Overview of DeFi Yield Farming Development

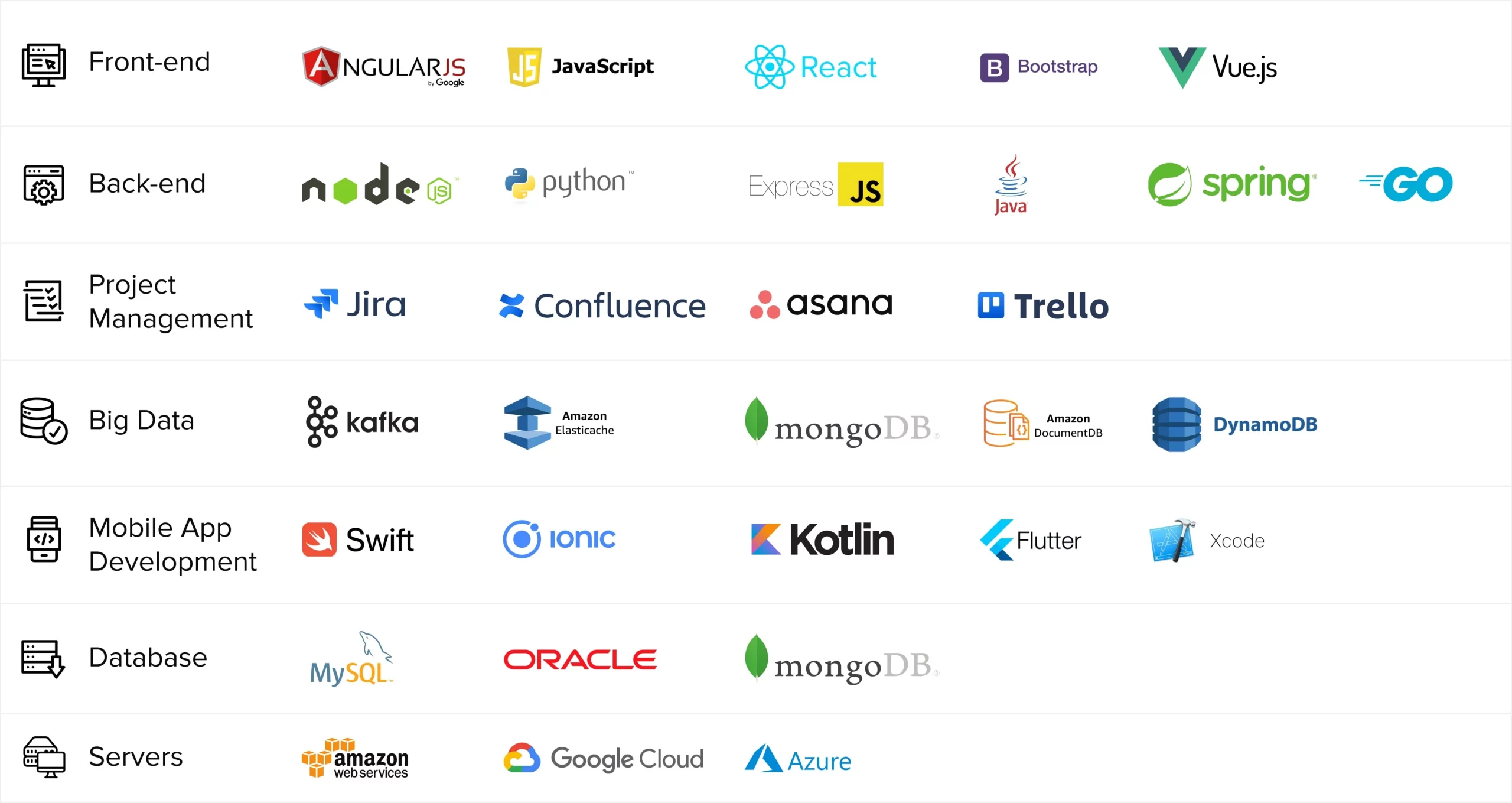

DeFi tech is revolutionizing global finance, offering innovation and potential. Diverse DeFi protocols reshape financial processes, while savvy investors adopt DeFi strategies for higher digital asset yields. Notably, Yield Farming is a DeFi trend. As a specialized DeFi Yield Farming Development Company, SDLC Corp leads in holistic yield farming solutions. We blend profound yield farming insight with advanced finance tech, enabling cutting-edge solutions. Our services span smart contract dev, precise UI/UX design, robust security audits, and ongoing tech support. SDLC Corp is steadfast in delivering inventive, reliable DeFi solutions that meet evolving market needs and empower client success.