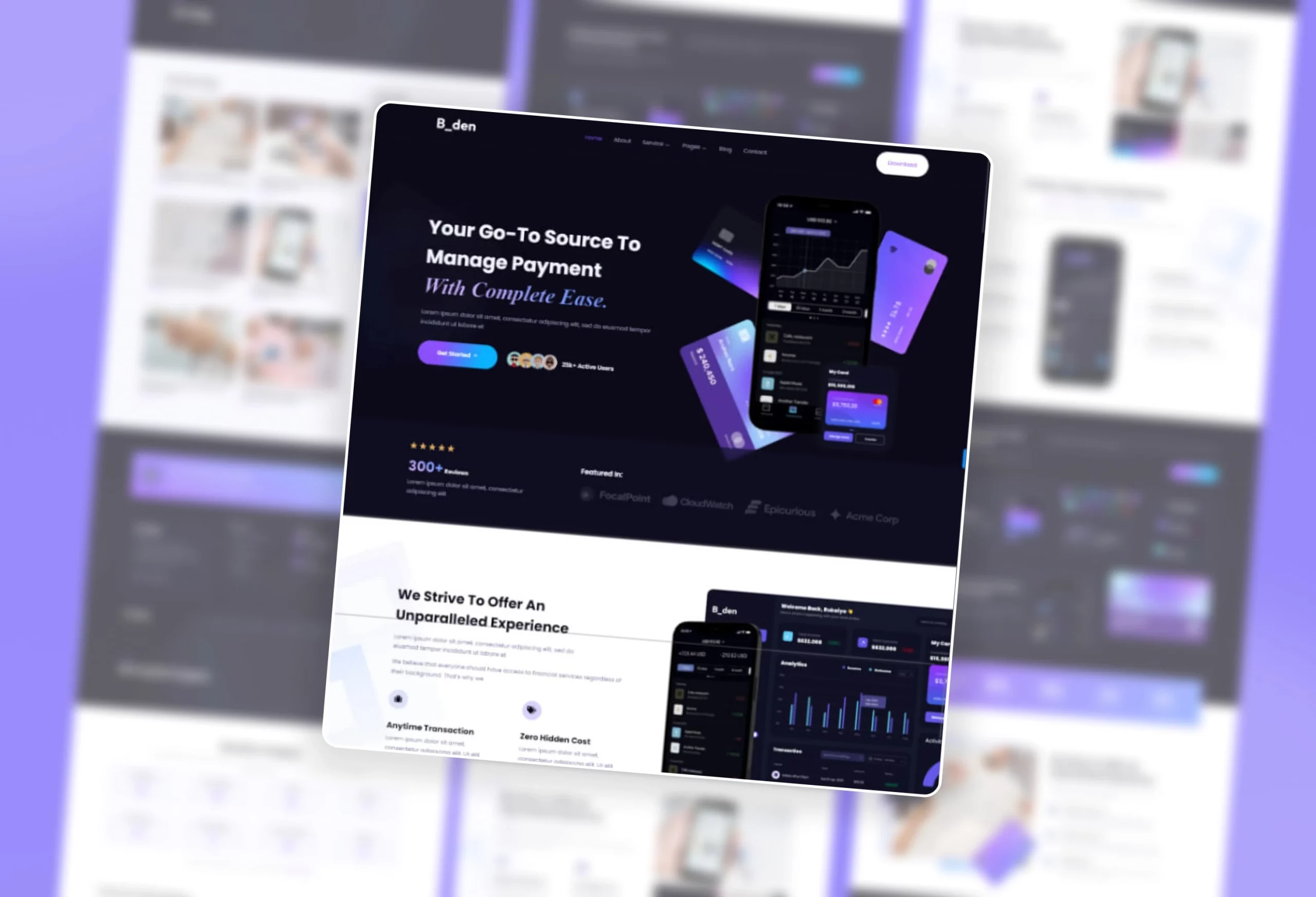

Our P2P Lending Platform Overview

Welcome to SDLC Corp, your premier destination for P2P lending solutions. With our expertise in loan lending app development, lend and borrow app creation, and lending origination software, we’re here to revolutionize the way you access financing. Our platform offers a seamless digital marketplace where borrowers connect directly with lenders, ensuring transparency and efficiency in every transaction.

Whether you’re seeking a personal loan or financing for your business, our micro lending software provides flexible options tailored to your needs. Trust in our commitment to security, compliance, and customer satisfaction as we pave the way for a new era of financial empowerment. Welcome to a world of opportunity with SDLC Corp.