Introduction

When businesses are looking to implement Odoo, choosing the right consultant can be a daunting task. With multiple options available onsite, offshore, and nearshore it’s crucial to understand which one aligns with your company’s specific needs. In this blog, we will explore the differences between these options and help you choose the best Odoo consultant for your business.

Supercharge Growth with Odoo Experts!

Tailored Odoo Solutions for Streamlined Business Efficiency and Growth

Key Considerations When Choosing an Odoo Consultant

Before delving into the specific types of Odoo consultants, let’s outline the essential criteria for selecting the right one:

- Project Scope & Complexity: How extensive is your Odoo implementation? Complex projects often benefit from consultants with specialized expertise, which might affect the type (onsite, offshore, nearshore) of consultant best suited to your needs.

- Budget Constraints: Consultancy costs vary significantly across regions, and understanding your financial limits can help narrow down the choices.

- Timeline & Urgency: If the project is time-sensitive, proximity and availability become more important factors.

- Communication Needs: Real-time collaboration or frequent meetings may require local consultants, while email or periodic check-ins may suffice for others.

- Data Security & Compliance: Different countries have distinct data protection laws, making it crucial to consider potential risks associated with offshoring or nearshoring.

Understanding Odoo and Its Benefits

Odoo is an open-source enterprise resource planning (ERP) software that integrates a wide range of business functions into a single system. From sales, finance, and inventory to human resources and project management, Odoo’s modular nature allows businesses to tailor the software according to their needs. The Odoo solutions are scalable, making them an ideal choice for small businesses, medium-sized enterprises, and large corporations.

Whether your company is new to ERP or upgrading from an existing system, the decision to implement Odoo can significantly enhance operational efficiency. However, the success of this implementation largely depends on the expertise of the Odoo development partner you choose.

Types of Odoo Consultants: Onsite, Offshore, and Nearshore

There are three main types of Odoo consultants: onsite, offshore, and nearshore. Each offers distinct advantages and potential drawbacks. Below, we explore each of these options to help you decide the best fit for your company.

1. Onsite Odoo Consultant

An onsite Odoo consultant is a professional who works directly with your team at your location. This type of consultant is typically hired when companies prefer face-to-face interactions, which can help in more complex implementations and require a detailed understanding of the organization’s operations.

Benefits of Onsite Consulting:

- Direct collaboration: Being physically present enables the consultant to interact closely with your team, ensuring better communication.

- In-depth analysis: An onsite consultant can fully immerse themselves in your business processes, offering tailored Odoo implementations.

- Instant troubleshooting: Immediate issue resolution becomes easier with an onsite presence.

Rawbacks of Onsite Consulting:

- Cost: Hiring an onsite consultant is generally more expensive because of travel, accommodation, and daily rates.

- Limited availability: If your business operates in multiple time zones or countries, the onsite consultant may not always be available when needed.

2. Offshore Odoo Consultant

An offshore Odoo development firm refers to a consultant or team located in a different country, often with a significant time zone difference. Offshore consultants are typically located in countries like India, the Philippines, or Eastern European nations. Businesses outsource Odoo-related projects to these firms for various reasons.

Benefits of Offshore Consulting:

- Cost-effective: Offshore consultants often offer lower rates due to differences in the cost of living. This makes it an appealing option for small businesses or companies on a budget.

- Access to global talent: Offshore firms often have access to a vast pool of skilled professionals who are well-versed in Odoo development.

- Scalability: Offshore firms can quickly scale their resources up or down depending on the project requirements.

3. Nearshore Odoo Consultant

A nearshore Odoo consultant works from a nearby country, typically in a similar time zone. For example, a U.S.-based company may hire a nearshore consultant in Mexico or Canada. This option combines some of the benefits of both onsite and offshore consulting.

Benefits of Nearshore Consulting:

- Proximity: The time zone difference is minimal, making it easier to schedule meetings and receive support during business hours.

- Cost-effective: While still more affordable than onsite consultants, nearshore consultants are typically more expensive than offshore options. However, they strike a balance between cost and quality.

- Cultural compatibility: There may be fewer cultural barriers compared to offshore consultants, as the working culture and language may be more similar to that of your business.

