Introduction

A DeFi lending platform operates on the principle of decentralization, leveraging blockchain technology to facilitate peer-to-peer lending without the need for intermediaries like banks. In this model, users can lend their digital assets to others in exchange for interest payments, or borrow assets by providing collateral. Smart contracts execute the lending agreements, ensuring transparency and security. Revenue is typically generated through fees charged on loans, collateralization, or other platform services. DeFi lending platforms aim to provide financial services globally, with greater accessibility and lower costs compared to traditional finance.

How does DeFi Lending and Borrowing Platforms Work?

DeFi, or Decentralized Finance, lending and borrowing platforms operate within blockchain ecosystems, offering users a decentralized alternative to traditional financial institutions. Here’s a breakdown of how they typically work

1. Smart Contracts

DeFi lending and borrowing platforms utilize smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce the terms of the loan, removing the need for intermediaries like banks.

2. Liquidity Pools

Many DeFi lending platforms operate using liquidity pools, where users contribute their assets to a pool that is then used to fund loans. In return, users earn interest on their deposited assets. These pools help to ensure that there is enough liquidity available for borrowers to access funds when needed.

3. Automated Market Makers (AMMs)

Some DeFi lending platforms utilize AMMs to facilitate lending and borrowing activities. AMMs are algorithms that automatically adjust the price of assets based on supply and demand, ensuring that borrowers can access funds quickly and efficiently.

4. Governance Tokens

Lenders deposit their assets into liquidity pools, which are then available for borrowers. These pools are managed by smart contracts that handle loan issuance, interest payments, and collateral management automatically.

5. Risk Management

DeFi lending platforms employ various mechanisms to manage risk, including overcollateralization requirements, liquidation mechanisms, and insurance funds. These measures help to protect lenders from defaults and ensure the stability of the platform.

6. Transparency and Audibility

Since DeFi lending platforms operate on blockchain networks, all transactions are transparent and auditable. This transparency helps to build trust among users and provides a level of security that is often lacking in traditional financial systems.

What is the difference between Blockchain DeFi Lending vs Traditional Loans?

Aspect | Blockchain DeFi Lending | Traditional Loans |

Decentralization | Operates on decentralized blockchain networks. | Centralized, typically provided by banks or financial institutions. |

Intermediaries | Peer-to-peer lending, no need for intermediaries. | Banks or financial institutions act as intermediaries. |

Transparency | Transactions recorded on a public ledger. | Limited transparency, information held by banks. |

Smart Contracts | Utilizes programmable smart contracts for automation. | Relies on traditional legal agreements and paperwork. |

Accessibility | Open to anyone with an internet connection. | Access may be restricted based on credit and location. |

Credit Checks | Generally less reliant on traditional credit checks. | Requires credit checks and collateral for risk mitigation. |

How Enterprises can take advantage of DeFi Platforms with sdlccorp?

In today’s dynamic business landscape, enterprises are constantly seeking innovative ways to optimize their operations and maximize returns on their investments. Decentralized Finance (DeFi) platforms offer a promising avenue for enterprises to explore, providing a range of financial services without the need for traditional intermediaries. In collaboration with SDLCCorp, a leading DeFi development company, enterprises can unlock a host of opportunities to streamline processes, enhance liquidity management, and drive growth. Here’s a comprehensive guide on how enterprises can harness the power of DeFi platforms in partnership with SDLCCorp

1. Streamlined Access to Capital

DeFi platforms offer enterprises direct access to a global pool of capital without the bureaucratic hurdles often associated with traditional financing channels. SDLCCorp specializes in developing customized DeFi solutions tailored to the specific needs of enterprises, ensuring seamless access to capital for expansion, innovation, or other strategic initiatives.

2. Enhanced Liquidity Management

Efficient liquidity management is critical for enterprises to maintain financial stability and seize market opportunities. By leveraging DeFi platforms developed by SDLCCorp, enterprises can optimize their liquidity management strategies through features such as automated market making, liquidity provision, and yield farming. These solutions empower enterprises to effectively manage their cash flows and mitigate liquidity risks.

3. Cost-effective Financial Services

Traditional financial services often come with hefty fees and inefficiencies. DeFi platforms, on the other hand, leverage blockchain technology to automate processes and eliminate intermediaries, resulting in lower costs and faster transaction times. SDLCCorp specializes in building DeFi protocols that enable enterprises to access a wide range of financial services, including lending, borrowing, trading, and asset management, at a fraction of the cost of traditional alternatives.

4. Security and Compliance

Security and compliance are paramount concerns for enterprises operating in the financial sector. SDLCCorp adheres to the highest security standards and regulatory requirements in the development of DeFi platforms, ensuring that enterprises can confidently transact on secure and compliant networks. Through advanced encryption techniques, multi-signature authentication, and smart contract audits, SDLCCorp mitigates the risk of fraud and ensures the integrity of enterprise transactions on DeFi platforms.

