Introduction

Online gambling has become increasingly popular in Argentina, with millions of players participating in sports betting, casino games, and other gambling activities. While the excitement of winning can be thrilling, it’s essential to understand the tax implications that come with online gambling earnings. In Argentina, gambling winnings are subject to tax regulations, which can affect both local and international bettors.

This blog will provide a detailed breakdown of how gambling winnings are taxed in Argentina, helping players understand their legal obligations. We’ll also discuss how these regulations relate to online betting, including the role of Betting Software Development Agencies and Gambling App Development Agencies in shaping the landscape.

By the end of this article, you’ll be better equipped to navigate the legalities of online gambling in Argentina and ensure compliance with the country’s tax laws.

Build Your Custom Betting App Today!

A App development company specializes in building secure, decentralized applications.

Overview of Online Gambling Taxation in Argentina

In Argentina, the tax treatment of gambling winnings varies depending on the type of gambling activity. The country has established a regulatory framework for online gambling, and individuals must report their winnings accordingly. Here is a quick overview of the key points regarding gambling taxes in Argentina:

- Tax Rate on Gambling Winnings

Argentina taxes gambling winnings at a rate of 31.5%. This rate applies to all forms of gambling, including online betting, casino games, and lotteries. It is important to note that the tax rate may vary slightly based on the jurisdiction, with some provinces imposing their own taxes on gambling winnings. - Types of Taxable Gambling Winnings

Online gambling winnings in Argentina that are subject to taxation include:- Sports betting

- Casino winnings (including online casino apps)

- Lottery prizes

- Poker winnings

- Withholding Tax

Online gambling operators, including those offering soccer betting app development services or sports betting app developers, are responsible for withholding tax on winnings before paying out to the bettor. This ensures that taxes are collected upfront, simplifying the process for the individual taxpayer. - Declaration of Winnings

Argentine tax residents are required to declare their gambling winnings as part of their annual income tax returns. The Federal Administration of Public Revenue (AFIP) oversees tax collection and enforcement. - International Gambling and Taxes

For international online gambling, winnings are still subject to taxation in Argentina, especially if the bettor is an Argentine tax resident. However, Argentina has tax treaties with several countries to prevent double taxation, which can provide relief to players earning money from international betting platforms.

Detailed Tax Implications for Different Forms of Online Gambling

1. Sports Betting

Sports betting is one of the most popular forms of online gambling in Argentina. Whether it’s betting on soccer, basketball, or other sports, players need to be aware of the tax implications involved.

- Tax Rate: Sports betting winnings are taxed at the standard 31.5% rate.

- Taxation Process: Winnings from online sports betting are subject to withholding tax at the time of payout. The betting software development agency or platform you use will typically deduct this tax automatically.

- Example: If a player wins 100,000 ARS from a soccer betting app, the betting platform will automatically deduct 31,500 ARS as tax before releasing the remaining 68,500 ARS to the player.

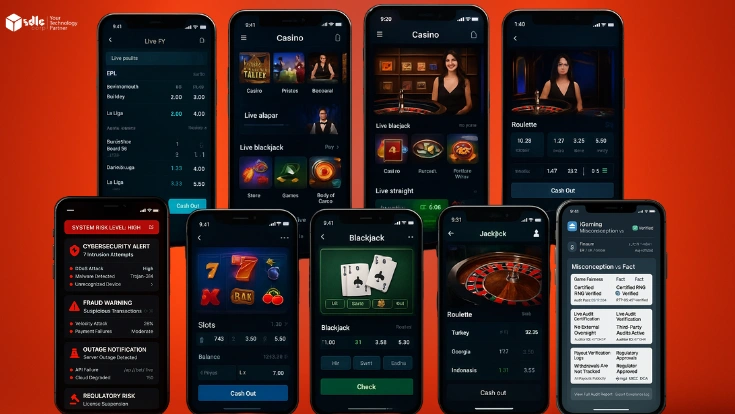

2. Casino Gambling (Online)

Online casinos in Argentina are governed by the same tax regulations as sports betting. Casino games like slots, poker, and blackjack have specific tax implications.

- Tax Rate: Casino winnings, both from live and online casinos, are taxed at 31.5%.

- Taxation Process: Online casinos, including platforms developed by gambling app development agencies, are responsible for withholding the applicable tax before paying the player.

- Example: If a player wins 200,000 ARS from an online casino, the platform will deduct 63,000 ARS as tax before releasing the net amount.

3. Poker and Other Games of Skill

Poker has a unique tax treatment compared to other forms of gambling. While it is largely considered a game of skill, it still falls under the category of gambling for tax purposes.

- Tax Rate: Poker winnings are taxed at 31.5%, similar to other gambling activities.

- Taxation Process: Online poker platforms, including those developed by sports betting app developers, are responsible for deducting the tax at the time of the payout.

- Example: A poker player winning 50,000 ARS would receive 34,250 ARS after the 31.5% tax is withheld.

Unlock Betting potential with expert development!

A betting development company builds decentralized gaming platforms, enabling secure, transparent, and automated gaming services.

