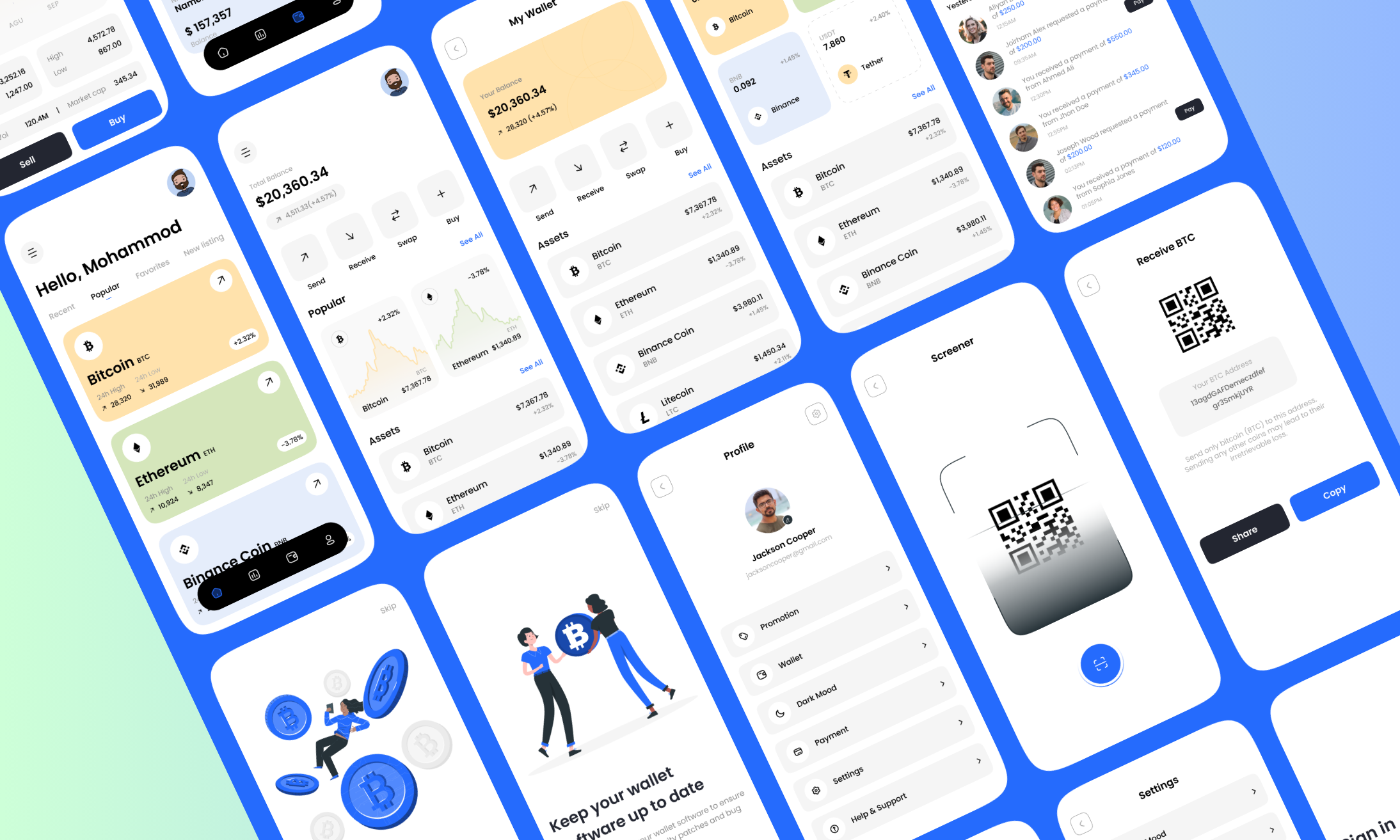

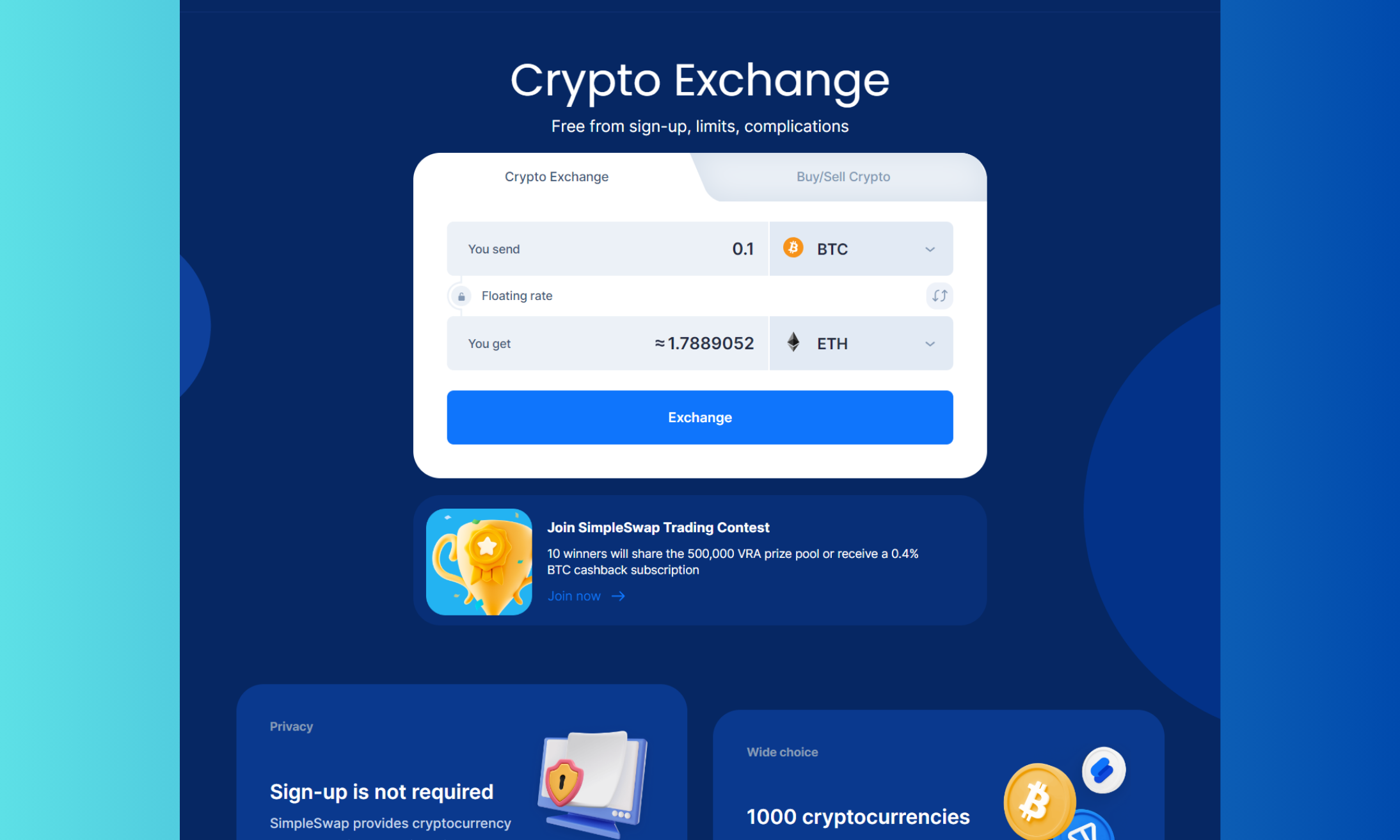

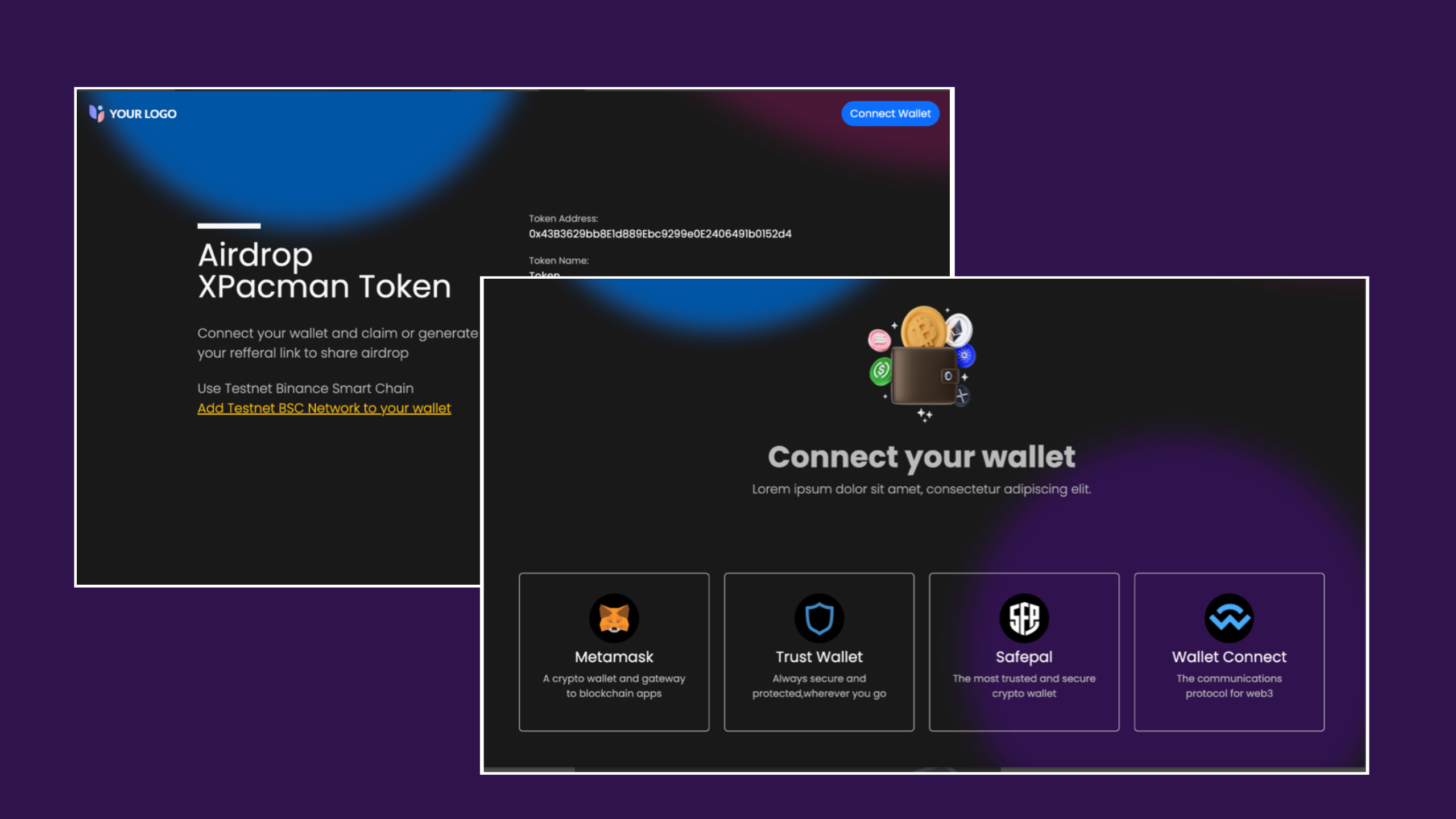

Overview: DeFi DEX Aggregator Platform Development

Our DeFi DEX Aggregator Platform Development service offers a comprehensive solution for building cutting-edge decentralized exchange (DEX) aggregators. We specialize in crafting robust platforms that seamlessly integrate multiple DEXs, providing users with enhanced liquidity, reduced slippage, and improved trading efficiency. Our team leverages the latest technologies and best practices to ensure scalability, security, and user-friendly interfaces. From smart contract development to UI/UX design and backend infrastructure, we cover all aspects of platform development. Whether you’re a startup or an established firm, we tailor our services to meet your specific requirements, empowering you to stay ahead in the rapidly evolving DeFi landscape. With our expertise, you can unlock the full potential of decentralized finance and offer users a superior trading experience.