5. Strategic

Partnerships and Ecosystem Integration: Collaboration is key to unlocking the full potential of DeFi platforms for enterprises. SDLCCorp facilitates strategic partnerships and ecosystem integration, connecting enterprises with leading DeFi protocols, liquidity providers, and decentralized applications (dApps) to create synergies and unlock new business opportunities. Whether it’s integrating DeFi solutions into existing enterprise systems or exploring new avenues for value creation, SDLCCorp empowers enterprises to leverage the full spectrum of DeFi services and capabilities.

Top 5 DeFi Based Business Models

1. DeFi based Apps

DeFi (Decentralized Finance) apps revolutionize traditional financial services by operating on blockchain networks, enabling peer-to-peer transactions without intermediaries. They offer users a range of services including lending, borrowing, trading, and yield farming, all while prioritizing transparency, security, and accessibility.

2. Border Payments

Border payments refer to financial transactions that occur across international borders, involving the transfer of funds between individuals, businesses, or financial institutions located in different countries. These payments often involve considerations such as currency exchange rates, regulatory compliance, and cross-border fees, impacting the efficiency and cost of conducting international transactions.

3. Loan management system

A Loan Management System is a software solution designed to streamline the entire lifecycle of lending operations, from application processing and approval to disbursement, repayment tracking, and collection management. It provides financial institutions with comprehensive tools to efficiently manage loans, mitigate risks, and enhance customer experience while ensuring compliance with regulatory requirements.

4. Decentralised Insurance Projects

Decentralized payments revolutionize traditional financial systems by eliminating intermediaries, ensuring secure and direct transactions via blockchain technology. Defi crowdfunding development companies spearhead the creation of decentralized finance platforms, enabling users to raise funds autonomously and transparently while leveraging smart contracts for enhanced security and efficiency.

5. Decentralized Payments

Decentralized payments revolutionize traditional financial systems by eliminating intermediaries, ensuring secure and direct transactions via blockchain technology. Defi crowdfunding development companies spearhead the creation of decentralized finance platforms, enabling users to raise funds autonomously and transparently while leveraging smart contracts for enhanced security and efficiency.

Our DeFi Development services and solutions which include

Embrace the decentralized revolution with our comprehensive DeFi Development services and solutions. At sdlccorp, we empower businesses and individuals to tap into the transformative potential of decentralized finance (DeFi). From building robust DeFi protocols to crafting intuitive DeFi wallets, we offer end-to-end solutions tailored to your specific needs.

1. DeFi Protocol Development

Our experienced team specializes in developing cutting-edge DeFi protocols that enable seamless peer-to-peer transactions, automated market making, lending, borrowing, and more. Leveraging the latest blockchain technologies, we ensure scalability, security, and interoperability, empowering you to create innovative financial products and services.

2. DeFi Wallet Development:

As a leading DeFi wallet development company, we understand the importance of security, usability, and functionality in decentralized finance. Our expert developers design and build custom DeFi wallets that provide users with full control over their assets, seamless access to DeFi protocols, and robust security features to safeguard their funds. Whether you need a web, mobile, or hardware wallet, we’ve got you covered.

3. Smart Contract Development

Smart contracts are the backbone of DeFi applications, automating transactions and ensuring trustless execution. With our expertise in smart contract development, we help you design, audit, and deploy secure and efficient smart contracts tailored to your specific DeFi use cases, minimizing risks and maximizing reliability.

4. Liquidity Provisioning and Yield Farming

Maximize the potential of your DeFi project with our liquidity provisioning and yield farming solutions. Our team assists you in creating liquidity pools, optimizing yield farming strategies, and integrating with leading decentralized exchanges (DEXs) to enhance liquidity and profitability for users and stakeholders.

5. Compliance and Security Audits

Security and compliance are paramount in the DeFi space. Our comprehensive security audits and compliance services help you identify and mitigate potential vulnerabilities, ensuring regulatory compliance and fostering trust among users and investors.

What broader benefits do businesses derive from DeFi lending?

1. Global Accessibility

DeFi lending platforms operate on blockchain networks, enabling businesses worldwide to access lending services without traditional barriers like geographic restrictions or lengthy paperwork.

2. Efficiency and Speed

DeFi lending processes are automated and executed through smart contracts, reducing the need for intermediaries and speeding up loan approval and disbursement processes.

3. Transparency

Blockchain technology ensures transparency in transactions, providing businesses with real-time visibility into lending activities, interest rates, and collateralization requirements.