Comparison of Tax Implications for Different Types of Online Gambling in Argentina

Type of Gambling | Tax Rate | Tax Withholding Process | Example |

Sports Betting | 31.5% | Withheld by betting platform at payout | A 100,000 ARS win results in 31,500 ARS tax deducted. |

Online Casino | 31.5% | Withheld by the casino platform | A 200,000 ARS win results in 63,000 ARS tax deducted. |

Poker | 31.5% | Withheld by poker platform | A 50,000 ARS win results in 15,750 ARS tax deducted. |

Lottery | 31.5% | Withheld by the lottery provider | A 1,000,000 ARS lottery win results in 315,000 ARS tax deducted. |

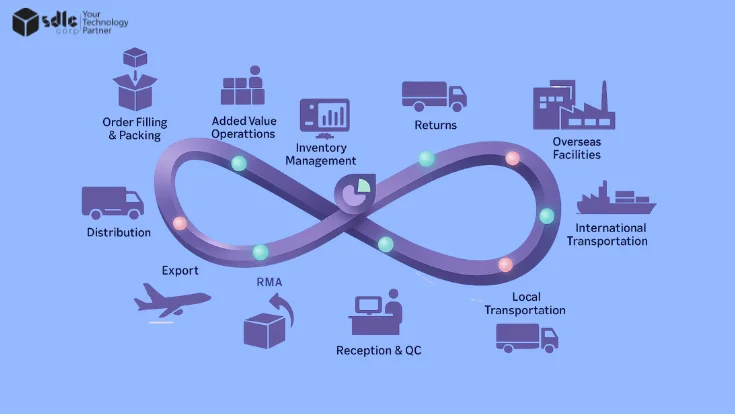

How Betting Software Development Agencies Play a Role in Gambling Tax Compliance

Betting software development agencies play a critical role in the online gambling ecosystem. Their involvement ensures that online gambling platforms are not only user-friendly and innovative but also compliant with the legal and regulatory frameworks, including tax requirements.

- Tax Automation: Modern betting software integrates tax calculation and withholding functionality. This allows gambling operators to automatically deduct the tax on winnings, making the process seamless for players.

- Reporting Tools: Many betting software platforms offer reporting tools that help players track their winnings and the taxes withheld, ensuring compliance with Argentina’s tax regulations.

- Global Compliance: Gambling app development agencies also ensure that their software complies with global tax regulations, especially for international players who may be subject to different tax laws.

The Role of Sports Betting App Developers and Soccer Betting App Development Services

Sports betting app developers are crucial in shaping the online gambling industry, particularly in Argentina, where soccer betting is immensely popular. These developers are responsible for creating apps that are user-friendly, secure, and compliant with local tax laws.

- Soccer Betting Apps: Argentina has a rich football history, and soccer betting is one of the most lucrative sectors in the online gambling market. Soccer betting app development services ensure that users can bet on local and international soccer events with ease, all while ensuring that taxes are automatically calculated and withheld.

Betting App Development: These apps typically come with built-in features that automatically apply the appropriate tax deductions based on the player’s jurisdiction. They also offer detailed reports for players to submit their tax returns accurately.

What Happens If You Don’t Pay Taxes on Gambling Winnings?

Failure to pay taxes on gambling winnings can lead to legal consequences in Argentina. The Federal Administration of Public Revenue (AFIP) is responsible for monitoring tax compliance, and failure to report or pay taxes on gambling winnings could result in penalties, including:

- Fines: Non-compliance with gambling tax laws can result in significant fines.

- Audits: AFIP may conduct audits if it suspects that a taxpayer has not reported their gambling winnings accurately.

- Legal Action: In extreme cases, failing to pay taxes could lead to legal action, including criminal charges.

Conclusion

Understanding the tax implications of online gambling winnings in Argentina is crucial for both local and international bettors. With a tax rate of 31.5%, players must ensure that they comply with the country’s tax laws when engaging in online gambling activities such as sports betting, casino games, and poker. Betting software development agencies, gambling app developers, and sports betting app developers play an essential role in ensuring that taxes are automatically withheld, simplifying the process for players.

Whether you are a bettor using a soccer betting app or a casual gambler engaging in online casino games, it’s important to keep track of your winnings and ensure compliance with Argentina’s tax laws. By doing so, you can avoid potential legal issues and enjoy your gambling experience with peace of mind.

Build Your sports betting software with SDLC CORP Today!

A betting software development company creates platforms for unique development.

How SDLC CORP Can Help with Sports Betting ?

SDLC CORP can assist with sports betting by providing custom betting software development solutions, creating secure and scalable platforms, and optimizing user experiences. With expertise in gambling app development, SDLC CORP delivers innovative features like real-time odds tracking, secure payment gateways, and seamless integrations. Their team ensures compliance with industry standards, enhancing functionality, security, and performance for both operators and players in the sports betting sector.

Services | Descriptions |

A Betting Software Development Agency specializes in creating customized, scalable, and secure betting platforms for sports, casinos, and gambling businesses. | |

A Gambling App Development Agency specializes in creating secure, innovative, and user-friendly mobile apps for online gambling and betting platforms. | |

A Sports Betting App Developer creates mobile applications that allow users to place bets on sports events, integrating secure payment systems. | |

Soccer betting app development services create custom mobile platforms for betting on soccer, offering real-time odds, secure transactions, and user-friendly interfaces. | |

Betting software development involves creating custom applications and platforms for sports betting, ensuring secure, scalable, and engaging user experiences. | |

A game development company specializes in creating, designing, and developing interactive video games for various platforms and audiences. |