Token in Real Estate: Year over year, real estate tokenization has become an unusual investment properties method that is good for both issuers and investors. According to Atlas One, a Canadian-based digital securities company, the real estate investment trust sector now accounts for approximately 40% of the digital securities market, amounting to roughly $200 million.

The value of a real estate is converted into a token that is stored on a blockchain, allowing for digital ownership and transfer. Each of these divisible tokens represents a fractional share of ownership in that real estate.

This article investigates the emerging trend of real estate tokenization and its primary benefits and potential to revolutionize the real estate investment market.

What Exactly is Real Estate Tokenization?

The process of fragmenting an asset into digital tokens representing the underlying property with all of its rights and obligations is referred to as the tokenization of real estate. Smart contracts are used for specific contractual terms. If a predefined contract condition is met, the algorithm encoded in the digital contract triggers the events specified in the code.

A smart contract, for example, can execute a transfer in the land register without requiring human intervention. It validates the actions and automatically generates another block, which is added to the blockchain.

ERC-721 tokens are used to fractionalize NFTs. ERC-721 denotes a predefined standard on the Ethereum (ETH) blockchain and is associated with a smart contract that tracks transactions in which these tokens play a role. The ERC-721 standard is intended to improve transaction traceability and security.

Unlock Real Estate Tokens: Revolutionize Property Investment!

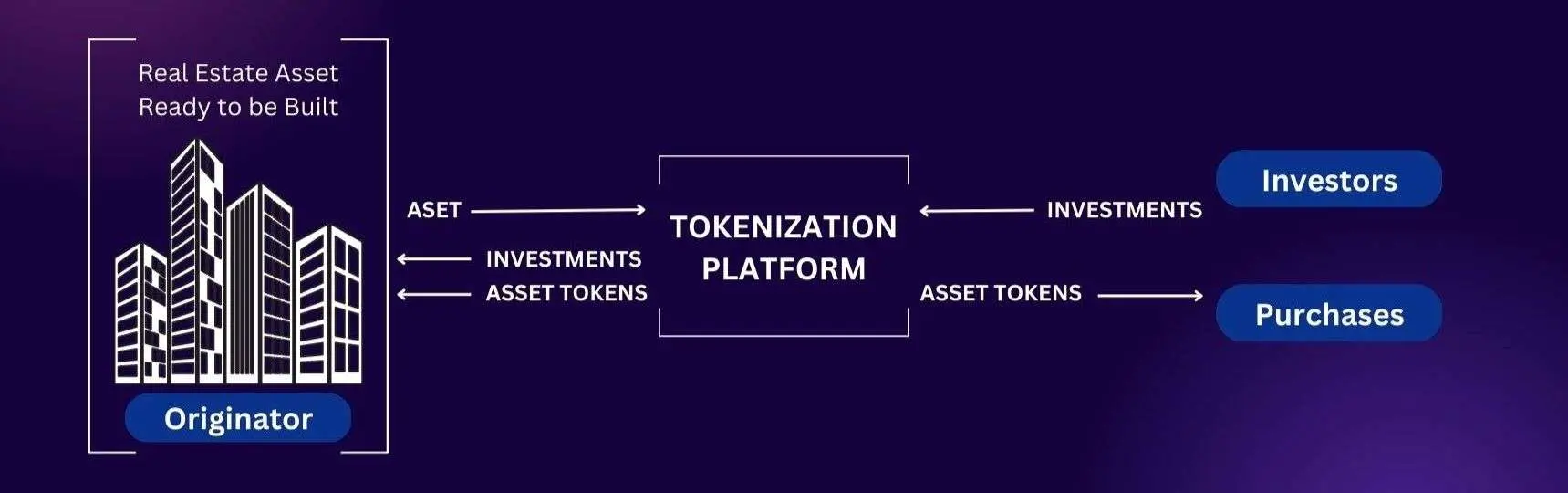

How does the Tokenization of Real Estate Work?

Real estate tokenization is similar to crowdfunding in that an asset is divided into tiny fractions with the help of a smart contract, an automated code stored on a blockchain. Anyone who purchases or owns a token owns a part of real estate. They are entitled to the underlying asset and its profits and losses. (Read More about How Can Metaverse Revolutionize Real Estate Industry)

To better understand, suppose someone owns a $100,000 rental property and requires quick cash flow. However, the investors who approach them need more funds, and the owners are willing to sell their property for a lower price.

