What are the Difference Between 2 Way, 3 Way and 4 Way Invoice Matching ?

2 way Invoice matching

Two-way invoice matching is a process used in accounting and procurement to ensure that the information on an invoice matches the corresponding purchase order (PO) and the goods or services received. It involves comparing three key documents:

- Purchase Order (PO): A purchase order is a document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services.

- Goods Receipt (GR): A goods receipt is a document that confirms the receipt of goods or services and verifies that they meet the specifications outlined in the purchase order.

- Invoice: An invoice is a document sent by the seller to the buyer, requesting payment for goods or services provided.

Master your invoicing accuracy with our guide on 2-way, 3-way, 4-way invoice matching.

The two-way matching process typically involves the following steps:

- Purchase Order Creation:: he buyer creates a purchase order detailing the goods or services to be purchased, including quantities, prices, and delivery dates.

- Goods Receipt: Upon receiving the goods or services, the buyer creates a goods receipt to confirm the delivery and verify that it meets the terms specified in the purchase order.

- Invoice Submission: The seller submits an invoice to the buyer, requesting payment for the delivered goods or services.

Two-way matching helps ensure that the buyer only pays for goods or services that were actually received and that the prices charged are in line with the agreed-upon terms. It also helps prevent overpayment and reduces the risk of fraud.

3 way Matching:

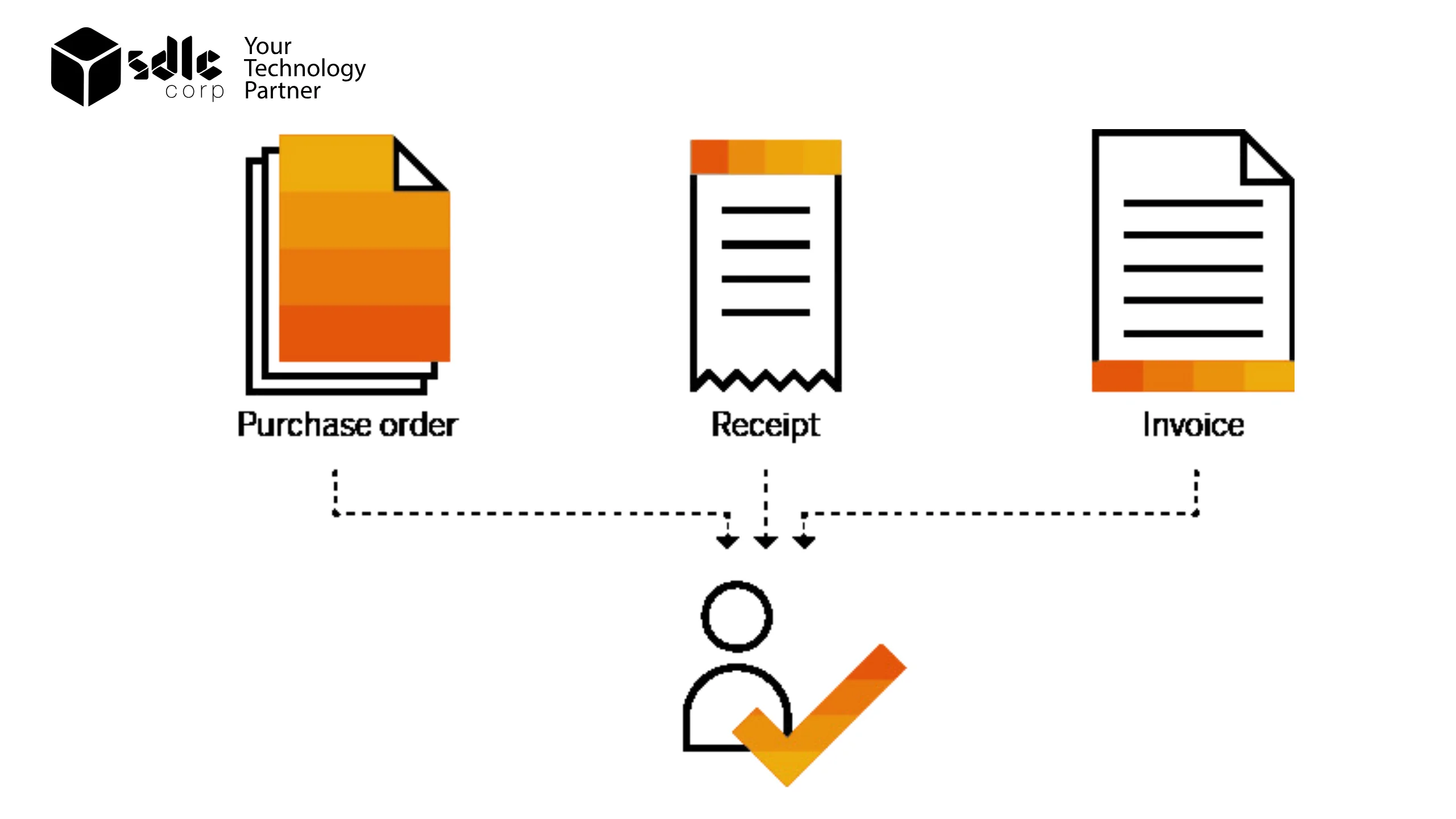

Three way Invoice is a crucial process in accounts payable that involves comparing three key documents: the supplier’s invoice, the purchase order (PO), and the receiving report (also known as the goods receipt note). The purpose of three-way matching is to ensure that the details of the supplier’s invoice match both the purchase order and the actual receipt of goods or services.

