Imagine giving your users the power to buy now, pay later interest-free, stress-free, and within a few clicks. That’s the magic Klarna brought to the world, and it’s why businesses around the globe are racing to build BNPL apps.

Whether you’re in retail, fintech, or SaaS, this guide will help you calculate the cost to develop an app like Klarna and make the most cost-efficient tech decisions.

Why Build a Klarna-Like App?

The BNPL market is experiencing explosive growth, with Klarna leading the charge in user adoption and innovation. Investing in Klarna app development can drive higher conversions, boost loyalty, and unlock new revenue streams for businesses.

The global Buy Now Pay Later (BNPL) market is projected to reach $3.98 trillion by 2030, making it one of the fastest-growing fintech segments.

Klarna has over 150 million active users spread across 45+ countries, showing massive global adoption and user trust.

70% of online shoppers prefer flexible payment options, reinforcing the shift toward BNPL solutions like Klarna.

Klarna app development enables businesses to boost conversion rates by up to 30% by offering seamless payment flexibility.

Improves customer retention and loyalty through convenient, interest-free installment plans.

Significantly reduces cart abandonment rates, as users can delay payments without financial stress.

Unlocks merchant commission-based revenue models, giving BNPL apps a sustainable monetization strategy.

Explore Our New Blog On – How to Build an App like Brigit

Key Features for a App Like Klarna

To ensure your BNPL app works seamlessly and retains users, it must include the following components:

1. User Registration

Enable sign-up using phone number or email with support for biometric authentication for secure logins a core part of BNPL app features.

User Registration Options

Enable sign-up using phone number or email to offer flexible onboarding for users.Biometric Authentication

Integrate biometric login options such as fingerprint or Face ID to enhance security and provide frictionless access.Two-Factor Authentication (2FA)

Add an extra layer of protection using OTPs or authenticator apps during sign-ins and sensitive transactions.User Profile Management

Allow users to update personal details, manage saved addresses, and link payment methods within their profile settings.Secure Login Sessions

Implement session timeout, device management, and encrypted login tokens to protect user data and ensure trust.

2. KYC & Credit Scoring

Integrate credit bureaus like Experian, TransUnion, or identity verification services such as Onfido for soft credit checks without affecting users’ scores.

Soft Credit Checks

Integrate soft credit inquiry systems that assess users’ creditworthiness without impacting their credit scores.Credit Bureau Integration

Connect with trusted credit bureaus like Experian, TransUnion, or Equifax to retrieve accurate financial history.Identity Verification Services

Use third-party tools like Onfido, Jumio, or Trulioo to verify user identities using documents and biometric scans.Real-Time Decisioning Engine

Automate credit approval using AI/ML models that combine bureau data, transaction history, and behavioral scoring.Regulatory Compliance

Ensure your app complies with financial regulations and KYC/AML standards by partnering with authorized verification providers.

3. Pay in 4 / EMI Options

Offer flexible installment plans such as “Pay in 4” or monthly EMIs with automated reminders one of the most demanded BNPL app features.

Flexible Installment Options

Provide users with multiple payment choices like “Pay in 4,” bi-weekly payments, or monthly EMIs to suit different budgets.Automated Payment Reminders

Send timely in-app notifications, SMS, or emails to remind users of upcoming due dates and avoid late payments.Zero-Interest Plans

Offer interest-free installment plans to encourage higher purchase values and improve customer satisfaction.Customizable Payment Schedules

Let users choose or adjust installment dates based on their salary cycle or preferences.Transparent Repayment Breakdown

Display a clear schedule with due dates, principal amount, and any applicable fees for full transparency.Early Repayment Option

Allow users to repay their EMIs early without penalties, helping build trust and financial discipline.

4. Merchant Integration

Add seamless integration with eCommerce platforms like Shopify, Magento, and WooCommerce, making it easy for merchants to enable BNPL options.

eCommerce Platform Integration

Seamlessly integrate your BNPL solution with popular platforms like Shopify, Magento, and WooCommerce to ensure wide adoption.Developer-Friendly SDKs & APIs

Offer easy-to-implement SDKs and RESTful APIs so merchants can integrate BNPL features with minimal development effort.Real-Time Plugin Support

Provide ready-made plugins or extensions that merchants can install instantly on their eCommerce stores.Customizable Checkout Widgets

Enable branded, embeddable checkout modules with BNPL options that blend into the merchant’s existing UI.Merchant Dashboard Access

Give sellers full control with dashboards to manage BNPL orders, track payments, and analyze customer behavior.Multi-Store Support

Allow merchants to use the same BNPL backend for multiple storefronts, improving scalability.