Tokenization comes in handy in this situation. Their assets will be divided into units, with each unit representing $1,000 in digital tokens. As a result, the purchase can be efficiently invested in over time. Furthermore, this is accomplished via a decentralized network, ensuring complete transparency.

Real estate, whether commercial, residential or trophy, can be tokenized. Expensive commercial properties, such as shopping malls and shopping centers, could be cut into fractional slices to make investments more affordable.

Apartments in multi-story residential towers can also be tokenized, allowing faster sales price and purchases. One could liquidate their trophy asset while raising funds for projects through tokenization.

Trophy assets are extremely scarce properties that are in high demand among investors. Trophy assets include iconic structures with substantial real estate underpinnings. It can sometimes be a structure.

It could be a vineyard producing high-quality grapes for winemaking or a riverbank with precious stones. As a result, anything from a digitized share to a portion of the deed, an equity interest in a legal entity, or ownership of the collateralized limited liability companies can be tokenized.

Benefits of Tokenizing Real Estate

1. Less of a Barrier to Entry

By making it easier to invest in modest real estate holdings company, real estate tokenization makes it possible for small investors to take part and lowers the barriers to entry for retail investors. So, lower minimums and smaller mortgage rates can be used to take advantage of the high returns from traditional real estate investments, which usually require much more money upfront.

2. The Ability to Generate Liquidity

Thanks to blockchain technology, real estate tokens are easily and securely transferable, enabling investors to diversify their portfolios, reduce risk, and create liquidity in the real estate market. Issuers, on the other hand, have access to a larger pool of investors.

3. Reduced Transactional Costs

Blockchain technology could speed up and lower the cost of investment transactions by using automated processes and a digital ledger that can’t be changed. Because of this, most investment deals are done faster and for less money so that investors can make more money. Tokenization also provides many other advantages, including real-time capitalization table tracking, improved accessibility, and increased transparency for prospective investors.

Dive into Real Estate Tokens: Transform Property Investment!

Essential Considerations for Real Estate Tokenization

1. Implications of Securities Law

Generally, tokenizing real estate will be seen as a security, but each token should be looked at from the start. If the token is a security, it must come with a prospectus or use an exemption, like the “accredited investor” exemption, to be sold.

The issuer needs to think about the registration and prospectus requirements that apply.

2. Settlement with Land Registries

Real estate tokenization necessitates reconciling the relevant transaction with the current land registration systems.

Because each Canadian province and territory has its land registration system, a real estate token issuer must ensure that the transaction matches up with the land registration systems of the provinces and territories where the real estate is located.

How Real Estate Assets will Work in the Future?

The conditions of the markets are evolving with the help of the tokenization of real estate assets. In addition, investors can transfer their funds; asset owners can manage their equity. Some factors depict that real estate tokenization is the future of real estate assets. These factors are listed below:

1. It increases the real estate industry by assuring better market transparency.

2. Tokenization is expected to yield a revenue of $4.2 billion for the global real estate industry in the next five years.

Therefore, these factors prove that real estate tokenization is the future of real estate assets as it offers high security and perfect flexibility.

Real Estate Tokenization's Future

Tokenization is a convenient and cost-effective way to invest in real estate assets; however, as a relatively new investment vehicle, regulators have yet to establish a consistent set of rules that govern real estate tokenization.

The type of asset being tokenized influences which regulatory frameworks will be used. For example, as securities, tokens are subject to Canadian securities laws. Furthermore, market confusion and knowledge gaps must be overcome before real estate tokenization can be widely adopted.

Real estate tokenization could change how people invest in real estate by making an asset class that is usually very illiquid more liquid, making it easier for small investors to get into the market and lowering transaction costs.

However, market participants need help with the need for precise market regulation, reconciliation with land title registries, and centralized transaction reporting.

Investors and property owners who want to capitalize on the real estate tokenization trend should seek advice from legal, financial, and real estate professionals.

Please contact SDLC if you have questions about tokenization, real estate industry, tangible property assets, or corporate or securities law.

Conclusion

It concludes that tokenization allows people to change how they invest in real estate. Moreover, developers should consult experts in securities, tax as well as real estate professionals early in the process of planning a real estate security token.