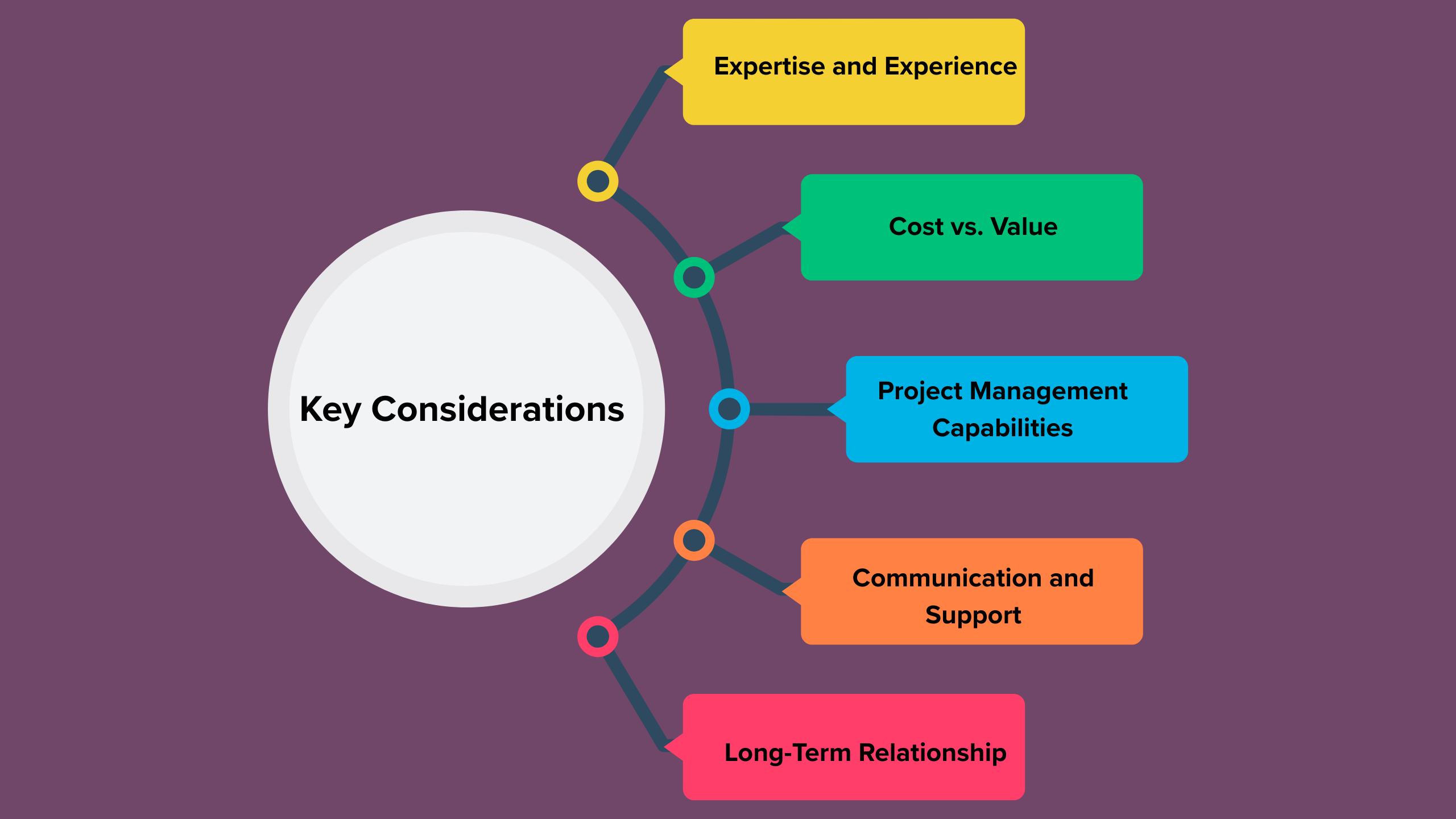

Key Considerations When Choosing an Odoo Consultant

Selecting the right Odoo consultant for your business is not just about location. There are several other factors to consider when making your decision.

1. Expertise and Experience

When outsourcing Odoo-related projects to a consultant or firm, it’s crucial to evaluate their level of expertise. Look for an Odoo development partner with experience in implementing the specific Odoo modules you need. Whether it’s finance, inventory management, or human resources, the consultant should be proficient in the modules relevant to your business.

Furthermore, partnering with a Certified Odoo Partner ensures that the consultant is officially recognized by Odoo, which adds credibility to their services.

2. Cost vs. Value

While cost is an important factor, it’s essential to balance it with the value provided by the consultant. Offshore consultants may be cheaper, but they may not always offer the same level of expertise or communication as an onsite or nearshore consultant. Therefore, it’s important to weigh the trade-off between the cost of services and the quality of Odoo development they provide.

