In today’s rapidly evolving financial landscape, wealth management firms face immense pressure to deliver personalized, timely, and compliant services to high-net-worth clients. Managing diverse portfolios, regulatory compliance, client communication, and operational workflows simultaneously demands a unified and efficient system. This is where Odoo ERP for Wealth Management steps in as a comprehensive solution, streamlining complex processes and enhancing overall operational efficiency.

Odoo ERP, a powerful open-source enterprise resource planning platform, offers a modular and customizable system designed to address the unique challenges of wealth management firms. Whether managing investment portfolios, financial planning, or client relations, firms leveraging Odoo benefit from real-time insights, automation, and scalable workflows that improve decision-making and client satisfaction.

Why Odoo Is a Game-Changer for Wealth Management Firms

Unlike traditional siloed systems, Odoo offers:

- Modularity Deploy only the wealth management modules you need now, and expand easily as your business grows.

- User-Friendly Interface An intuitive UI designed for advisors, compliance officers, and back-office teams.

- Regulatory Compliance Support Built-in tools to help meet financial regulations and audit requirements.

- Flexibility & Customization Tailor workflows, client portals, and reporting dashboards specific to your firm’s strategies.

Odoo transforms complex wealth management operations into streamlined processes, enabling firms of all sizes from boutique advisory practices to global asset managers to compete and grow efficiently.

Key Odoo Modules for Wealth Management Success

1. Centralized Wealth Management Dashboard

Gain a consolidated, real-time overview of client portfolios, assets under management (AUM), investment performance, and operational KPIs. Odoo’s dashboard integrates data from CRM, accounting, and portfolio management modules, allowing advisors and managers to monitor:

- Portfolio diversification and risk exposure

- Client acquisition and retention metrics

- Compliance alerts and document status

- Revenue and fee tracking

This unified dashboard empowers decision-makers to quickly spot trends, mitigate risks, and optimize client strategies.

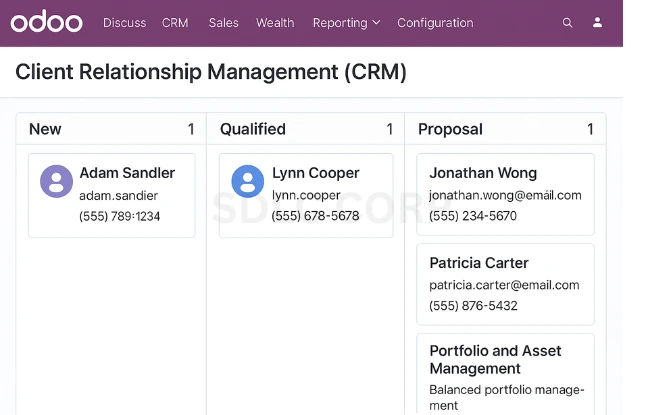

2. Client Relationship Management (CRM) for Personalized Engagement

At the heart of wealth management lies strong client relationships. Odoo’s CRM module supports:

- Tracking client interactions and meeting notes

- Managing lead pipelines for new prospects

- Segmenting clients by wealth tiers or preferences

- Automating reminders for portfolio reviews or regulatory disclosures

Rich client profiles and communication histories allow advisors to deliver tailored advice and timely follow-ups, enhancing client satisfaction and loyalty.

3. Portfolio and Asset Management Integration

Odoo can integrate with portfolio management tools or host asset tracking within its ecosystem. Features include:

- Multi-asset class tracking: equities, bonds, real estate, alternative investments

- Real-time valuation updates and performance analytics

- Automated rebalancing alerts

- Integration with market data providers for pricing and benchmarks

This empowers portfolio managers to maintain optimal asset allocation and respond rapidly to market changes.

4. Financial Planning and Goal Tracking

Advisors can create detailed financial plans aligned with client goals such as retirement, education funding, or wealth transfer. Functionalities include:

- Scenario modeling for different investment outcomes

- Cash flow projections and risk tolerance assessments

- Goal progress tracking with visual reports

These tools build client trust by demonstrating transparent, data-driven planning and monitoring

5. Compliance and Risk Management

Regulatory compliance is critical for wealth managers. Odoo supports:

- Document management for KYC (Know Your Customer), AML (Anti-Money Laundering), and suitability checks

- Automated workflows for compliance approvals and audits

- Role-based access controls for sensitive client data

- Audit trails and electronic signatures to ensure accountability

Such features reduce compliance risks while streamlining regulatory workflows.

