes the name, address, contact information, and possibly the logo of the company or individual sending the invoice.

- Recipient Information: Includes the name, address, and contact information of the customer or client receiving the invoice.

- Itemised List of Products or Services: A detailed description of each product or service provided, including quantity, unit price, and total price for each item.

- Total Amount Due: The sum of all charges for products or services provided, including any taxes or discounts.

- Payment Terms: Specifies the acceptable methods of payment, such as bank transfer, credit card, or check, and any late payment fees or discounts for early payment.

- Terms and Conditions: Any additional terms and conditions related to the sale, such as return policies or warranties.

- Invoice Footer: May include additional information, such as a thank you message, or instructions for how to contact the sender with questions or concerns.

These elements are crucial for ensuring that the invoice is clear, accurate, and legally compliant.

Get paid faster - automate your invoicing today!

Importance of Invoice in accounting

In accounting, invoices play a crucial role in several ways:

- Record Keeping: Invoices serve as a record of a transaction between a seller and a buyer. They provide details of the products or services sold, the quantities, prices, and terms of sale. This information is essential for accurately recording revenue, expenses, and inventory.

- Revenue Recognition: Automated Invoice processing help determine when revenue should be recognized in the accounting records. Revenue is typically recognized when goods are delivered or services are rendered, as indicated on the invoice.

- Accounts Receivable: Invoices create a record of the amount owed by customers, which is known as accounts receivable. Tracking accounts receivable is important for managing cash flow and following up on unpaid invoices.

- Tax Compliance: Invoices provide important information for calculating and reporting taxes, such as sales tax or VAT. They serve as supporting documentation for tax filings and audits.

- Payment Tracking: Invoices help track payments from customers. They provide a reference point for matching payments to specific sales transactions and identifying outstanding balances.

- Dispute Resolution: Invoices can be used as evidence in case of disputes between a seller and a buyer regarding the terms of a sale, such as pricing, quantities, or delivery dates.

Overall, invoices are critical documents in accounting as they provide a detailed record of sales transactions, support revenue recognition, facilitate accounts receivable management, ensure tax compliance, track payments, and help resolve disputes.

What are the Benefits of using an invoice?

Using invoices offers several benefits for businesses, including:

- Professionalism: Invoices create a professional image for your business and help build trust with clients by providing a clear and formal record of the transaction.

- Organisation: Invoices help you stay organised by keeping track of sales, payments, and outstanding balances. They provide a clear record of financial transactions, making it easier to manage your accounts receivable.

- Payment Tracking: Invoices provide a clear record of the amount owed by each client and the due dates for payments. This makes it easier to track payments and follow up on overdue invoices.

- Legal Protection: Invoices serve as a legal record of the goods or services provided, the terms of the sale, and the agreed-upon price. They can be used as evidence in case of disputes or legal issues.

- Financial Planning: Invoices provide valuable information for financial planning and budgeting. They help you track your income and identify trends in your sales and cash flow.

- Tax Compliance: Invoices provide the information needed for tax reporting and compliance. They help you calculate and track sales tax, VAT, and other taxes related to your sales transactions.

- Customer Communication: Invoices can be used Robotic Process Automation as a tool for communicating with your customers. They can include personalised messages, payment instructions, and other important information.

Overall, using invoices can help you manage your finances more effectively, improve customer relationships, and protect your business legally.

Boost your cash flow - send professional invoices in seconds!

FAQs

1.What should be included in an invoice?

- An invoice should include the seller’s contact information, the buyer’s contact information, a unique invoice number, the invoice date, the due date for payment, a description of the items sold, the quantity, unit price, total price, and any applicable taxes or discounts.

2. What is the difference between an invoice and a receipt?

An invoice is a request for payment issued before the payment is made, while a receipt is a document issued after the payment has been made. Invoices are used to request payment from a buyer, while receipts are used to provide proof of payment to a customer.

3. Can an invoice be used as a legal document?

Yes, an invoice can be used as a legal document. It serves as evidence of a transaction between a seller and a buyer and can be used in case of disputes or legal issues.

4. What is the difference between a proforma invoice and a regular invoice?

A proforma invoice is similar to a regular invoice but is used to provide a quote or estimate to a customer before the actual sale occurs. It is not a demand for payment like a regular invoice.

5. What should I consider when integrating invoice scanning software with other financial systems?

A credit memo on an invoice is used to indicate that a credit has been applied to the buyer’s account. This could be due to a return or refund issued to the buyer.

Level Up Your Game Development Skills Today: Join Our Step-by-Step Online Course!

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)