Introduction

An invoice payment is a transaction where a customer settles a bill issued by a seller for goods or services provided. It involves the transfer of funds from the customer to the seller to fulfill the financial obligation outlined in the invoice. Invoice payments are typically made using various methods, including cash, checks, credit cards, or electronic transfers. They are an essential part of business operations, ensuring that sellers are paid for their goods or services and that customers fulfill their financial obligations. Timely invoice payments help maintain positive relationships between businesses and their customers and suppliers.

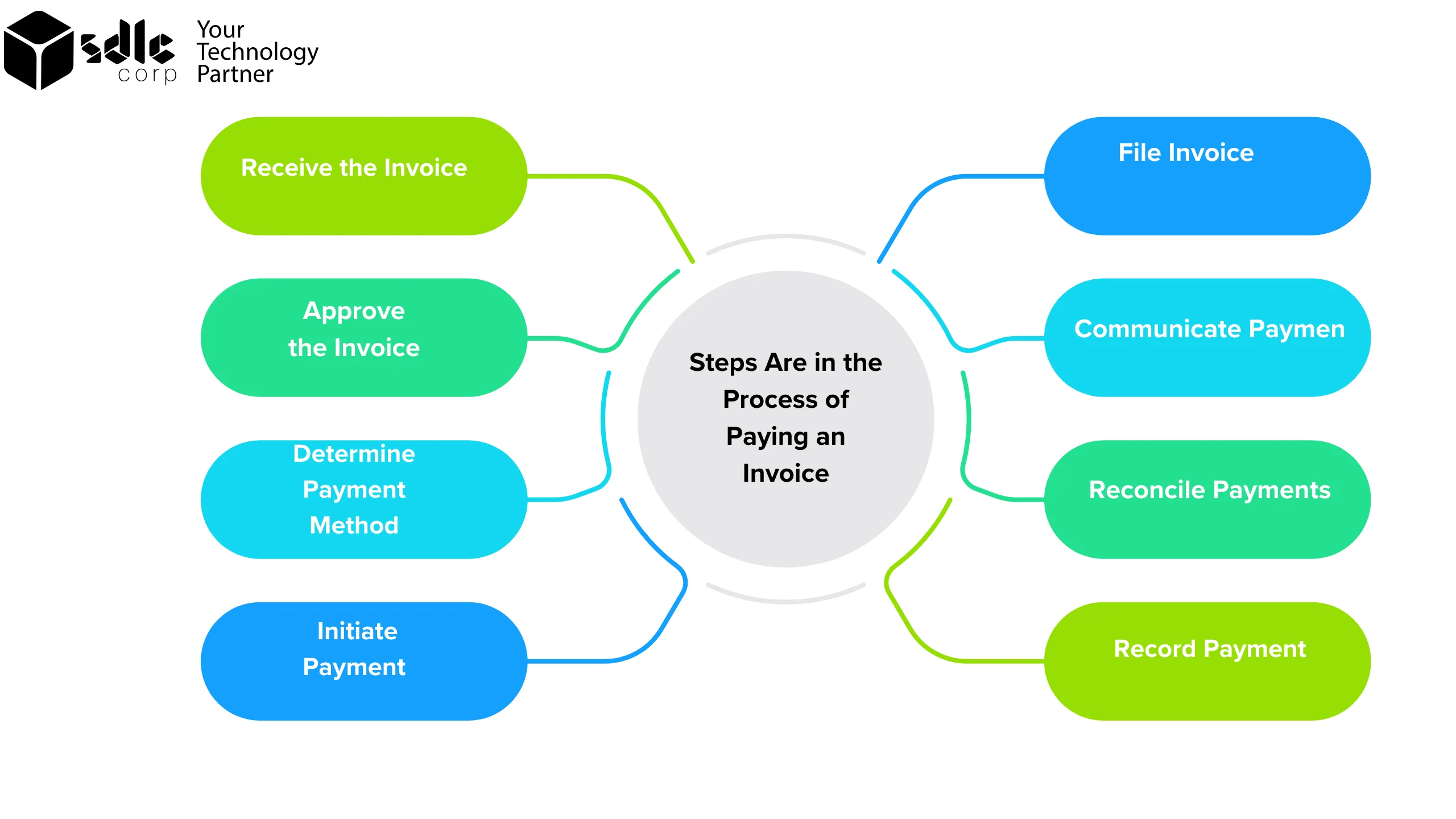

What Steps Are Included in the Process of Paying an Invoice?

The process of paying an invoice typically involves several steps:

- Receive the Invoice: The invoice is sent by the supplier or vendor to the customer, detailing the goods or services provided and the amount due.

- Approve the Invoice: If the invoice is correct, the customer approves it for payment. In some cases, the invoice may need to go through an approval process within the customer’s organization.

- Determine Payment Method: The customer decides on the payment method to use, such as bank transfer, credit card, check, or electronic payment.

- Initiate Payment: Using the chosen payment method, the customer initiates the payment to the supplier or vendor. This may involve logging into an online banking system, using a payment gateway, or issuing a check.

- Record Payment: After making the payment, the customer records the transaction in their accounting records, noting the invoice number, payment date, and amount paid.

- Reconcile Payments: The customer reconciles the payment with their accounts payable records to ensure that the invoice is marked as paid and that the payment is reflected accurately in their financial statements.

- Communicate Payment: If necessary, the customer communicates to the supplier or vendor that the invoice has been paid, providing any relevant payment confirmation details.