4. Lower Costs

By eliminating intermediaries and leveraging blockchain technology, DeFi lending platforms typically have lower overhead costs compared to traditional financial institutions, resulting in potentially lower interest rates and fees for borrowers.

5. Collateral Flexibility

DeFi lending platforms often accept a wide range of digital assets as collateral, allowing businesses to unlock liquidity from their crypto holdings without needing to sell them.

6. Innovative Financial Products

DeFi lending continuously introduces new financial products and services, such as yield farming and liquidity mining, providing businesses with opportunities to earn additional income or optimize their asset utilization.

7. Risk Mitigation

Some DeFi lending platforms offer decentralized insurance or risk management solutions, providing businesses with additional protection against smart contract vulnerabilities or platform risks.

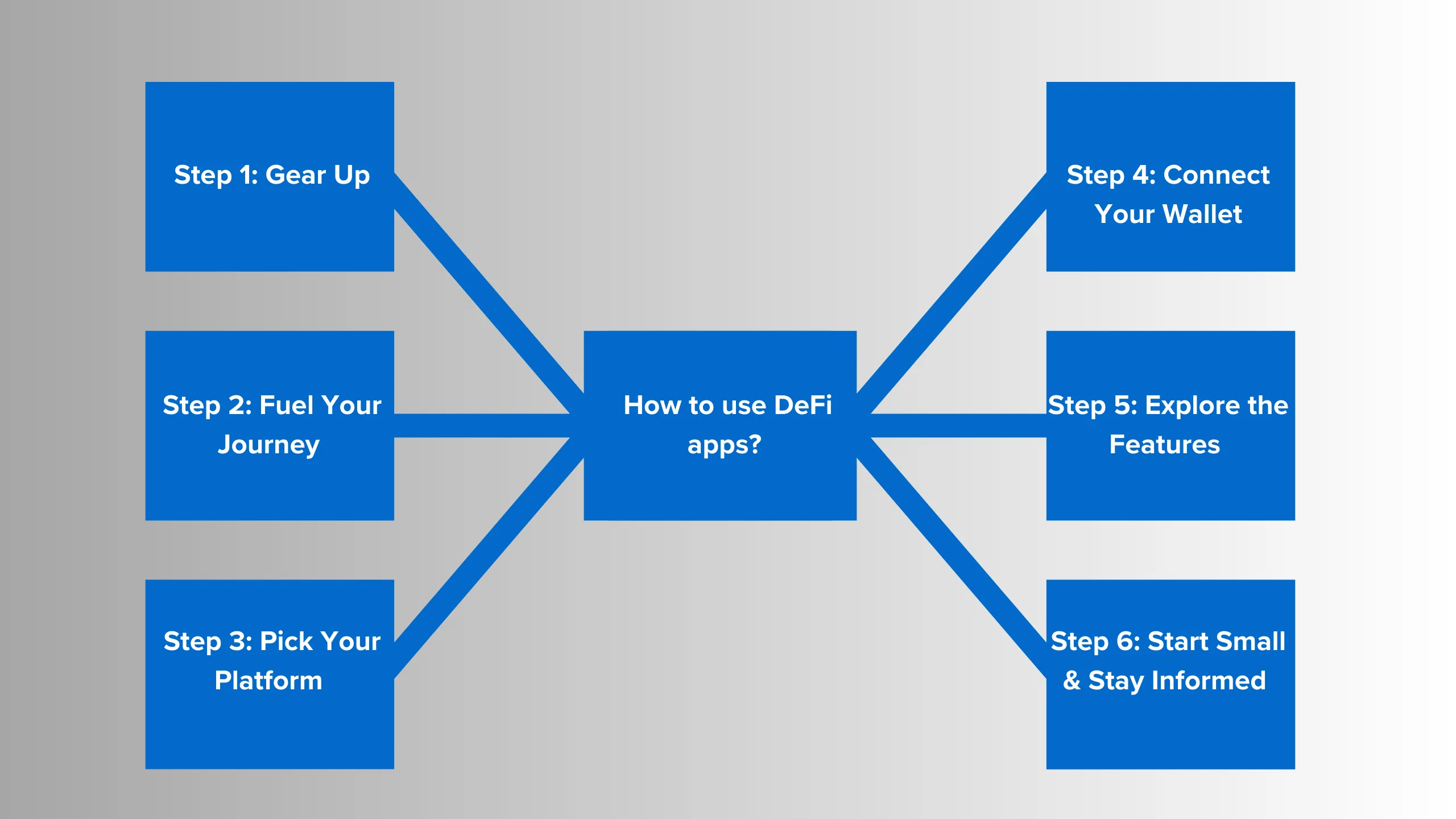

How to use DeFi apps?