6. Accounting and Fee Management

Seamlessly track all financial transactions related to portfolios, client billing, and management fees:

- Automated fee calculations based on AUM or performance

- Integration with general ledger and invoicing

- Transparent client statement generation

- Expense tracking for operational efficiency

This integration reduces errors and accelerates revenue recognition.

7. Document Management and Client Portal

Odoo’s document management system centralizes contracts, disclosures, statements, and reports with version control and secure access. Additionally, client portals provide:

- Self-service access to portfolio reports and documents

- Secure messaging channels with advisors

- Online scheduling for meetings and approvals

These features improve client engagement and reduce administrative burdens.

Odoo: One Platform for All Wealth Management Operations

Whether a small advisory firm or a large wealth management company, Odoo offers a comprehensive platform covering:

- CRM and Client Onboarding

- Portfolio and Asset Tracking

- Financial Planning and Reporting

- Compliance and Risk Controls

- Accounting and Fee Processing

- Client Communication and Collaboration

All modules interconnect seamlessly, eliminating data silos and enabling holistic insights into client wealth and firm performance.

Customization & Integration Capabilities

Odoo’s flexible architecture allows integration with:

- Third-party portfolio management and trading platforms

- Market data feeds and analytics providers

- Regulatory and compliance databases

- Banking and payment gateways

With Odoo Studio and APIs, firms can build custom workflows, dashboards, and client reports with minimal coding, ensuring the system evolves with business needs

Security & Compliance

Odoo implements robust security features including:

- Role-based access control and user permissions

- Encrypted data storage and secure backups

- Full audit logs and change tracking

- Compliance support for GDPR and industry-specific regulations

These capabilities safeguard sensitive client information and ensure trustworthiness.

Business Benefits of Odoo for Wealth Management Firms

- Increased Operational Efficiency: Automate repetitive tasks and eliminate manual data entry.

- Enhanced Client Experience: Deliver personalized advice with up-to-date client insights and accessible portals.

- Improved Compliance: Ensure consistent KYC, AML, and reporting standards while reducing audit preparation time.

- Better Data Visibility: Gain a 360-degree view of clients and portfolios for smarter decision-making.

- Cost Reduction: Streamline workflows and reduce overhead with an integrated platform.

- Scalability: Easily add modules or customize as your firm expands or regulations evolve.

Real-World Use Case: Transforming a Boutique Wealth Advisory

Consider a boutique advisory managing over 500 clients with diverse portfolios. Before Odoo, their processes relied on spreadsheets, disconnected systems, and manual compliance checks.

By implementing Odoo:

- Client onboarding time reduced by 40% with automated KYC workflows.

- Portfolio managers accessed real-time asset performance dashboards.

- Compliance officers tracked document approvals and audit logs seamlessly.

- Clients used self-service portals to view statements and schedule meetings.

The result was improved client retention, reduced operational risk, and a platform ready to scale as assets under management grew.

Why Partner with SDLC Corp for Your Odoo Wealth Management Implementation?

At SDLC Corp, we specialize in implementing Odoo solutions tailored for financial services and wealth management firms. Our experts guide you through:

- Business process analysis and system design

- Regulatory compliance integration

- Custom module development and seamless data migration

- Training and ongoing support

Partner with us to unlock Odoo’s full potential and gain a competitive edge

Conclusion

In an increasingly competitive and regulated environment, wealth management firms must adopt agile, integrated, and scalable solutions. Odoo ERP provides a unified platform that streamlines operations, strengthens compliance, and enhances client experiences.

Whether you’re looking to optimize portfolio management, automate compliance workflows, or engage clients through self-service portals, Odoo is the trusted platform for boosting wealth management efficiency.

Contact SDLC Corp today for a free consultation and discover how Odoo ERP can transform your wealth management operations for the future.

FAQs

Is Odoo Suitable For Small And Large Wealth Management Firms?

Yes. Odoo’s modular design enables firms of any size to deploy essential features and scale as business needs evolve.

Can Odoo Integrate With Third-Party Portfolio Management Software?

Absolutely. Odoo supports integrations via APIs to connect with existing portfolio and trading systems.

Does Odoo Help With Regulatory Compliance In Wealth Management?

Yes. It includes document management, role-based access, approval workflows, and audit trails to support KYC, AML, and reporting.

Can Clients Access Their Portfolios And Reports Through Odoo?

Odoo offers secure client portals where clients can view statements, reports, and communicate with advisors.

How Long Does An Odoo Implementation Typically Take For Wealth Management Firms?

Implementation timelines vary, but most projects complete within 8-16 weeks, depending on customization and training needs.

Is Odoo Customizable To Match Unique Business Processes?

Yes, Odoo Studio and APIs allow extensive customization without heavy coding.