Online gambling is a booming industry, with millions of users participating in activities like sports betting, casino games, and poker from the comfort of their homes. In Ireland, the growth of online gambling has been bolstered by the increasing availability of modern gambling platforms, often developed by innovative Betting Software Development Agencies and Sports Betting App Developers. However, as exciting as it may be to secure a big win, it’s important to understand the tax implications surrounding online gambling winnings in Ireland.

This blog delves into the tax laws governing online gambling in Ireland, how they impact players, and what bettors and gambling operators need to know to stay compliant.

The Tax-Free Nature of Gambling Winnings in Ireland

Ireland is unique in its approach to gambling taxation. Unlike in some other countries where gambling winnings are subject to personal income tax, online gambling winnings in Ireland are generally tax-free for the player. This rule applies to all forms of gambling, including winnings from online casinos, lotteries, poker, and sports betting.

This tax exemption stems from the Irish Revenue Commissioners’ stance that gambling is not considered a trade or profession for the bettor. Therefore, individual winnings are not classified as taxable income. While this is great news for the casual player, professional gamblers or those earning a living from betting might face different scrutiny, which will be discussed later

Unlock Expert Game Development Services Today!

Game development services offer end-to-end solutions for creating engaging, high-quality games across platforms.

Taxation for Operators: Betting Duties and Licensing

Although players enjoy tax-free winnings, operators providing gambling services in Ireland are subject to specific tax obligations. Any Betting Software Development Company or Gambling App Development provider looking to enter the Irish market must be aware of these duties:

1. Betting Duty

Operators offering betting services must pay a betting duty, which currently stands at 2% of all bets placed. This applies to bookmakers and online betting platforms operating under Irish jurisdiction.

2. Exchange Duty

For betting exchanges, a duty of 15% is applied to the commission earned rather than the stakes or winnings. This allows for a more equitable approach to taxation for these platforms.

3. Gaming Duty

Casinos and gaming operators offering online casino games must pay a gaming duty, which varies depending on the type of games provided. Operators working in Soccer Betting App Development Services or similar specialized niches may have unique regulatory considerations, depending on the structure of their games and services.

4. Licensing Costs

Every operator, including those developing sports betting apps or gambling platforms, must obtain the appropriate licenses to operate legally in Ireland. These licensing fees can be significant, adding another layer of cost for businesses entering the market.

Implications for Professional Gamblers

While casual players are exempt from taxation, professional gamblers fall into a gray area. If gambling is your primary source of income, the Irish Revenue may determine that you are operating as a business. In such cases, your winnings could potentially be classified as taxable income.

Key Considerations for Professional Gamblers:

- Proof of Business Activity:

The Revenue might assess factors such as regularity, skill, and intention to profit. Professional poker players or sports bettors relying on platforms built by cutting-edge Sports Betting App Developers might find themselves under this scrutiny. - Declaring Income:

If deemed a professional, you may need to declare your gambling income and pay taxes accordingly. This may include income tax, PRSI (Pay Related Social Insurance), and USC (Universal Social Charge).

How Gambling App Development Influences Tax Compliance

The surge in advanced gambling platforms has made it easier than ever for users to engage in betting activities. However, these platforms also play a crucial role in ensuring compliance with tax and legal requirements.

1. Betting Software Features:

Leading Betting Software Development Companies integrate features that track bets, calculate operator duties, and ensure transparency. These tools simplify compliance for operators, ensuring they fulfill their tax obligations.

2. Automated Reporting:

Many gambling platforms offer automated reporting tools, enabling operators to easily manage their financial records. Whether it’s a Soccer Betting App Development Service or a multi-sport platform, tax compliance becomes significantly easier with robust reporting functionalities.

3. User Tax Education:

Some gambling apps are now incorporating educational resources for players to understand the legal and tax implications of their activities. While winnings in Ireland are typically tax-free, cross-border gambling might carry different obligations, and awareness is key.

Cross-Border Taxation: Gambling in the EU and Beyond

While Ireland’s tax rules on gambling winnings are favorable, the same cannot be said for every country. For Irish residents gambling on foreign platforms or earning winnings abroad, the tax implications can vary.

Key Points for Cross-Border Gambling:

- Foreign Tax Laws:

Winnings earned in countries where gambling is taxable (such as the U.S. or Germany) may be subject to local taxes. Understanding the rules of that jurisdiction is crucial. - Double Taxation Agreements (DTA):

Ireland has treaties with various countries to prevent double taxation. This means any tax paid abroad on gambling winnings might be offset against Irish tax obligations. - Regulatory Compliance by Developers:

Gambling platforms developed by reputable Betting Software Development Agencies often ensure adherence to international tax laws, providing users with clear guidelines.