- File Invoice: The customer files the paid invoice for future reference and auditing purposes.

- Monitor Payment Status: The customer may monitor the payment status to ensure that it is processed and received by the supplier or vendor.

Take Control of Your Finances: Learn About Invoice Payments Today!

How to Pay for an Invoice?

To pay for an Automated invoice Process, start by reviewing the invoice details, including the amount due, payment due date, and payment instructions. Choose a payment method that is convenient for you and accepted by the supplier or vendor, such as bank transfer, credit card, check, or online payment platform. If paying online, log in to your banking or payment account and navigate to the bill payment section. Enter the invoice details, including the amount to pay and the recipient’s information. Double-check the payment details for accuracy before confirming the payment. If paying by check, write the check for the invoiced amount and mail it to the supplier or vendor’s address, ensuring it arrives before the due date. After making the payment, keep a record of the transaction, such as a confirmation number or receipt, for your records.

What are some best practices for ensuring timely invoice payments?

Ensuring timely invoice payments is essential for maintaining positive relationships with suppliers and vendors. One of the best practices is to establish clear payment terms upfront, including due dates and accepted payment methods. Using invoice management software can help you track and manage your invoices more efficiently, ensuring that you don’t miss any payment deadlines. It’s also beneficial to schedule regular payment runs to process invoices in batches, reducing the risk of overlooking any payments.

Monitoring your cash flow regularly can help you ensure that you have enough funds available to make timely payments. Communicating openly with your suppliers about payment expectations and any issues that may arise can also help avoid misunderstandings. Additionally, automating payments through electronic funds transfer or online platforms can streamline the payment process and reduce the likelihood of errors.

Stay on Top of Your Bills: Explore the World of Invoice Payments Now!

What are some common challenges faced when making invoice payments?

Several common challenges can arise when making invoice payments. These include issues such as missing or incorrect invoice details, delays in invoice approval processes, difficulties in reconciling payments with invoices, and challenges related to cash flow management. Other common challenges include issues with payment methods, such as delays in bank transfers or problems with online payment platforms. Additionally, managing a large volume of invoices and ensuring that payments are made on time can be challenging for some businesses.

What are the benefits of paying invoices on time?

Paying invoices on time offers several benefits that can positively impact your business. Firstly, it helps maintain strong relationships with your suppliers and vendors. Consistently paying on time shows reliability and professionalism, which can lead to better terms, discounts, and priority service. Good relationships with suppliers are crucial for ensuring a steady supply of goods and services, which is vital for the smooth operation of your business.

Secondly, paying invoices promptly helps you avoid late fees and penalties. Many suppliers impose penalties for late payments, which can quickly add up and increase your costs. By paying on time, you can avoid these extra expenses and keep your budget in check.

Thirdly, timely payments can improve your creditworthiness. Some suppliers report payment history to credit agencies, and consistently paying invoices on time can help build a positive credit profile for your business. This can be beneficial when applying for loans or negotiating terms with other vendors and reconciliation.

Moreover, paying invoices on time ensures a smooth cash flow. Delayed payments can disrupt your cash flow, making it difficult to meet other financial obligations. By paying on time, you can maintain a healthy cash flow and avoid unnecessary stress.

Additionally, timely payments help you avoid supply chain disruptions. Late payments can strain relationships with suppliers and lead to delays in receiving goods or services. This, in turn, can impact your ability to fulfill orders and meet customer demands. By paying invoices on time, you contribute to a more efficient supply chain and reduce the risk of disruptions.

In conclusion, paying invoices on time is not only about fulfilling a financial obligation but also about building trust, maintaining a positive reputation, and ensuring the smooth operation of your business. It is a fundamental aspect of good financial management that can benefit your business in various ways.

Is there a penalty for late payments on invoices?

Late payment penalties can vary depending on the terms agreed upon between the parties involved. In many cases, businesses include a clause in their invoices that stipulates a late payment penalty. This penalty could be a fixed amount or a percentage of the invoice total. It’s important to review the terms and conditions of the invoice or contract to understand the specific penalties that may apply.

What information need to include when making an invoice payment?

When making an invoice payment, you typically need to include the following information:

- Invoice Number: This helps the recipient identify which invoice you are paying for.

- Payment Amount: The total amount you are paying.

- Payment Date: The date when the payment is made.

- Payment Method: How you are making the payment (e.g., check, bank transfer, credit card).

- Your Contact Information: Your name, address, and contact details.

- Recipient’s Contact Information: The name, address, and contact details of the entity or person you are paying.

- Any Reference or Account Number: Any specific reference or account number requested by the recipient to ensure proper allocation of the payment.

Simplify Your Payments: Discover the Basics of Invoice Payment Processing!

FAQs

1. What is an invoice payment term?

Invoice payment terms specify the period within which a customer is expected to pay an invoice. Common terms include “Net 30” (payment due within 30 days), “Net 60,” and “Due on receipt.

2. How do I submit an invoice for payment?

Provide instructions on how vendors or suppliers can submit invoices for payment, including any required format or documentation.

3. How long does it take for invoices to be processed and paid?

Provide an estimated timeline for processing invoices and making payments, taking into account any approval processes or payment terms.

4. Can I track the status of my invoice?

- Explain whether vendors or suppliers can track the status of their invoices and how they can do so (e.g., through an online portal or by contacting your accounts payable department).

5. What payment methods do you offer?

List the payment methods available for vendors or suppliers, such as electronic funds transfer (EFT), checks, or virtual credit cards.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)