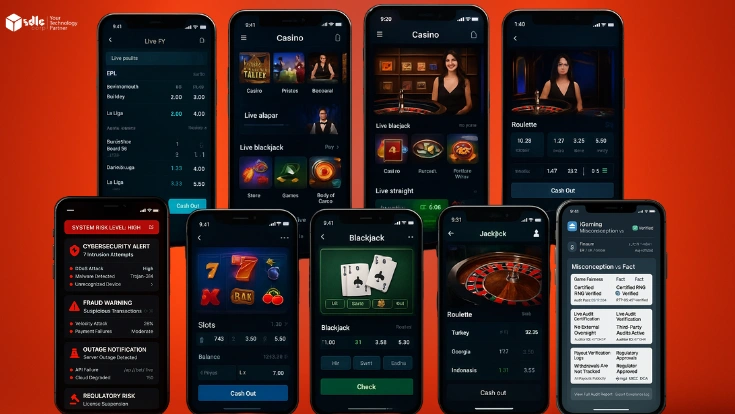

Online gambling has grown rapidly in the Philippines, fueled by the rise of digital platforms and mobile apps. Many Filipinos now engage in online betting activities such as casino games, sports betting, and poker tournaments. While the excitement of potentially hitting a jackpot is palpable, there’s an often-overlooked aspect to consider: taxation on gambling winnings.

This article delves into the tax implications of online gambling winnings in the Philippines, providing essential insights for players, platforms, and even businesses involved in Betting Software Development Agency and related services.

Unlock Expert Game Development Services Today!

Online Gambling in the Philippines

The Philippines has a thriving online gambling industry, regulated primarily by the Philippine Amusement and Gaming Corporation (PAGCOR) and the Cagayan Economic Zone Authority (CEZA). These regulatory bodies oversee online casinos, sports betting, and other gambling platforms to ensure compliance with local laws.

Online gambling platforms have seen exponential growth thanks to innovations introduced by Sports Betting App Developers and Gambling App Development companies. These platforms enable users to place bets conveniently via smartphones or computers, increasing accessibility and participation.

Legal Framework Governing Online Gambling Winnings

Taxation of Gambling Winnings

In the Philippines, gambling winnings are considered a form of income. Under the National Internal Revenue Code (NIRC), all incomes earned within and outside the Philippines by residents are taxable. Non-residents, on the other hand, are taxed only on their Philippine-sourced income.

When it comes to gambling winnings, the law treats them as part of “other income.” As such, they are subject to income tax unless explicitly exempted by a law or regulation.

Withholding Tax on Gambling Winnings

Operators of online gambling platforms are typically required to withhold taxes on behalf of their players. For local gambling activities, the withholding tax rate can vary depending on the type of game and the prevailing regulations. PAGCOR-licensed operators are also obligated to comply with specific tax policies related to revenue-sharing agreements.

However, winnings from overseas platforms may not always be reported. This raises challenges in enforcement and compliance, particularly in the age of international gambling facilitated by cutting-edge Soccer Betting App Development Services.

Calculating Taxes on Gambling Winnings

Individual Players

For individual players, taxes on online gambling winnings are calculated as part of their total annual income. This income is subject to the graduated income tax rates outlined in the TRAIN Law (Tax Reform for Acceleration and Inclusion).

For example:

- If a player earns PHP 250,000 or less annually, they are exempt from income tax.

- Beyond this threshold, rates range from 20% to 35%, depending on the taxable income bracket.

Players must report their gambling winnings when filing their annual income tax returns (ITR).

Gambling Operators

Operators, including those involved in Betting Software Development and the broader industry, are subject to different tax rules. PAGCOR and other licensed entities must pay a 5% franchise tax on gross gaming revenues. Additionally, corporate income tax applies to the net income of operators, typically at a rate of 25%.

This means platforms developed by a Betting Software Development Company must factor tax obligations into their business models to remain compliant.

Challenges in Tax Enforcement

Lack of Transparency

Many players use international platforms that may not disclose winnings to Philippine tax authorities. This creates a significant enforcement gap, particularly as more Filipinos access offshore sites.

