Introduction

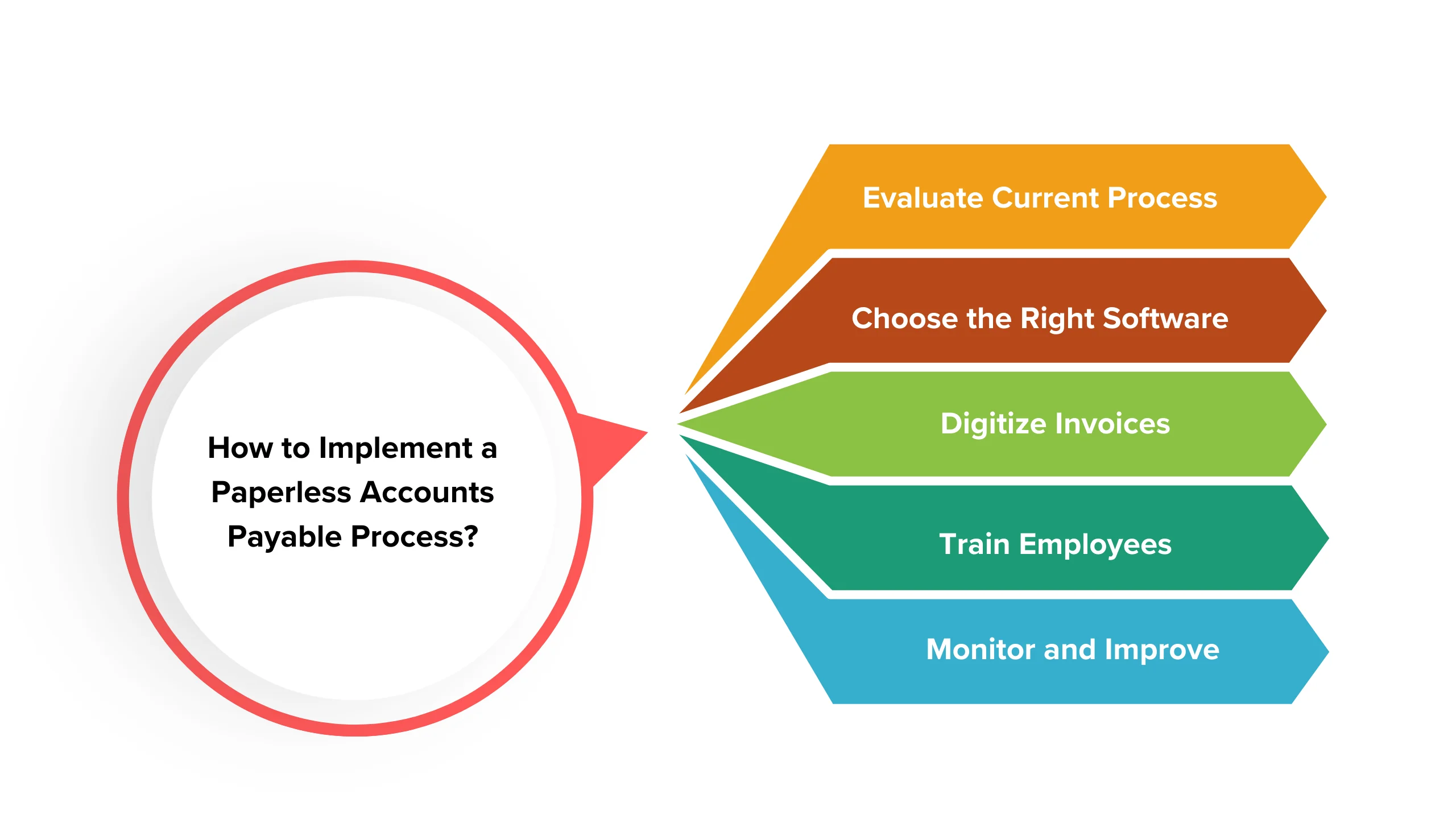

Implementing a paperless accounts payable process involves several key steps:

- Evaluate Current Process: Review your current accounts payable process to identify areas where paper can be eliminated or reduced.

- Choose the Right Software: Select an accounts payable software that meets your needs, such as electronic invoicing, automated approval workflows, and digital document storage.

- Digitize Invoices: Convert paper invoices into digital format using scanning or electronic invoicing methods.

- Implement Approval Workflows: Set up automated approval workflows to route invoices to the appropriate stakeholders for approval.

- Enable Electronic Payments: Use electronic payment methods, such as ACH transfers or virtual credit cards, to pay vendors.

- Integrate Systems: Integrate your accounts payable software with other systems, such as your accounting software or ERP system, to streamline data entry and Accounts Payable Reconciliation

- Train Employees: Provide training to employees on how to use the new accounts payable process and software.

