Introduction

Accounts Payable Month-End Close:

The accounts payable month-end close is the process of finalising all accounts payable transactions for the month. It involves reconciling vendor statements, ensuring all invoices are recorded and accounted for correctly, and preparing reports that summarise the accounts payable activity for the period. This process is important for accurate financial reporting and helps ensure that all payments to vendors are processed in a timely manner.

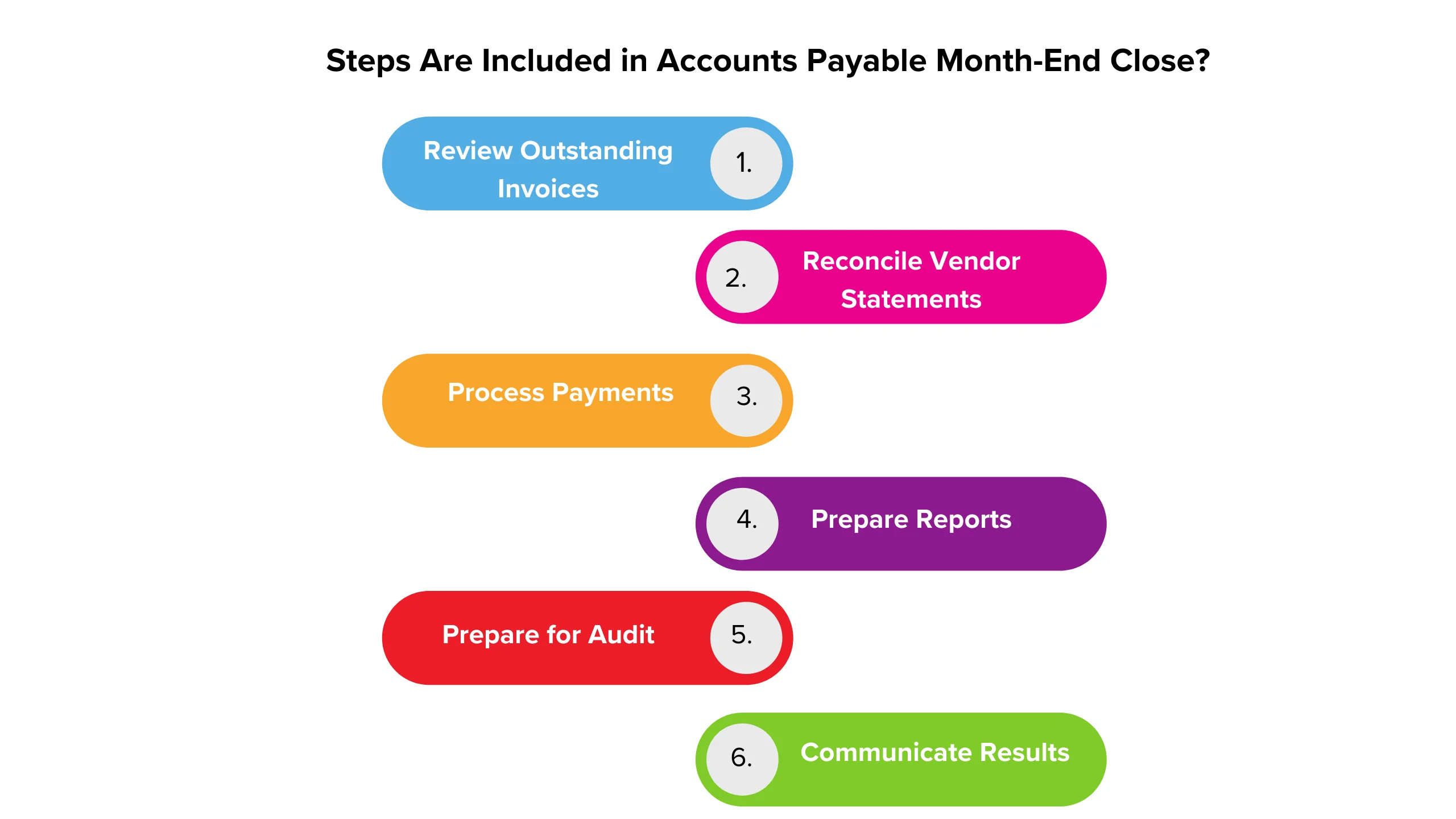

Steps Are Included in Accounts Payable Month-End Close:

The accounts payable month-end close process typically includes the following steps:

- Review Outstanding Invoices: Review all outstanding invoices to ensure they are properly recorded and accounted for. Follow up on any missing or incorrect invoices.