Emerging Technologies

The rise of cryptocurrency betting and blockchain-based platforms adds complexity to tax compliance. These technologies often lack centralized control, making it challenging for tax authorities to monitor transactions. For instance, Gambling App Development now frequently includes cryptocurrency wallets and decentralized systems, complicating oversight.

Limited Awareness

Many Filipino players are unaware of their tax obligations when it comes to online gambling. This lack of knowledge leads to widespread non-compliance, either intentional or accidental.

Tips for Complying with Tax Obligations

For individuals and businesses involved in online gambling, compliance with tax laws is crucial. Here are some practical steps:

For Individual Players

- Track Your Winnings: Maintain a record of all gambling transactions, including amounts won and lost.

- Report All Income: Include your winnings in your annual ITR, even if they are from offshore platforms.

- Seek Professional Advice: Consult a tax professional to ensure accurate reporting and avoid penalties.

For Gambling Operators

- Automate Tax Calculations: Integrate tax compliance features into your platform with the help of a Sports Betting App Developer.

- Stay Updated: Keep abreast of changes in tax laws and regulatory requirements.

- Collaborate with Regulators: Work closely with PAGCOR or CEZA to ensure compliance.

Role of Betting Software Development in Tax Compliance

Betting Software Development Agencies play a vital role in fostering compliance within the industry. By integrating advanced tax reporting and withholding systems into gambling platforms, these agencies can help operators adhere to legal requirements.

For example, platforms built using cutting-edge Soccer Betting App Development Services can include:

- Automated Tax Calculations: Systems that calculate withholding taxes based on the player’s location and winnings.

- Real-Time Reporting: Tools that share tax data with local authorities.

- Player Notifications: Features that inform players about their tax liabilities and provide reminders for ITR filing.

These innovations ensure transparency and streamline compliance for both operators and players.

Emerging Trends Impacting Taxation

As the online gambling industry evolves, several trends could shape future tax policies:

1. Cryptocurrency Adoption

With more platforms integrating cryptocurrency payments, authorities may introduce specific rules for taxing digital assets.

2. Increased Collaboration Between Regulators

Cross-border cooperation between tax authorities could lead to better tracking of offshore winnings.

3. Focus on Responsible Gambling

Governments may require operators to promote responsible gambling practices, including educating players about tax obligations.

Conclusion

The tax implications of online gambling winnings in the Philippines are complex but manageable with proper awareness and compliance. Whether you’re an individual player or an operator leveraging the latest advancements in Gambling App Development, understanding your obligations is crucial to avoiding legal issues.

As the industry continues to expand, driven by innovative solutions from Betting Software Development Companies, it is essential to prioritize transparency and compliance. Doing so will not only protect players and operators from potential penalties but also contribute to a sustainable and ethical online gambling ecosystem.

Whether you’re developing the next big Sports Betting App or enjoying the thrill of online wagering, staying informed about taxation ensures a smooth and enjoyable experience.

FAQs

Are online gambling winnings taxed in the Philippines?

Explain the taxation policy in the Philippines regarding online gambling winnings, including the fact that gambling winnings are generally not taxed for individual players, unless they are considered professional gamblers.

Do I need to report my online gambling winnings to the BIR (Bureau of Internal Revenue)?

Clarify whether Filipino players need to report their gambling winnings, discussing situations where reporting might be required, particularly if the player earns substantial or consistent income from gambling.

What taxes are applied to online gambling operators in the Philippines?

Discuss the taxes imposed on online gambling operators in the Philippines, including the licensing fees and taxes they must pay to legally operate in the country.

Are there any specific tax rules for foreign players gambling online in the Philippines?

Explain if foreign players, such as tourists or expatriates, need to pay taxes on winnings while gambling online in the Philippines, and if they are subject to the same tax laws as residents.

What about winnings from offshore online casinos? Are they taxable in the Philippines?

Provide insights into the tax implications for players who win at offshore online casinos, addressing whether the winnings are subject to taxes under Philippine law.