5. Checkout Integration

Incorporate a branded BNPL button directly into partner store checkouts or through browser extensions, improving conversion rates.

Branded BNPL Checkout Button

Embed a clearly visible, branded BNPL button directly within the partner store’s checkout flow to enhance user engagement.Seamless User Experience

Ensure that the BNPL button triggers a smooth, pre-approved payment process without redirecting users off-site.Browser Extension Support

Offer BNPL functionality via browser extensions for users shopping outside integrated platforms like Chrome or Firefox.Custom Button Styling for Merchants

Allow partners to customize button styles (color, size, label) to match their brand identity and checkout layout.Placement Optimization

Strategically position the BNPL button near “Add to Cart” or “Proceed to Checkout” to improve click-through rates.Mobile & Desktop Compatibility

Design buttons to be fully responsive and accessible across mobile devices, tablets, and desktops.

6. Transaction Tracking

Provide a timeline interface showing all upcoming payments, completed transactions, and due dates key for user transparency.

Interactive Payment Timeline

Display a visually engaging interface showing all upcoming payments, completed transactions, and pending dues in chronological order.Real-Time Status Updates

Mark payments as “Upcoming”, “Paid”, or “Overdue” with clear status indicators for each transaction.Calendar View Integration

Offer a calendar layout where users can quickly view installment dates, set reminders, and track payment cycles.Detailed Transaction History

Allow users to access past transaction details including item names, payment methods, and amounts paid.Smart Alerts & Notifications

Trigger automated alerts for due dates, successful payments, and any missed installments via push or email.Filter & Sort Options

Enable users to sort by status, date, or amount improving navigation and clarity.Export & Download Receipts

Let users download or share receipts and transaction summaries for recordkeeping or tax purposes.

7. Push Notifications & Reminders

Send real-time alerts for due payments, transaction approvals, and promotional offers, keeping users informed and engaged.

Real-Time Payment Reminders

Notify users instantly about upcoming installment due dates to reduce missed payments and late fees.Transaction Approval Alerts

Send immediate confirmations when a BNPL transaction is approved or declined to keep users informed.Promotional Offer Notifications

Push updates about exclusive merchant discounts, cashback deals, or seasonal offers to boost user engagement.Custom Notification Preferences

Allow users to choose their preferred alert channels push, SMS, or email and customize what types of alerts they receive.In-App Notification Center

Provide a centralized space where users can view all their alerts, messages, and updates in one place.Security Alerts

Instantly notify users about suspicious activity, login attempts, or account changes to ensure security and trust.Localization & Time-Zone Awareness

Deliver notifications based on the user’s time zone and preferred language to enhance personalization and accuracy.

Cost Breakdown by App Complexity

App development costs vary based on the scope and complexity of the app. Here’s a breakdown:

| Tier | Basic MVP | Mid-Level | Full-Scale |

|---|---|---|---|

| Cost | $10K – $20K | $25K – $50K | $50K – $100K+ |

| Timeline | 3–4 months | 5–8 months | 9–12 months |

| Core Features |

|

|

|

| Compliance | KYC basic (manual) |

|

|

| Integrations | 1 Payment API |

|

|

| Security | Standard encryption | Tokenization |

|

| AI/Analytics | — |

|

|

Explore new blog on – The Cost of Developing a FinTech App

How to Optimize Development Cost

Let’s face it BNPL apps can get expensive if not carefully planned. Here are smart ways to cut down development costs without compromising on quality:

1. Start With MVP (Minimum Viable Product)

- Focus only on essential features like split payments, KYC, and merchant checkout.

- Launch a beta version to gather user feedback.

2. Use Prebuilt APIs and SDKs

- Leverage Plaid, Alloy, Stripe, and Onfido to save time on backend infrastructure.

- Use white-label wallets and integrate instead of building from scratch.

