The Procure-to-Pay (P2P) process is a vital aspect of business operations, encompassing the entire cycle from procurement to payment. Within this framework, the “3P cycle” stands out, comprising the Procurement, Purchasing, and Payment phases. In the Procurement phase, needs are identified, suppliers are selected, and negotiations for contracts or purchase orders occur. Following this, the Purchasing phase executes transactions, including order placement, receipt verification, and invoice processing. Finally, in the Payment phase, invoices are approved, payments are processed, and accounts are reconciled. Technology innovations like QR code scanning are increasingly integrated into these processes, expediting tasks such as order placement and invoice processing. By leveraging QR code scanners, organizations can enhance efficiency and accuracy throughout the P2P process, leading to cost savings and stronger supplier relationships.

How Its Work?

let’s dive into the Procure-to-Pay (P2P) process, specifically focusing on the 3P cycle and the role of accounts payable within it.

Procure-to-Pay (P2P) Process:

The Procure-to-Pay process, often abbreviated as P2P, encompasses all the steps involved in obtaining goods or services required for a business operation, from the initial procurement requisition to the final payment to the supplier. It’s a vital component of any organization’s operations and involves multiple stakeholders, departments, and systems working in sync to ensure efficiency, cost-effectiveness, and compliance.

The 3P Cycle:

The 3P cycle in the Procure-to-Pay process refers to three key phases: Procurement, Processing, and Payment.

1. Procurement: This phase involves the identification of the need for goods or services within the organization. It begins with a requisition raised by the end-user or department requiring the product or service. The requisition details the specifications, quantity, and any other relevant information. Once approved, it moves to the procurement team or purchasing department.

2. Processing: After receiving the requisition, the procurement team initiates the sourcing process. This involves identifying potential suppliers, obtaining quotes or proposals, negotiating contracts, and selecting the best vendor based on factors such as price, quality, and delivery terms. Once the purchase order (PO) is issued and accepted by the supplier, goods or services are delivered.

3. Payment: Accounts Payable (AP) plays a crucial role in this phase. Upon receipt of the goods or services, the supplier submits an invoice to the organization. The AP team verifies the invoice against the purchase order, receiving report, and any other relevant documentation to ensure accuracy and compliance. Once approved, the invoice is entered into the accounting system for payment processing. Payments may be made via various methods, such as electronic funds transfer (EFT), checks, or virtual credit cards, depending on the agreement with the supplier and organizational policies.

Role of Accounts Payable (AP):

Accounts Payable (AP) is responsible for managing the payment process within the Procure-to-Pay cycle. Their duties include:

– Invoice Processing: AP receives and reviews invoices from suppliers, ensuring they match the corresponding purchase orders and receiving reports. Any discrepancies or issues are resolved through communication with the supplier or internal departments.

– Approval Workflow: AP manages the approval workflow for invoices, routing them to the appropriate stakeholders for review and authorization. This ensures that only valid and approved invoices are processed for payment.

– Payment Processing: Once invoices are approved, AP initiates the payment process according to the agreed-upon terms with the supplier. This may involve scheduling payments, generating checks or electronic payments, and reconciling accounts to ensure accurate and timely disbursements.

– Vendor Management: AP maintains relationships with suppliers, addressing any inquiries or concerns related to payments, invoices, or accounts. They also negotiate payment terms and discounts to optimize cash flow and minimize costs for the organization. By efficiently managing the accounts payable function, organizations can streamline the Procure-to-Pay process, improve vendor relationships, and enhance financial visibility and control.

Demystify the P2P cycle! Click to learn.

What is Procure-to-Pay?