During the three-way matching process, the quantities, prices, and descriptions of items on the supplier’s invoice are compared against those on the purchase order. Then, the receiving report is checked to verify that the goods or services listed on the invoice were actually received. Any discrepancies, such as incorrect quantities, prices, or missing items, are identified and resolved before the invoice is approved for payment.

Three-way matching helps to ensure the accuracy of invoices and prevent overpayments by only approving invoices that match the terms of the purchase order and the goods received. It is a critical control measure in accounts payable, helping to reduce the risk of errors, fraud, and payment disputes.

- Provides enhanced control and accuracy in verifying invoices by comparing them against both purchase orders and goods receipts.

- Reduces the risk of overpayment, errors, and fraud by ensuring alignment between the three key documents.

- Strengthens relationships with suppliers by addressing discrepancies promptly and fairly, fostering trust and transparency in business transactions.

4 way matching:

Four-way matching is an enhanced version of the traditional three-way matching process, adding an additional layer of verification by comparing the supplier’s invoice against the purchase order, receiving report, and the contract or agreement terms. This comprehensive matching process ensures that all aspects of the transaction are in alignment, including quantities, prices, items, and any special terms or conditions agreed upon in the contract

By incorporating contract terms into the matching process, four-way matching helps to further reduce the risk of errors, discrepancies, and overpayments. It provides a more thorough verification process, ensuring that the invoice accurately reflects the agreed-upon terms and conditions of the purchase. This level of scrutiny can help organisations maintain accurate financial records, improve supplier relationships, and minimise the risk of fraud or payment disputes. However, four-way matching can be more time-consuming and resource-intensive than traditional three-way matching, as it requires careful review and comparison of multiple documents.

What is the difference Between 2 way , 3 way and 4 way invoice matching?

Aspect | Two-Way Matching | Three-Way Matching | Four-Way Matching |

Number of Documents | Two: Invoice and Purchase Order | Three: Invoice, Purchase Order, Receiving Report | Four: Invoice, Purchase Order, Receiving Report, Contract/Terms |

Purpose | Ensure invoice matches the purchase order | Ensure invoice matches PO and goods received | Ensure invoice matches PO, goods received, and contract terms |

Verification | Quantities and prices on invoice vs. PO | Quantities, prices, and items vs. PO | Quantities, prices, items, and contract terms vs. PO |

Discrepancy Identification | Limited to invoice vs. PO discrepancies | Can identify discrepancies in quantities, prices, or items | Can identify discrepancies in quantities, prices, items, and contract terms |

Risk Reduction | Helps prevent overpayments and errors | Reduces risk of overpayments and errors | Further reduces risk of overpayments and errors |

Resource Intensity | Less intensive, quicker process | More intensive than two-way matching | Most resource-intensive, requires thorough review |

Complexity | Less complex due to fewer documents | More complex due to additional document | Most complex due to multiple documents and terms |

What are the benefits of Automated Invoice Matching?

Conclusion:

Automated invoice matching offers several benefits compared to manual matching processes. Some of the key advantages include

- Efficiency: Automated matching can process invoices much faster than manual methods, reducing the time and effort required to reconcile invoices with purchase orders and receiving reports.

- Accuracy: Automation helps minimize human errors that can occur during manual data entry and matching processes, leading to more accurate invoice processing and reduced risk of overpayments or underpayments.

- Cost savings: By streamlining the invoice matching process, organizations can reduce labor costs associated with manual data entry and matching, as well as potential costs related to errors and discrepancies.

- Improved visibility and control: Automated systems provide real-time visibility into the status of invoices, enabling better tracking and management of the entire invoicing process.

- Compliance: Automated systems can help ensure that invoices are matched according to predefined rules and compliance requirements, reducing the risk of non-compliance.

- Faster dispute resolution: Automated systems can flag discrepancies and exceptions more quickly, allowing for faster resolution of disputes with suppliers.

- Scalability: Automated systems can easily scale to handle large volumes of invoices, making them suitable for organisations of all sizes.

Overall, automated invoice matching can help organisations streamline their accounts payable processes, reduce costs, improve accuracy, and enhance control and visibility over their financial operations.

ensure accuracy in quantities and prices. Three-way matching adds an extra layer of validation by including the receiving report, confirming that goods or services were received as invoiced. This helps prevent overpayments and discrepancies. Four-way matching further enhances the process by incorporating contract or agreement terms, ensuring that all aspects of the transaction align with the agreed-upon terms. While four-way matching offers the highest level of scrutiny and risk mitigation, it also requires more time and resources. Organisations should consider their priorities for accuracy, efficiency, and risk management when choosing the appropriate matching method for their accounts payable processes.