3. Offshore Development

- Hire expert BNPL developers from India or Eastern Europe, where hourly rates are 3x lower than in the US.

4. Open-Source UI Libraries

- Use Material UI, TailwindCSS, or Klarna-inspired UI kits from Figma.

Tech Stack Required for an App Like Tabby

The right technology stack ensures your app is scalable, secure, and high-performing.

1. Frontend Technologies

Flutter

React Native (Ideal for cross-platform mobile app development)

2. Backend Technologies

Node.js

Python (Powerful for handling business logic and API integrations)

3. Database Options

MongoDB

PostgreSQL (Support for both structured and flexible data storage)

4. Payment Gateways & APIs

Stripe

Razorpay

Tabby API (Facilitate seamless checkout and split payments)

5. KYC/AML Verification Tools

Onfido

ShuftiPro (Used for automated identity checks and compliance requirements)

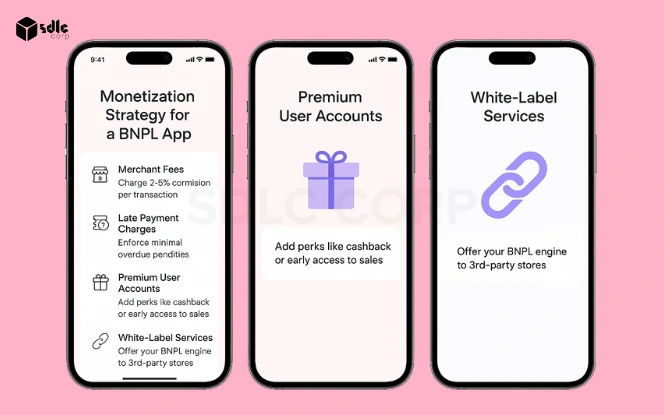

Monetization Strategy for a BNPL App

Make your Klarna clone app a profitable venture by implementing a diverse Klarna revenue model. Here are the key ways to generate consistent BNPL app income

1. Merchant Transaction Fees

Charge a 2–5% commission on every transaction processed through your platform, similar to Klarna’s merchant-based earnings model.

2. Late Payment Penalties

Apply small penalties on overdue payments to encourage timely repayments and create a secondary income stream.

3. Premium User Accounts

Offer subscription-based upgrades that include features like cashback rewards, flexible limits, or early access to exclusive sales.

4. White-Label Services

License your BNPL technology to third-party merchants and eCommerce platforms under a white-label agreement.

5. Affiliate Partnerships

Collaborate with featured brands or merchants and earn commissions through affiliate links placed within your shopping marketplace.

How to Choose the Right Development Partner

Your choice of a development partner directly influences the quality and security of the product.

Key Criteria

- Proven experience in fintech app development

- Expertise in compliance, payment integration, and data security

- Clear communication and agile methodology

- Offers post-launch maintenance & support

Conclusion & Next Steps

Building an app like Klarna is not just a trend it’s a strategic leap into the fintech future. With skyrocketing BNPL usage and growing customer demand for financial flexibility, now is the time to invest in a Klarna-style app tailored to your niche.

Whether you’re a startup or a retail brand, we provide end-to-end development from discovery to deployment.

Ready to bring your BNPL app idea to life? Contact SDLC Corp for a Free Consultation.

FAQ'S

How Much Does It Cost To Build An App Like Klarna?

Anywhere between $10,000 to $20,000+, depending on complexity and location of developers.

What Are The Top Features In A Klarna-Style App?

Core features include Pay-in-4, KYC, merchant checkout, and virtual cards.

How Long Will Development Take?

Expect a timeline of 4–9 months, depending on scope and speed.

Can I Add BNPL to My Existing Store?

Yes! Our team can integrate Klarna-style BNPL through a custom plugin or SDK.

Do I Need Licenses Or Compliance To Launch?

Yes, you need to comply with PCI DSS, KYC norms, and local lending regulations.

How Can I Reduce App Development Cost?

Build an MVP, use third-party APIs, and hire offshore fintech developers to cut costs.

Can You Help With White-Label Klarna Clones?

Absolutely! We build scalable BNPL engines you can brand as your own.

Where Can I Start?

Talk to our fintech experts and get a project roadmap in 24 hours.