- Reconcile Vendor Statements: Reconcile vendor statements with your accounts payable records to ensure all invoices are accounted for and no discrepancies exist.

- Accrue Expenses: Accrue any expenses that have been incurred but not yet invoiced by vendors. This ensures that expenses are recorded in the correct accounting period.

- Review Aging Reports: Review aging reports to identify any overdue invoices. Follow up with vendors to ensure timely payment.

- Process Payments: Prepare and process payments for approved invoices. Ensure that payments are made in accordance with payment terms and that all necessary approvals are obtained.

- Adjust Accruals: Make any necessary adjustments to accruals based on the reconciliation of vendor statements and aging reports.

- Prepare Reports: Prepare reports summarizing accounts payable activity for the month, including total invoices processed, total payments made, and outstanding balances.

- Review Controls: Review and ensure that internal controls over the accounts payable process are being followed, including segregation of duties and approval processes.

- Close Accounts Payable Subledger: Close the accounts payable subledger for the month once all transactions of Assets and Liability have been properly recorded and reconciled.

- Perform Reconciliation: Reconcile accounts payable subledger balances with the general ledger to ensure accuracy.

- Verify Accruals: Verify that all accrued expenses have been properly recorded and accounted for.

- Review Financial Statements: Review financial statements to ensure that accounts payable balances are accurately reflected.

- Archive Documents: Archive all supporting documentation, such as invoices and payment records, in accordance with company policy and regulatory requirements.

- Prepare for Audit: Prepare accounts payable records and reports for audit purposes, ensuring that all documentation is accurate and complete.

- Communicate Results: Communicate the results of the month-end close process to relevant stakeholders, including management and other departments.

What finalizes the AP month-end?

The accounts payable (AP) month-end close is finalized through a series of meticulous steps designed to ensure accuracy, compliance, and efficiency in financial operations. Modern practices have streamlined this process, often leveraging automation and digital tools to expedite tasks and reduce errors. Key components include reconciling vendor statements, verifying invoices, processing payments, and preparing financial reports. Automation tools can help reconcile large volumes of invoices quickly, flagging discrepancies for manual review. Additionally, digital approval workflows and electronic payments speed up processing times and reduce the risk of errors associated with manual tasks. Ultimately, a well-executed AP month-end close ensures that financial records are accurate, vendors are paid on time, and compliance requirements are met.

Streamline your accounts payable month-end close with our proven checklist!

Why is month-end close critical?

The month-end close process is critical for several reasons. Firstly, it ensures the accuracy and completeness of financial records. By reconciling accounts and verifying transactions, organisations can identify and correct errors, ensuring that financial statements present a true and fair view of the company’s financial position. This is crucial for stakeholders such as investors, regulators, and internal management who rely on these statements to make informed decisions.

Secondly, the month-end close process is essential for compliance purposes. It ensures that financial reporting adheres to relevant accounting standards and regulatory requirements. This is particularly important for publicly traded companies, which are subject to strict reporting standards and face potential penalties for non-compliance.

Additionally, the month-end close process is vital for effective financial management. By reviewing financial performance and analysing key metrics, organisations can gain insights into their operations and make informed decisions about resource allocation, strategic planning, and performance improvement.

Finally, the month-end close process helps organizations manage cash flow effectively. By reconciling accounts payable and accounts receivable, organizations can ensure that they have accurate records of their financial obligations and incoming cash, enabling them to plan and manage their cash flow more efficiently.

In conclusion, the month-end close process is critical for ensuring the accuracy of financial records, compliance with regulatory requirements, effective financial management, and efficient cash flow management. It is an essential process that helps organizations maintain financial health and make informed decisions.

Ensure accuracy and compliance in your AP processes with our month-end close guide.

What does the month-end close process involve?

What does the month-end close process involve?

The month-end close process typically involves several steps to ensure that financial statements are accurate and complete for the month. Here is an overview of the process:

- Review Transactions: Review all financial transactions for the month to ensure they are accurately recorded.

- Adjusting Entries: Make any necessary adjusting entries to account for items such as accruals, prepayments, depreciation, and other adjustments.

- Reconciliations: Reconcile bank statements, accounts receivable, accounts payable, and other accounts to ensure they match the general ledger.

- Financial Statement Preparation: Prepare financial statements, including the income statement, balance sheet, and cash flow statement, for the month.

- Review and Approval: Review the financial statements for accuracy and obtain approval from management.

