An ICO (Initial Coin Offering) is a way for companies to raise money by selling digital tokens (cryptocurrency) to investors. People buy these tokens hoping they will increase in value or be useful in the company’s project. It works like a crowdfunding method but with crypto instead of traditional money.

How Do ICOs Work?

6. Post-ICO Operations

How Have ICOs Evolved Over Time?

From humble beginnings to global prominence, the evolution of ICOs mirrors the rapid growth and maturation of the cryptocurrency ecosystem. In the early days, ICOs were relatively straightforward affairs, often conducted through online forums and chat groups, with minimal regulatory oversight.

However, as ICOs gained mainstream attention, they underwent a transformation, becoming more structured and regulated. Projects began to prioritize transparency, investor protection, and compliance with regulatory requirements. This shift towards professionalism and accountability was driven by a desire to instill confidence in investors and foster long-term sustainability within the blockchain industry.

One notable development in the evolution of ICOs is the emergence of security token offerings (STOs). Unlike traditional ICOs, which primarily offer utility tokens, STOs involve the issuance of security tokens that represent ownership in an underlying asset, such as equity, debt, or real estate. This convergence of blockchain technology and traditional finance has attracted institutional investors and paved the way for greater adoption and integration of digital assets into the mainstream financial system.

Despite facing regulatory scrutiny and occasional setbacks, ICOs continue to thrive as a viable fundraising mechanism for blockchain projects. With ongoing advancements in technology, regulation, and investor protection, ICOs are poised to remain a driving force behind innovation and disruption in the global financial landscape.

What are the Types of ICOs?

1. Public ICOs

2. Private ICOs (Pre-Sales)

3. Security Token Offerings (STOs)

4. Utility Token Offerings

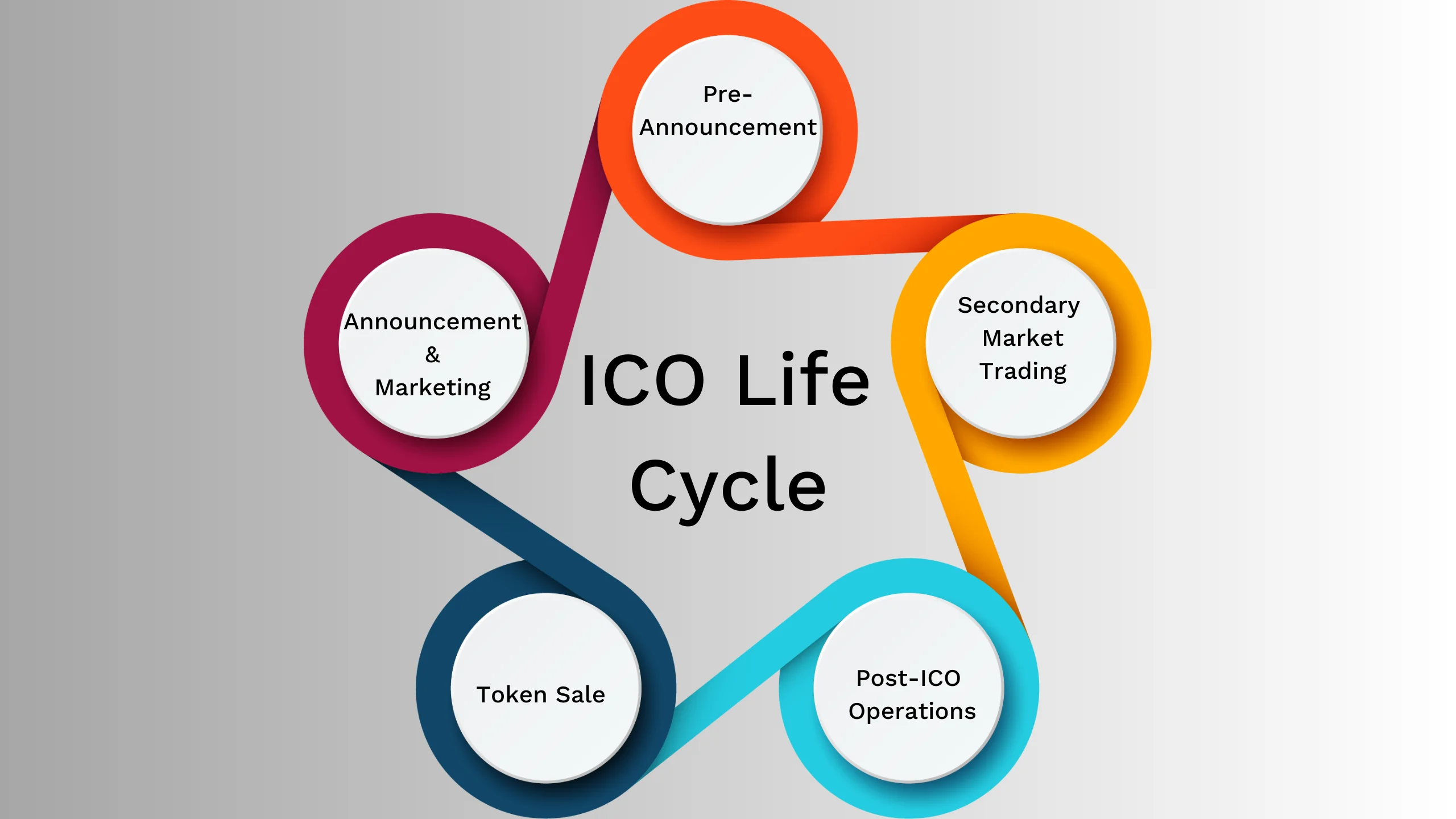

What is the Life Cycle of an ICO?

