Introduction

Online gambling has become an increasingly popular activity worldwide, with Mexico being no exception. As millions of players engage in online sports betting, casino games, and other gambling activities, the question of how gambling winnings are taxed becomes more pertinent. In Mexico, the taxation of gambling winnings involves a complex set of rules, which differ depending on whether the winnings come from domestic or international platforms, whether the player is a casual gambler or a professional, and whether the gambling activity is classified as part of a business.

For those involved in the Betting Software Development industry, whether as part of a Betting Software Development Agency or a Sports Betting App Developer, it’s equally important to understand how the Mexican tax system impacts their business operations. Developers and operators alike must navigate both local laws and regulations to ensure compliance with the country’s tax rules. this blog will guide you through the tax implications of online gambling winnings in Mexico, covering essential points that players, operators, and developers should know to stay compliant with Mexican tax laws.

The Legal Landscape of Gambling in Mexico Gambling Laws and Regulations in Mexico

In Mexico, gambling is regulated by the Federal Gambling and Raffles Law (Ley Federal de Juegos y Sorteos), which governs both land-based and online gambling activities. This law ensures that gambling is conducted legally and transparently while protecting players from fraud and unethical practices. The Ministry of the Interior (Secretaría de Gobernación) is responsible for overseeing gambling operations in Mexico, issuing licenses, and enforcing the regulations set forth in the Gambling Law.

Mexico has legalized various forms of gambling, including online sports betting, casino games, poker, and other games of chance. However, only gambling operators with valid licenses from the Mexican government can legally offer online gambling services to Mexican residents. These platforms are subject to both licensing and tax regulations, ensuring a level playing field for players and operators alike.

Unlock Expert Game Development Services Today!

Game development services offer end-to-end solutions for creating engaging, high-quality games across platforms.

Legal Online Gambling Platforms

While gambling is regulated, there is still room for operators, both domestic and international, to participate in the market. For online platforms, the key to legality is obtaining a license from the Ministry of the Interior. International operators must meet the same licensing standards as domestic companies to ensure compliance with Mexican laws.

It’s important to note that unlicensed platforms, particularly those based in other countries, cannot legally offer their services to Mexican residents. Players engaging with illegal online gambling platforms risk not only losing their winnings but also facing legal consequences. This is why ensuring compliance with licensing and regulatory requirements is a top priority for operators, including those involved in Sports Betting App Development or Gambling App Development.

Taxation of Online Gambling Winnings in Mexico

The next major area of concern for both players and operators is taxation. While gambling laws define who can operate legally in Mexico, tax regulations determine how gambling winnings are handled. In Mexico, gambling winnings are taxed, but the tax treatment varies depending on several factors.

Taxation for Casual Gamblers

For casual players engaging in online gambling for entertainment, the situation is generally favorable. In Mexico, winnings from casual gambling activities are not subject to personal income tax. This includes individuals who engage in sports betting, casino games, or poker on an infrequent basis as a form of leisure. The key point here is that the Mexican tax authorities do not tax gambling winnings for recreational players.

However, while casual gamblers are typically exempt from paying taxes on their winnings, there are exceptions. If a player wins a large sum of money from gambling, especially if it is a result of continuous winnings or if they are engaging in gambling as part of a larger business operation, they may be required to report their earnings. This is particularly relevant if the individual is classified as a professional gambler.

Taxable Income for Professional Gamblers

A professional gambler is defined as someone who consistently earns money from gambling, making it their primary source of income. This could include individuals who bet on sports regularly or play poker with the intention of making a profit. In such cases, the winnings of professional gamblers are considered taxable income and must be reported on their annual income tax returns.

The tax treatment for professional gamblers is similar to that for any other self-employed individual. The Mexican income tax system is progressive, with rates ranging from 1.92% to 35% depending on the level of income. Professional gamblers are obligated to keep detailed records of their gambling earnings and expenses, and they must pay taxes based on the net profits they report.

Taxation for Gambling Operators

The tax responsibilities for gambling operators are also an important aspect of the Mexican gambling landscape. Any Betting Software Development Agency or Gambling App Development Agency that operates in the country needs to be aware of their tax obligations.

Corporate Tax for Gambling Operators

The most significant tax that gambling operators must contend with is the corporate income tax, which applies to all businesses operating in Mexico. The corporate tax rate is 30%, and gambling operators are required to pay taxes on the profits they generate from their gambling activities. This tax is applicable to both domestic and foreign operators, provided they are licensed to offer services in Mexico.

Whether the operator is offering sports betting, online casino games, or poker, they must report their earnings and pay taxes accordingly. For instance, if a Sports Betting App Developer creates a platform that generates revenue for an operator, the operator is responsible for paying corporate tax on the income received from players who use the platform.

Betting Revenue Taxes

In addition to corporate tax, operators in Mexico are also required to pay a tax on their betting revenue. This tax is often referred to as a betting tax and can range from 1% to 30%, depending on the type of betting and the overall volume of revenue generated. For example, an online sports betting platform may face a higher betting tax than an operator running a casino or poker site. This tax is typically assessed on the net revenue generated from betting activities, meaning that operators are taxed on their gross income minus the winnings paid out to players.

Operators need to ensure that their financial records are properly maintained and that they are fully compliant with the reporting and tax payment requirements.

Hire skilled casino game developers to create engaging, high-quality casino games like slots, poker, and blackjack that captivate players.

Value Added Tax (VAT) and Gambling in Mexico

- Another important aspect of taxation for gambling operators is Value Added Tax (VAT). In Mexico, VAT is applied to most goods and services, and gambling is no exception. However, the VAT rate for gambling-related services is typically exempt or subject to a reduced rate, depending on the type of gambling.