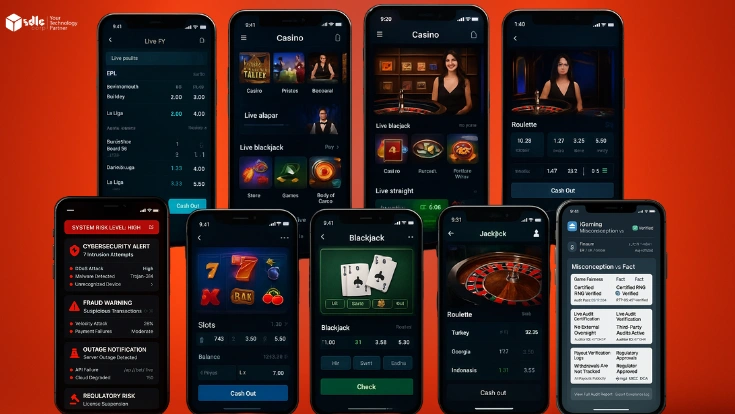

Hire skilled casino game developers to create engaging, high-quality casino games like slots, poker, and blackjack that captivate players.

Future Trends in Gambling Taxation in Ireland

The Irish government periodically reviews its gambling tax policies to ensure they remain effective in the digital age. Several trends could shape the future landscape:

- Increased Regulation:

With the rise of Gambling App Development and mobile platforms, authorities may introduce stricter monitoring of online gambling activities. - Focus on Problem Gambling:

Tax revenue from gambling operators might increasingly fund problem gambling initiatives, creating a more socially responsible industry. - Technological Advancements:

The involvement of Sports Betting App Developers in crafting sophisticated AI-based platforms could lead to improved tax reporting and compliance mechanisms.

Practical Advice for Bettors and Operators

For Bettors:

- Enjoy your winnings without worrying about taxes if you are a casual player.

- Maintain records of winnings and losses, especially if you gamble regularly or at a professional level.

- Be aware of foreign tax obligations if you gamble on international platforms.

For Operators:

- Partner with a reliable Betting Software Development Company to ensure your platform meets all tax and legal requirements.

- Stay updated on Irish betting duties and licensing costs.

- Invest in robust compliance tools for accurate tax reporting and user transparency.

Conclusion

Ireland’s favorable tax treatment for online gambling winnings is a significant advantage for players. However, operators must navigate a complex landscape of betting duties, licensing fees, and compliance requirements. Whether you’re a player or an operator, partnering with the right Betting Software Development Agency or leveraging the expertise of a skilled Sports Betting App Developer can make all the difference in ensuring a smooth, legally compliant gambling experience.

As the online gambling industry continues to evolve, staying informed about tax implications and regulatory trends will remain essential for all stakeholders.

Boost Profits with Expert Betting App Services!

Comprehensive betting app development services for secure, user-friendly apps with real-time odds, analytics, and engaging features.

How can SDLCCORP Help to Online Gambling Site

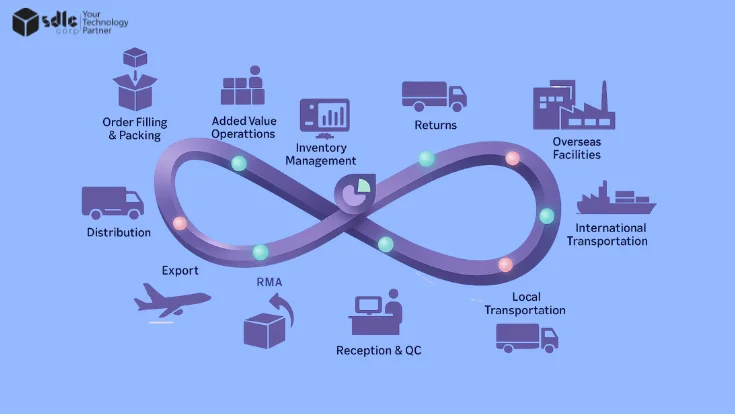

SDLCCORP offers tailored solutions to help online gambling sites thrive in a competitive industry. From developing innovative platforms to ensuring regulatory compliance, SDLCCORP provides end-to-end services designed to enhance user experience, boost profitability, and maintain operational excellence. Here’s how SDLCCORP can assist:

Service | Description | Link |

Betting Software Development Services | Tailored software solutions for developing secure and scalable betting platforms. | |

Sports Betting App Development | Custom mobile apps for sports betting with real-time updates, live odds, and smooth user experiences. | |

Gambling Software Development Services | End-to-end gambling app development for various casino games, sports betting, and online gambling solutions. | |

Betting App Development Company | Specialized company for developing betting apps with a focus on seamless UX/UI, high performance, and regulatory compliance. | |

Game Development Company | A full-service game development company offering innovative solutions for creating engaging casino and betting games. | |

Hire Casino Game Developer | Hire expert casino game developers to create immersive, customizable, and high-performing casino games. |