Explore the power of 2-way, 3-way, 4-way invoice matching for a more efficient business.

Importance of invoice matching:

Invoice matching is a critical process in accounting and procurement for several reasons:

- Accuracy and Control: Invoice matching ensures that the amounts billed by suppliers are accurate and in line with the agreed-upon prices in the purchase orders. It helps prevent overpayments and ensures that the organisation only pays for goods or services that have been received.

- Fraud Prevention: By comparing invoices with purchase orders and goods receipts, invoice matching helps detect and prevent fraudulent activities, such as billing for goods or services not provided.

- Compliance: Many industries have regulatory requirements for documenting and verifying financial transactions. Invoice matching helps ensure compliance with these regulations by providing a clear audit trail of transactions.

- Supplier Relationships:Efficient invoice matching can lead to faster payment processing, which can improve relationships with suppliers. Resolving discrepancies promptly and accurately can also help build trust and collaboration with suppliers.

- Cost Savings: By preventing overpayments and reducing errors, invoice matching can lead to cost savings for the organisation. It also helps streamline the procurement process, reducing administrative costs.

- Inventory Management: Matching invoices with goods receipts helps in tracking inventory levels accurately. This information is crucial for managing stock levels and planning future purchases.

- Process Efficiency: Implementing a robust invoice matching process can streamline the accounts payable process, reducing the time and effort required to process invoices and make payments.

In summary, invoice matching plays a vital role in ensuring the accuracy, compliance, and efficiency of financial transactions, ultimately contributing to the overall financial health and operational effectiveness of an organization.

What are the Challenges We faced in invoice matching ?

Data Entry Errors:

Challenge: Mistakes in manually entering data from invoices, purchase orders, or goods receipts can lead to mismatches.

Solution: Implement automated data entry systems or use optical character recognition (OCR) technology to reduce manual errors.

Mismatched Quantities:

Challenge: Differences in the quantity of goods or services listed on the invoice, purchase order, and goods receipt can lead to discrepancies.

Solution: Conduct regular audits to identify and resolve quantity discrepancies. Implement systems that automatically flag inconsistencies.

Price Discrepancies:

Challenge: Variances in prices between the invoice and the purchase order can result in overpayment or underpayment.

Solution: Implement automated price verification systems that compare invoice prices with purchase order prices. Establish clear communication channels with suppliers to resolve pricing issues promptly.

Invoice Errors:

Challenge: Inaccurate or incomplete invoices can hinder the matching process.

Solution: Implement validation checks to ensure that invoices meet all requirements before they are processed. Provide suppliers with clear guidelines for submitting invoices.

Delayed Goods Receipts:

Challenge: Delays in receiving goods or services can lead to discrepancies between the invoice and the goods receipt.

Solution: Implement systems to track and manage goods receipts in real time. Communicate closely with suppliers to ensure timely delivery and receipt of goods.

Optimize your financial processes with a deep dive into invoice matching methods.

In conclusion, the choice between two-way, three-way, or four-way invoice matching depends on the specific needs and requirements of the organization:

- Two-Way Matching: Offers a basic level of validation by comparing invoices with purchase orders. It is suitable for organizations with straightforward procurement processes and minimal quality control requirements.

- Three-Way Matching: Provides a more comprehensive approach by adding goods receipts to the comparison process. It helps ensure that invoices align with both purchase orders and actual receipt of goods or services. This method is suitable for most organizations that require a higher level of accuracy and control.

- Four-Way Matching: Incorporates quality inspection reports into the validation process, making it ideal for industries with strict quality control requirements. It offers the highest level of validation but may be more complex and time-consuming to implement.

In general, organisations should choose the matching method that best suits their specific needs, considering factors such as the complexity of their procurement processes, the level of quality control required, and the resources available for invoice processing and validation.

FAQs

1. Why is two-way matching important?

Two-way matching helps organisations prevent overpayments by verifying that the supplier’s invoice matches the terms of the purchase order.

2. Does two-way matching require manual intervention?

Two-way matching can be done manually or automated using software, with automation offering greater efficiency and accuracy.

3. How does three-way matching help prevent overpayments?

By verifying that the quantities and prices on the invoice match both the purchase order and the goods received, three-way matching reduces the risk of paying for items not received or at incorrect prices.

4. What are some common steps in a sales invoicing process flowchart?

Challenges include managing discrepancies between the invoice, purchase order, and receiving report, which can require manual intervention and delay the payment process.

5. Is four-way matching more time-consuming than three-way matching?

Yes, four-way matching can be more time-consuming due to the need to verify contract terms in addition to quantities, prices, and items. However, the added scrutiny can help prevent costly errors and disputes.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.