- Monitor and Improve: Continuously monitor the effectiveness of your paperless accounts payable process and make improvements as needed.

Can accounts payable be made paperless?

Yes, accounts payable (AP) can be made paperless through the implementation of various digital tools and processes. Here’s a detailed overview:

- Electronic Invoicing: Receive invoices electronically via email or through a supplier portal. This eliminates the need for paper invoices.

- Document Imaging and Management: Scan and digitize paper invoices, receipts, and other relevant documents. Store them electronically in a secure document management system.

- Automated Data Capture: Use optical character recognition (OCR) technology to extract data from invoices and input it directly into your AP system, reducing manual data entry.

- Electronic Approval Workflow: Implement an automated approval process for invoices. This streamlines the approval process and reduces the need for physical signatures.

- Digital Payment Methods: Use electronic payment methods such as Automated Clearing House (ACH) transfers, virtual credit cards, or online payment platforms to pay suppliers. This eliminates the need for paper checks.

- Integration with Accounting Software: Integrate your AP system with your accounting software or enterprise resource planning (ERP) system to ensure seamless transfer of data and eliminate duplicate data entry.

- Supplier Collaboration Portals: Provide suppliers with access to a secure portal where they can submit invoices and track payment status, reducing the need for paper-based communication.

- Regular Audits and Reviews: Conduct regular audits of Asset and Liability to your paperless AP process to ensure compliance with regulations and identify areas for improvement.

Implementing these strategies can help organizations transition to a paperless accounts payable process, reducing costs, improving efficiency, and enhancing overall transparency and accuracy.

Go green with a paperless accounts payable process—digitize your invoices today!

How can I transition to a paperless accounts payable process?

Transitioning to a paperless accounts payable process involves several key steps:

- Evaluate Current Processes: Assess your current AP processes to identify areas where paper can be eliminated or reduced.

- Select the Right Software: Choose an accounting or AP automation software that supports electronic invoicing, digital document management, and automated workflows.

- Implement Electronic Invoicing: Encourage suppliers to send invoices electronically via email or through a supplier portal.

- Digitize Paper Invoices: Scan and digitize any paper invoices you receive to create digital copies for storage and processing.

- Automate Invoice Processing: Use OCR technology to extract data from invoices and automate the data entry process.

- Set Up Electronic Approval Workflows: Implement automated approval workflows to streamline the approval process and reduce manual intervention.

- Integrate Systems: Integrate your AP software with your accounting or ERP system to ensure seamless data transfer.

- Encourage Electronic Payments: Use electronic payment methods such as ACH transfers or virtual credit cards to pay suppliers.

- Train Employees: Provide training to employees on the new paperless processes and how to use the new software effectively.

- Monitor and Improve: Regularly monitor the paperless AP process to identify areas for improvement and make adjustments as needed.

Simplify your workflow by implementing a paperless accounts payable system.

What are the benefits of implementing paperless vendor payments in accounts payable (AP)?

What are the benefits of implementing paperless vendor payments in accounts payable (AP)?Implementing paperless vendor payments in accounts payable (AP) offers several benefits:

- Cost Savings: Eliminating paper checks and postage costs reduces the overall cost of processing by Paperless Accounts Payable Process .

- Time Efficiency: Automated electronic payments are faster than manual processing, reducing the time spent on payment processing.

- Improved Accuracy: Electronic payments reduce the risk of errors associated with manual data entry and processing.

- Enhanced Security: Electronic payments are more secure than paper checks, reducing the risk of fraud and identity theft.

- Environmental Impact: Going paperless reduces the use of paper, helping to conserve natural resources and reduce carbon emissions.

- Better Cash Flow Management: Electronic payments can be scheduled and processed more quickly, improving cash flow visibility and management.

- Supplier Relationships: Faster, more reliable payments can improve relationships with suppliers and help negotiate better terms.

Explore paperless solutions for accounts payable and streamline your processes.

FAQS

1. What software do I need for a paperless accounts payable process?

You will need accounting or AP automation software that supports electronic invoicing, digital document management, and automated workflows.

2. How do I encourage suppliers to send invoices electronically?

You can encourage suppliers to send invoices electronically by providing them with easy-to-use tools, offering incentives for electronic invoicing, and clearly communicating the benefits of electronic invoicing.

3. What are some best practices for implementing accounts payable automation?

To ensure the security of electronic payments, use secure payment methods such as ACH transfers or virtual credit cards, and implement strict access controls and encryption protocols.

4. How can I measure the success of my paperless accounts payable process?

You can measure the success of your paperless AP process by tracking key performance indicators such as cost savings, processing times, error rates, and supplier satisfaction.

5. How do I handle paper documents that I still receive?

For paper documents that you still receive, such as invoices, you can scan and digitize them for storage and processing in your paperless AP system.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)