- Closing Entries: Make closing entries to transfer temporary account balances (e.g., revenue, expenses) to permanent accounts (e.g., retained earnings).

- Financial Analysis: Analyze the financial statements to identify trends, variances, and areas for improvement.

- Documentation: Document the month-end close process, including any issues or adjustments made, for audit purposes.

- Final Review: Conduct a final review of the month-end close process to ensure all steps have been completed accurately and on time.

- Reporting: Prepare and distribute financial reports to stakeholders, such as management, investors, and regulatory authorities.

Optimize your financial reporting with our step-by-step AP month-end close checklist.

What are the ins and outs of the accounts payable month-end close process?

Certainly! Here’s a breakdown of the accounts payable (AP) month-end close process in a bullet-point format:

INS | OUTS |

|

|

|

|

|

|

|

|

|

|

|

|

What makes having a modern accounts payable month-end close process important?

Having a modern accounts payable month-end close process is crucial for businesses seeking to optimize their financial operations. This approach emphasizes efficiency, accuracy, and compliance through the use of automation and advanced technologies. By streamlining tasks, such as invoice processing, accruals, reconciliations, and reporting, a modern process reduces manual effort and the risk of errors, ensuring that financial records are more accurate and reliable.

Moreover, the timeliness of the close process is improved, providing management with up-to-date financial information to make informed decisions. Additionally, a modern process enhances cost-effectiveness by lowering processing costs and improving cash flow management. It also strengthens vendor relationships by ensuring timely payments. Overall, a modern accounts payable month-end close process offers improved efficiency, accuracy, compliance, and cost-effectiveness, making it essential for businesses aiming to enhance their financial operations.

What are some tactics for creating a cutting-edge accounts payable month-end close process?

Creating a cutting-edge accounts payable month-end close process involves leveraging technology and best practices to streamline operations and improve efficiency. Here are four tactics to achieve this:

- Automation: How can you leverage automation to streamline invoice processing, approvals, and payments?

- Data Analytics: How can you use data analytics to identify trends, anomalies, and areas for process improvement?

- Integration: How can you integrate your accounts payable system with other financial systems for seamless data flow?

- Compliance: How can you ensure compliance with accounting standards and regulations through the use of technology and best practices?

What are the Challenges with solution of Month-End Closing?

- Manual Processes:

- Challenge: Relying on manual processes can lead to errors, delays, and inefficiencies.

- Solution: Implement automation to streamline tasks such as data entry, reconciliation, and reporting.

- Data Accuracy:

- Challenge: Ensuring the accuracy of financial data is challenging, especially with large volumes of transactions.

- Solution: Use automated validation checks and reconciliation tools to identify and correct errors.

- Time Constraints:

- Challenge: Meeting tight deadlines for month-end closing can be stressful and challenging.

- Solution: Establish a clear timeline and prioritize tasks to ensure that critical activities are completed on time.

- Communication and Collaboration:

- Challenge: Lack of communication and collaboration between departments can lead to misunderstandings and delays.

- Solution: Implement a system for sharing information and updates in real-time.

- Compliance:

- Challenge: Ensuring compliance with accounting standards and regulations is essential but can be complex.

- Solution: Use software that is compliant with relevant standards and regulations and regularly update policies and procedures.

- Audit Preparation:

- Challenge: Preparing for audits can be time-consuming and resource-intensive.

- Solution: Maintain accurate and up-to-date records throughout the month to simplify the audit process.

- Data Security:

- Challenge: Protecting sensitive financial data from unauthorised access and breaches is critical.

- Solution: Implement robust security measures, such as encryption and access controls, to safeguard data.

Addressing these challenges requires a combination of technology, process improvements, and communication strategies to streamline month-end closing processes and ensure accuracy, efficiency, and compliance.

FAQS

1. What is the accounts payable month-end close process?

The accounts payable month-end close process involves reconciling accounts, processing outstanding invoices, and preparing financial statements.

2. Why is the accounts payable month-end close process important?

It is important because it ensures that financial records are accurate and up-to-date, which is essential for decision-making and compliance purposes.

3.What are some best practices for the accounts payable month-end close process?

- How can automation help with the accounts payable month-end close process?

4. How can automation help with the accounts payable month-end close process?

- Automation can help by reducing manual errors, speeding up processes, and providing greater visibility into the status of invoices and payments.

5. What are some common challenges faced during the accounts payable month-end close process?

Common challenges include manual data entry errors, delays in invoice processing, and difficulty in reconciling accounts.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)