3. Project Management Capabilities

Effective project management is key to the success of your Odoo implementation. Look for consultants who use proven project management methodologies to ensure the project is completed on time and within budget. This is especially important for complex Odoo implementations that may require frequent updates or integrations with other systems.

4. Communication and Support

Ensure that your consultant offers excellent communication and support. Offshore consultants may have limited availability due to time zone differences, while onsite consultants may be more accessible. It’s important to choose a consultant who can offer timely support when issues arise, regardless of their location.

5. Long-Term Relationship

Choosing the right Odoo development company involves more than just the initial implementation. As your business expands, you’ll require ongoing support and potential further customization to align with your evolving needs. A consultant that can foster a long-term relationship with your business will be invaluable as you scale your use of Odoo solutions. Additionally, they can help you navigate Odoo pricing and ensure that you’re getting the most cost-effective solutions as your business grows.

Expert Odoo ERP Solutions Tailored

Streamline Operations and Boost Growth with Odoo ERP Solutions

Why Choose a Certified Odoo Partner?

Working with a Certified Odoo Partner provides several advantages, especially when considering the complexity of Odoo implementations. Certified partners have undergone extensive training and meet specific requirements set by Odoo, ensuring they possess the knowledge and skills to handle your implementation needs.

Additionally, Certified Odoo Partners are more likely to provide ongoing support and can assist with any Odoo licensing consultancy issues you may encounter. This ensures that your business remains compliant with all Odoo regulations and stays up to date with the latest releases.

How Odoo Consulting Partners Enhance Business Efficiency

An experienced Odoo Licencing Service can enhance business efficiency in several ways:

- Streamlining processes: Consultants help identify inefficiencies and implement the right Odoo modules to address them.

- Improving decision-making: With a proper Odoo implementation, you gain better insights into your business, leading to more informed decisions.

- Reducing costs: Automation and optimization lead to cost savings, allowing your business to allocate resources more effectively.

- Scaling operations: As your business grows, your Odoo system can scale to meet new demands, ensuring you can manage an expanding enterprise effectively.

Expert Odoo ERP Solutions Provider

Hire Expert Odoo Developers for Tailored ERP Solutions Today!

Conclusion

Choosing the right Odoo consultant is an essential step in ensuring the success of your Odoo implementation. Whether you choose onsite, offshore, or nearshore consulting, each option has its benefits and trade-offs. Evaluate the expertise, cost, communication, and support provided by the consultant to make an informed decision.

If you’re looking to implement Odoo solutions for your business, it’s essential to partner with an Odoo development company that has a proven track record and the necessary expertise to help you streamline your operations. Remember that a Certified Odoo Partner can provide the added benefit of official support and guidance throughout the implementation process.

By carefully considering your options, you can ensure that your business benefits from a successful and efficient Odoo implementation that enhances productivity and growth.

FAQ'S

What is the difference between onsite, offshore, and nearshore Odoo consultants?

Onsite Odoo consultants work directly at your company’s location, offering personalized, face-to-face support. Offshore Odoo consultants are located in different countries, often providing cost-effective services. Nearshore consultants, located in nearby countries within similar time zones, offer a balance between cost and proximity. Choosing between them depends on your project’s complexity, budget, and communication preferences.

What are the advantages of hiring an offshore Odoo consultant?

Hiring an offshore Odoo consultant can be a cost-effective solution, as many offshore Odoo development firms offer competitive rates. It also provides access to a global pool of skilled Odoo ERP developers and specialists who can work on your project around the clock, potentially reducing development timelines.

How does a nearshore Odoo consultant compare to an offshore consultant?

A nearshore Odoo consultant offers the advantage of being in similar time zones, making communication easier and more efficient compared to offshore consultants. While the cost may be higher than offshore services, nearshore consultants often offer a good balance between affordability and accessibility, making them ideal for projects that require closer collaboration.

What should I consider when choosing between onsite and offshore Odoo consultants?

When deciding between onsite and offshore Odoo consultants, consider factors such as Odoo project-management, communication preferences, and your budget. Onsite consultants allow for immediate, face-to-face interactions and more personalized support. However, offshore consultants provide significant cost savings and access to a broader talent pool but may involve challenges with time zone differences and communication.

How can Odoo consulting partners help with the decision-making process?

Odoo consulting partners can guide you in choosing the right consultant for your needs. They understand the technical, functional, and business requirements of Odoo implementations and can help you evaluate whether onsite, offshore, or nearshore consultants will best meet your project’s goals. They also provide valuable advice on Odoo pricing and licensing, ensuring you choose the most cost-effective and efficient solution.