Online gambling has become a global phenomenon, allowing individuals to bet on everything from casino games to sports events, all from the comfort of their homes. Montenegro, with its rich history of gambling and favorable tax policies, has emerged as one of the prime locations for both gamblers and companies involved in the gambling industry. As a European country with a highly regulated gambling sector, it is essential for both players and businesses to understand the tax implications of online gambling winnings. This blog explores these implications, including the role of various gambling entities such as betting software development agencies and sports betting app developers, and how their operations impact the overall tax framework.

The Gambling Landscape in Montenegro

Montenegro has long been a hub for tourism, and its status as a gambling destination is no exception. The country has embraced online gambling, offering a legal framework that encourages the establishment of gambling businesses. Regulatory authorities such as the Montenegro Gambling Authority (MGA) have set the groundwork for safe, transparent, and regulated online betting operations. As a result, Montenegro has attracted both international gambling operators and local businesses involved in various aspects of gambling technology, including betting software development agencies, gambling app development agencies, and sports betting app developers.

These businesses contribute significantly to the country’s economy by providing software solutions for online sportsbooks, casinos, and other gambling platforms. Companies offering services such as betting software development or soccer betting app development services play a crucial role in the success of online gambling platforms by providing reliable and secure betting systems. However, the key question for both players and businesses is how gambling winnings and business profits are taxed in Montenegro.

Hire skilled casino game developers to create engaging, high-quality casino games like slots, poker, and blackjack that captivate players.

Taxation of Online Gambling Winnings in Montenegro

In Montenegro, the tax treatment of gambling winnings is relatively straightforward for players. The government has implemented specific tax rates and rules to ensure that gambling winnings are subject to taxation while keeping the system simple and transparent.

Personal Income Tax on Gambling Winnings

For individual players, online gambling winnings in Montenegro are generally subject to personal income tax. However, the tax rate and the type of winnings can significantly impact the amount a player owes. Here is a breakdown of the key tax implications:

- Casino Winnings: Winnings from casino games, including online poker, blackjack, and slots, are taxed at a rate of 15%. This means that if an individual wins an amount from an online casino, they will be required to pay 15% of their total winnings in taxes.

- Sports Betting Winnings: Sports betting is extremely popular in Montenegro, and winnings from online sports betting are also taxed at 15%. This applies to all forms of sports betting, including traditional sports like soccer and basketball, as well as niche sports or e-sports events. Given the presence of sports betting app developers in the country, many online platforms make use of advanced betting software that ensures that winnings from sports betting activities are processed efficiently and in accordance with tax regulations.

- Lotteries and Other Games of Chance: Winnings from lottery tickets or other games of chance (such as bingo) are taxed in a similar fashion. Any winnings in this category are taxed at the same 15% rate.

- Exemptions: Interestingly, some smaller gambling activities or winnings may be exempt from tax or subject to lower rates. For example, in the case of low-value winnings that do not exceed a certain threshold, there may be exemptions, although this is relatively rare.

Withholding Tax on Gambling Winnings

In addition to personal income tax, online gambling winnings in Montenegro are also subject to withholding tax. This means that the gambling operator (whether a local or international company) is responsible for deducting the tax from the winnings before paying the player. The operator will then remit the taxes directly to the Montenegrin tax authorities on behalf of the player.

This system ensures that tax collection is more efficient and reduces the burden on players, as they do not have to deal with filing individual tax returns for their gambling winnings. However, players should still maintain accurate records of their gambling activities in case they need to file a tax return or claim any deductions in the future.

Unlock Expert Game Development Services Today!

Game development services offer end-to-end solutions for creating engaging, high-quality games across platforms.

Tax Implications for Gambling Businesses

While the tax system is relatively straightforward for individual players, the tax implications for businesses involved in online gambling are more complex. For betting software development agencies, gambling app development agencies, and sports betting app developers, the situation is as follows:

Corporate Income Tax

Gambling businesses that operate within Montenegro are subject to the country’s corporate income tax rate. The standard rate for corporate income tax in Montenegro is 9%, which is one of the lowest in Europe. This attractive rate has been a major factor in Montenegro’s appeal to foreign gambling companies, including those that specialize in betting software development.

For companies that offer soccer betting app development services or other specialized betting platforms, the tax structure remains the same. These businesses are taxed on their profits, which are determined by the net income after allowable expenses are deducted. This includes salaries for employees, development costs, marketing, and infrastructure expenses.

Value-Added Tax (VAT)

Businesses involved in online gambling may also be required to pay Value-Added Tax (VAT) on certain goods and services they provide. However, gambling-related services that involve games of chance (such as casino games) are typically exempt from VAT in Montenegro. This exemption helps keep operational costs low for companies that specialize in betting software development or sports betting app development.