- For example, sports betting activities are often subject to a 0% VAT rate in Mexico, while other forms of gambling, such as online casino games, may be subject to a reduced VAT rate. Operators need to carefully assess the type of gambling they are offering and determine whether VAT applies.

- Betting Software Development Agencies and other software providers should factor in these tax rates when pricing their services to operators. If they are developing platforms that provide taxable gambling services, the price may need to include VAT.

The Role of Gambling App Developers and Betting Software Providers

As the online gambling market in Mexico continues to grow, Betting Software Development Agencies and Sports Betting App Developers play an increasingly important role. These companies develop the software that powers online gambling platforms, helping operators provide a seamless and secure experience for players. Given the complex regulatory landscape in Mexico, software developers must be aware of the tax implications that apply to both operators and players.

Compliance for Software Developers

- For companies involved in Gambling App Development, it is crucial to stay informed about tax requirements in the regions where their software is deployed. Developers should assist operators in ensuring their platforms comply with tax laws. This might involve integrating tax reporting systems into the platform or providing operators with tools to help track revenue and gambling-related taxes.

- Additionally, developers need to understand how their services are taxed. If they are charging for software development services, they need to ensure that their pricing structure accounts for VAT and other taxes that may apply.

Importance of Transparent Reporting and Security

- Another key consideration for Gambling App Development Agencies is the implementation of features that ensure transparency and secure reporting. Since gambling operators must accurately report their financial transactions and winnings to the Mexican tax authorities, developers should ensure that their platforms can generate the necessary reports.

- Security is also an important aspect of gambling software development. Developers should incorporate strong encryption, payment protection, and fraud prevention systems to help operators comply with regulatory and security standards.

The Future of Gambling and Taxation in Mexico

- As the online gambling industry in Mexico continues to evolve, it is possible that the country’s tax laws will also change. These changes could affect both players and operators, particularly as the popularity of online sports betting and mobile gambling grows. Developers will need to stay updated on any changes to tax regulations and adapt their platforms accordingly.

- The increasing use of mobile apps and platforms for sports betting and casino games means that there may be new opportunities for developers to innovate, but they must remain vigilant about the tax implications of their services. This includes factoring in potential shifts in VAT rates, betting taxes, and corporate tax rates.

Boost Profits with Expert Betting App Services!

Comprehensive betting app development services for secure, user-friendly apps with real-time odds, analytics, and engaging features.

Conclusion

Understanding the tax implications of online gambling winnings in Mexico is crucial for both players and operators. Casual players generally do not face taxes on their winnings, but professional gamblers must report their income and pay taxes accordingly. For gambling operators, including those in the Betting Software Development and Sports Betting App Development sectors, the tax landscape is more complex, requiring careful attention to corporate taxes, betting revenue taxes, and VAT.

By staying informed about Mexico’s tax laws and maintaining compliance, both players and operators can avoid legal complications and continue to participate in the growing online gambling market. Developers of gambling platforms must also be proactive in ensuring their software helps operators comply with local regulations, making it easier for everyone involved to navigate the complexities of the tax system.

How can SDLCCORP Help to Online Betting Site ?

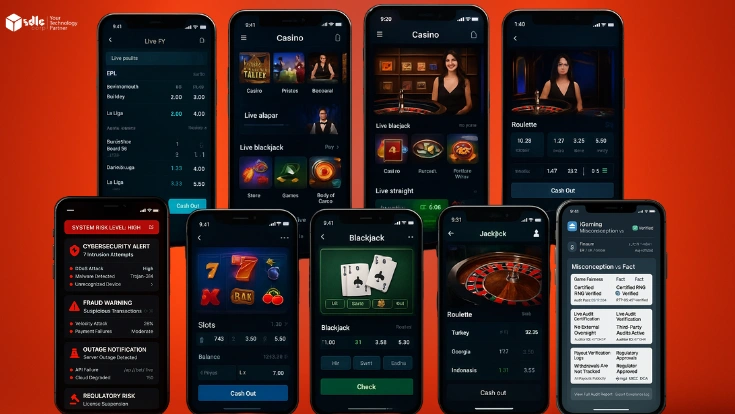

SDLCCORP offers comprehensive Betting Software Development Services, ensuring secure and scalable platforms tailored to your needs. With expertise in Sports Betting App Development, they create feature-rich apps for real-time betting experiences. Their Gambling Software Development Services include innovative tools like AI-powered analytics and blockchain integration for transparency. As a leading Betting App Development Company, SDLCCORP delivers customized solutions for niche markets like Football Betting App Development, enhancing user engagement and profitability. From seamless payment systems to robust backend support, SDLCCORP empowers online betting sites to thrive in a competitive industry.

| Service | Description | Link |

|---|---|---|

| Betting Software Development Services | Tailored software solutions for developing secure and scalable betting platforms. | Betting Software Development Services |

| Sports Betting App Development | Custom mobile apps for sports betting with real-time updates, live odds, and smooth user experiences. | Sports Betting App Development |

| Gambling Software Development Services | End-to-end gambling app development for various casino games, sports betting, and online gambling solutions. | Gambling Software Development Services |

| Betting App Development Company | Specialized company for developing betting apps with a focus on seamless UX/UI, high performance, and regulatory compliance. | Betting App Development Company |

| Game Development Company | A full-service game development company offering innovative solutions for creating engaging casino and betting games. | Game Development Company |

| Hire Casino Game Developer | Hire expert casino game developers to create immersive, customizable, and high-performing casino games. | Hire Casino Game Developer |