1. Pre-Announcement

During the pre-announcement phase, the project team conceptualizes the ICO and begins laying the groundwork for the token sale campaign. This may involve conducting market research, identifying target audiences, and developing a strategic roadmap for the project.

Key activities during this phase include brainstorming ideas, conducting feasibility studies, and establishing the project’s core objectives and value proposition.

2. Announcement and Marketing

With the project concept solidified, the team proceeds to announce the ICO to the public and launch a comprehensive marketing campaign to generate awareness and excitement among potential investors.

Marketing efforts may include creating a dedicated website and social media profiles, producing promotional materials such as videos and infographics, and engaging with industry influencers and media outlets to amplify the project’s visibility.

The goal of this phase is to attract a diverse range of investors and build a strong community around the project, laying the foundation for a successful token sale.

3. Token Sale

The token sale event marks the culmination of the ICO campaign, during which investors have the opportunity to purchase the project’s tokens in exchange for cryptocurrency or fiat currency.

The sale may be conducted through a dedicated ICO platform, website, or decentralized exchange, with investors submitting contributions according to the terms and conditions outlined in the project’s whitepaper and token sale agreement.

The success of the token sale hinges on factors such as token pricing, distribution structure, and investor confidence, all of which are carefully managed by the project team to ensure a smooth and transparent process.

4. Post-ICO Operations

Following the conclusion of the token sale, the project team shifts its focus to post-ICO operations, which encompass a range of activities aimed at supporting the long-term success and sustainability of the project.

Key tasks during this phase include token distribution, listing on cryptocurrency exchanges, ongoing development of the project’s technology and ecosystem, community building, and marketing efforts to maintain investor engagement and awareness.

The post-ICO period is critical for building momentum and driving adoption of the project’s tokens and platform, as well as establishing partnerships and strategic alliances to further enhance its value proposition.

5. Secondary Market Trading

Once the tokens are distributed to investors, they become available for trading on secondary cryptocurrency exchanges, where they can be bought, sold, and traded based on market demand and liquidity.

Secondary market trading provides investors with liquidity and flexibility to buy and sell tokens as needed, while also enabling price discovery and market efficiency.

The success of the project’s tokens in the secondary market depends on factors such as market sentiment, trading volume, and overall demand for the project’s products and services.

What are the common ICO Terminologies

1. Whitepaper

A comprehensive document that outlines the technical, financial, and operational aspects of a blockchain project, including its objectives, tokenomics model, roadmap, and team members.

Example: The Ethereum whitepaper, authored by Vitalik Buterin, introduced the concept of a decentralized platform for smart contracts and laid the groundwork for Ethereum’s groundbreaking ICO.

2. Token Sale

The process of offering and selling digital tokens to investors in exchange for cryptocurrency or fiat currency, typically conducted through a dedicated ICO platform or website.

Example: The EOS token sale, which raised over $4 billion, is one of the largest and most successful ICOs in history, attracting widespread attention and investor participation.

The economic model governing the creation, distribution, and utilization of tokens within a blockchain ecosystem, including factors such as token supply, distribution structure, utility, and governance mechanisms.

Example: The tokenomics model of the Binance Coin (BNB) incorporates features such as token burns, buybacks, and discounts on trading fees to incentivize adoption and drive demand for the token.

4. Smart Contract

Self-executing contracts with the terms of the agreement directly written into code, deployed on a blockchain for automated execution and enforcement.

Example: The ERC-20 standard, introduced by Ethereum, enables the creation and deployment of smart contracts for issuing fungible tokens, facilitating the development of ICOs and decentralized applications (dApps).

5. KYC (Know Your Customer) and AML (Anti-Money Laundering)

Regulatory compliance measures aimed at verifying the identity of investors and preventing illicit activities, such as money laundering and terrorism financing.

Example: ICO projects often implement KYC/AML procedures to ensure compliance with regulatory requirements and mitigate the risk of fraud and financial crime.

By familiarizing yourself with these terms and concepts, you’ll be better equipped to navigate the world of ICOs and make informed decisions as an investor or entrepreneur in the blockchain space.

Conclusion

Initial Coin Offerings (ICOs) have emerged as a transformative force in the realm of blockchain technology, offering innovative projects a means to secure funding and engage with a global investor base. From their humble beginnings to their current prominence, ICOs have evolved into sophisticated fundraising campaigns characterized by detailed whitepapers, strategic marketing, and regulatory compliance.

By understanding the history, mechanics, types, life cycle, and terminology of ICOs, investors and enthusiasts can gain a comprehensive understanding of this dynamic financial ecosystem. Despite facing regulatory challenges and occasional instances of fraud, ICOs remain a driving force behind blockchain innovation, shaping the future of finance one token sale at a time.

As the blockchain industry continues to mature and evolve, ICOs will likely undergo further transformation, with advancements in technology, regulation, and investor protection driving greater transparency, accountability, and sustainability within the ecosystem. By staying informed and vigilant, participants in the ICO market can contribute to the continued growth and maturation of the blockchain industry, unlocking new opportunities for innovation and disruption in the global financial landscape.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)