Decentralized lending, a cornerstone of the DeFi (Decentralized Finance) ecosystem, offers borrowers and lenders an alternative to traditional financial institutions. However, it’s not without its risks and challenges. One major concern is the lack of regulatory oversight, potentially exposing users to scams or fraudulent activities. Smart contract vulnerabilities pose another risk, as bugs or hacks can lead to loss of funds. Additionally, market volatility can impact the value of collateral, leading to liquidation and loss for borrowers. Developing a DeFi staking platform company must navigate these risks while ensuring robust security measures and compliance protocols are in place to protect users’ assets and foster trust in the platform.

Step 1: Gear Up

You’ll need a crypto wallet to store your crypto holdings and interact with DeFi apps. Popular options include MetaMask or Trust Wallet. Do your research and choose a reputable wallet provider.

Step 2: Fuel Your Journey

DeFi apps often require gas fees to process transactions on the blockchain. Think of gas fees like paying for tolls on a highway. Make sure you have some crypto in your wallet to cover these fees.

Step 3: Pick Your Platform

A vast array of DeFi apps exists, each offering unique features and functionalities. Explore popular platforms like Aave, Compound, or Uniswap, but always conduct your own research before diving in.

Step 4: Connect Your Wallet

Once you’ve chosen a DeFi app, you’ll need to connect your crypto wallet to it. This allows the app to access and interact with your crypto holdings.

Step 5: Explore the Features

Each DeFi app has its own interface, but common functionalities include lending, borrowing, swapping cryptocurrencies, and earning interest. Familiarize yourself with the app’s features and understand the associated risks before taking action.

Step 6: Start Small & Stay Informed

The DeFi space is exciting, but it can also be complex. Begin with small investments to understand the ropes and stay updated on market trends and potential risks.

Limitations of the Traditional Finance System

1. Centralization

Traditional finance systems are often centralized around banks, governments, or other financial institutions. This centralization can lead to issues such as single points of failure, lack of transparency, and potential manipulation.

2. Access Barriers

Many people, especially in developing countries or marginalized communities, face barriers to accessing traditional financial services due to factors like location, income level, or lack of documentation.

3. High Costs

Traditional finance systems often involve high fees for services such as money transfers, currency exchanges, and loans. These costs can disproportionately affect those with lower incomes.

4. Limited Transparency

The opacity of traditional financial systems can make it difficult for individuals to understand where their money is going or how it’s being managed, leading to distrust and inefficiency.

5. Slow Transactions

Transactions within traditional finance systems can be slow, especially for cross-border transactions, leading to delays in payments and settlements.

6. Risk of Fraud and Security Breaches

Traditional finance systems are susceptible to fraud, hacking, and security breaches, which can result in financial losses for individuals and institutions alike.

7. Exclusionary Practices

Some traditional financial institutions may engage in discriminatory or exclusionary practices, denying services to certain individuals or communities based on factors such as race, nationality, or socioeconomic status.

8. Limited Innovation

The traditional finance industry has been relatively slow to adopt new technologies and innovate, leading to inefficiencies and missed opportunities for improvement.

What are some of the challenges and risks involved?

1. Smart Contract Risks

While smart contracts enhance efficiency and security, they are not immune to vulnerabilities or bugs that could result in financial losses.

2. Price Volatility

The volatile nature of cryptocurrencies can pose risks to both lenders and borrowers, as the value of collateral assets may fluctuate significantly.

3. Regulatory Uncertainty

DeFi lending platforms operate in a rapidly evolving regulatory landscape, which could impact their legality and compliance requirements.

4. Market Risks

DeFi lending platforms are subject to market risks, including liquidity shortages, flash crashes, and black swan events that could disrupt normal operations.

Conclusion

The DeFi lending business model represents a paradigm shift in the financial industry, offering users decentralized, transparent, and efficient lending solutions. While the sector continues to grow and evolve, it is essential for participants to understand the mechanics, benefits, and risks associated with DeFi lending platforms. With proper risk management and regulatory compliance, DeFi lending has the potential to democratize finance and empower individuals globally.

FAQs

How does a DeFi lending platform work?

Users lend and borrow digital assets directly, using smart contracts to automate and secure transactions without intermediaries.

How do interest rates work on DeFi lending platforms?

Interest rates are algorithmically determined based on supply and demand, ensuring competitive rates for both lenders and borrowers.

What is collateral in DeFi lending?

Collateral refers to the digital assets borrowers must provide to secure a loan, reducing the risk for lenders.

What types of assets can be used as collateral?

Common collateral includes various cryptocurrencies and stablecoins, depending on the platform’s support.

What are liquidity pools in DeFi lending?

Liquidity pools are collections of funds provided by users, which are used to facilitate lending and borrowing on the platform.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)