License Fees and Other Regulatory Costs

Online gambling operators and developers in Montenegro must also contend with licensing fees. The MGA requires operators to obtain a license to offer online gambling services legally within the country. These licensing fees can be substantial, depending on the nature of the services provided and the scale of the operations. These costs are typically factored into the overall financial planning of gambling businesses and can be deducted as expenses when calculating taxable income.

Moreover, gambling companies involved in the development of betting software and sports betting apps may need to comply with various regulations related to data security, payment processing, and responsible gambling. Non-compliance with these regulations can lead to hefty fines or the loss of a gambling license, which further emphasizes the importance of adhering to the legal framework in Montenegro.

International Implications for Online Gambling Winnings

Given that many Montenegrin gambling companies operate globally, it is also important to consider the international tax implications. Players residing outside Montenegro but using Montenegrin-based gambling platforms may be subject to tax regulations in their home countries.

For instance, players in countries with double taxation treaties with Montenegro may be able to avoid paying taxes twice on their winnings. The treaties typically allow for tax credits or exemptions that reduce the overall tax burden. On the other hand, players in countries without such treaties may be required to pay taxes both in their home country and in Montenegro

The Role of Technology in Tax Compliance

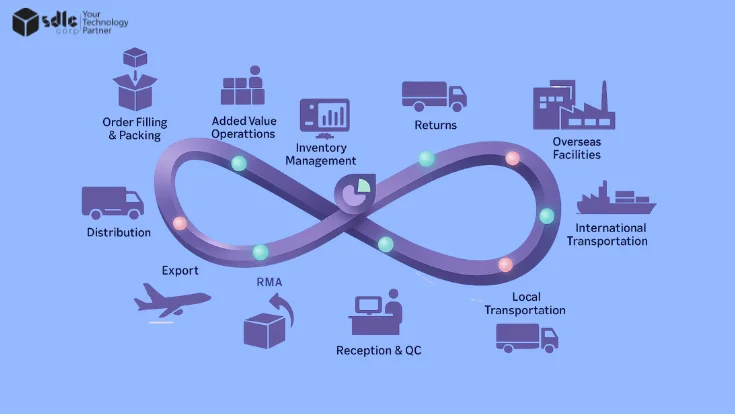

As the online gambling industry continues to evolve, technology plays a crucial role in ensuring compliance with tax regulations. The increasing sophistication of betting software development has led to more automated systems for tracking and reporting gambling winnings. Sports betting app developers and gambling app development agencies integrate these systems into their platforms, making it easier for both operators and players to meet tax obligations.

For example, the use of blockchain technology in betting software could offer a transparent, immutable record of transactions, making tax reporting simpler and more secure. Additionally, innovative solutions like crypto gambling apps may present unique challenges for tax authorities, as digital currencies could complicate the tracking of taxable events.

Conclusion

In conclusion, the tax implications of online gambling winnings in Montenegro are relatively straightforward for individual players but more complex for gambling businesses. Players are required to pay a 15% tax on their winnings, while gambling companies must navigate corporate taxes, VAT exemptions, licensing fees, and other regulatory costs. The country’s tax framework, combined with its favorable business environment, has made Montenegro a popular destination for both players and companies involved in the gambling industry.

For businesses such as betting software development agencies and sports betting app developers, understanding the local tax laws is essential for ensuring compliance and maximizing profitability. By working within the legal framework, these companies can help support Montenegro’s thriving gambling ecosystem while contributing to the country’s economic growth.

As the industry continues to grow, both players and businesses must stay informed about evolving tax policies to avoid surprises and ensure smooth operations. Whether you’re an individual gambler or part of a business offering soccer betting app development services, it’s crucial to understand how gambling winnings and profits are taxed in Montenegro, as this knowledge can significantly impact your bottom line.

Boost Profits with Expert Betting App Services!

Comprehensive betting app development services for secure, user-friendly apps with real-time odds, analytics, and engaging features.

How can SDLCCORP Help to Online Gambling Site ?

SDLCCORP offers tailored solutions to help online gambling sites thrive in a competitive industry. From developing innovative platforms to ensuring regulatory compliance, SDLCCORP provides end-to-end services designed to enhance user experience, boost profitability, and maintain operational excellence. Here’s how SDLCCORP can assist:

Service | Description | Link |

Betting Software Development Services | Tailored software solutions for developing secure and scalable betting platforms. | |

Sports Betting App Development | Custom mobile apps for sports betting with real-time updates, live odds, and smooth user experiences. | |

Gambling Software Development Services | End-to-end gambling app development for various casino games, sports betting, and online gambling solutions. | |

Betting App Development Company | Specialized company for developing betting apps with a focus on seamless UX/UI, high performance, and regulatory compliance. | |

Game Development Company | A full-service game development company offering innovative solutions for creating engaging casino and betting games. | |

Hire Casino Game Developer | Hire expert casino game developers to create immersive, customizable, and high-performing casino games. |