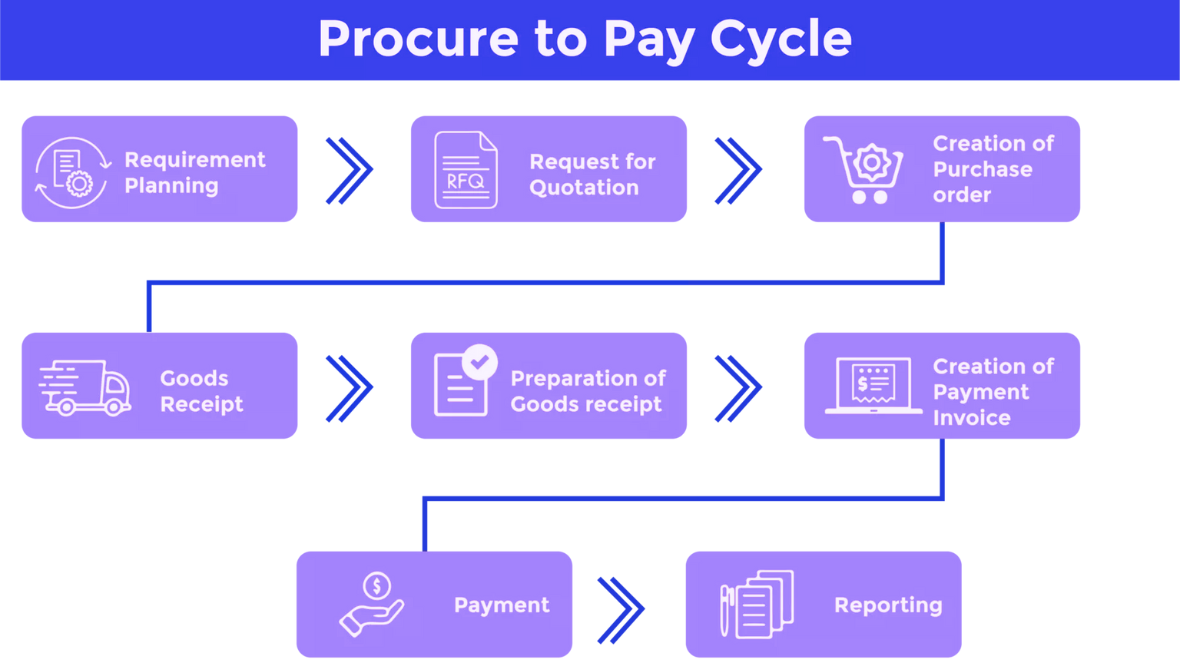

Procure-to-pay (P2P) is a comprehensive process within organizations that encompasses all activities from the initial procurement of goods and services to the final payment to suppliers. Here’s a detailed breakdown of what each stage entails:

1. Requisitioning: The process begins with the identification of the need for goods or services within the organization. This could be triggered by various factors such as depletion of inventory, project requirements, or operational needs. Departments or individuals create requisitions specifying what is required, including quantity, specifications, and any other pertinent details.

2. Vendor Selection and Approval: Once requisitions are created, they undergo scrutiny to ensure they comply with organizational policies and budgets. This involves selecting appropriate vendors or suppliers who can fulfill the requisitioned goods or services. Vendor selection may involve negotiations, comparisons of quotes, and assessments of vendor reliability and quality.

3. Purchase Order Creation: After vendor selection, purchase orders (POs) are generated to formalize the agreement between the organization and the supplier. POs outline the specifics of the transaction, including item descriptions, quantities, prices, delivery dates, and terms of payment. This document serves as a legally binding contract between the parties involved.

4. Goods Receipt and Inspection: Upon the delivery of goods or completion of services, the organization receives and inspects the items to ensure they meet the specified requirements and quality standards. This step is crucial for verifying that the goods received match what was ordered and that they are in acceptable condition. Any discrepancies or issues are documented and addressed accordingly.

5. Invoice Processing and Approval: Once the goods or services are received and verified, suppliers issue invoices to request payment. Invoices undergo review and approval processes within the organization to verify their accuracy and compliance with the terms outlined in the purchase orders. This involves matching invoices with corresponding POs and goods receipts to ensure consistency and prevent errors or discrepancies.

6. Payment Processing: The final stage of the P2P process involves the actual disbursement of funds to the suppliers. Payments are typically made according to the agreed-upon terms, which may include payment due dates, discounts for early payment, and preferred payment methods. Payments are processed through the organization’s financial systems, and records are maintained to track expenditures and ensure financial accountability.

Overall, the procure-to-pay process is designed to streamline and optimize the purchasing and payment cycle, ensuring efficiency, transparency, and compliance with organizational policies and regulations. By managing each step systematically, organizations can effectively manage their procurement activities while minimizing risks and costs associated with purchasing goods and services.

What is the procure-to-pay cycle?

The procure-to-pay (P2P) cycle is a fundamental process in business operations, encompassing everything from the initial request for goods or services to the final payment to the supplier. Here are six detailed descriptions of the P2P cycle:

1. Requisitioning:

The P2P cycle begins with requisitioning, where a department identifies the need for goods or services. This could involve anything from office supplies to specialized equipment. The requisition typically includes details such as quantity, specifications, and any relevant approvals. It serves as the formal request to initiate the procurement process.

2. Supplier selection and negotiation:

Once the requisition is approved, the next step is to select a supplier. This involves evaluating potential vendors based on factors such as price, quality, reliability, and past performance. Negotiations may occur to agree on terms, such as payment terms, delivery schedules, and any discounts or incentives. This phase requires effective communication and collaboration between procurement teams and suppliers.

3. Purchase order creation:

After supplier selection and negotiation, a purchase order (PO) is created. The PO serves as a legally binding document outlining the details of the transaction, including the items or services ordered, quantities, prices, delivery dates, and terms of payment. It provides clarity and ensures alignment between the buyer and the supplier.

4. Goods receipt and inspection:

Upon delivery of the goods or completion of the services, the receiving department verifies the receipt and inspects the quality and quantity of the items against the purchase order. Any discrepancies are documented and addressed through the established processes, such as notifying the supplier of damaged or missing items. This step ensures that the received goods meet the specified requirements before proceeding to the next phase.

5. Invoice processing:

Once the goods or services are received and verified, the supplier submits an invoice for payment. The accounts payable team reviews the invoice against the corresponding purchase order and goods receipt documentation to ensure accuracy. Any discrepancies or discrepancies are reconciled with the supplier before the invoice is approved for payment. This phase requires meticulous attention to detail to avoid errors and ensure timely payments.

6. Payment processing and reconciliation:

The final step in the P2P cycle involves processing the approved invoices for payment. This may include various payment methods, such as electronic funds transfer, checks, or virtual credit cards, depending on the agreement with the supplier. Once the payment is made, it is reconciled with the corresponding invoices and recorded in the accounting system to maintain accurate financial records. This phase aims to streamline the payment process, optimize cash flow, and strengthen vendor relationships through timely and accurate payments.

These six stages outline the end-to-end process of the procure-to-pay cycle, emphasizing the importance of collaboration, communication, and attention to detail at each step to ensure efficiency and effectiveness in procurement operations.

What are some tips for efficient procure-to-pay management?

Efficient procure-to-pay management is crucial for streamlining business operations and optimizing resources.

1. Streamline Procurement Processes:

– Standardize procurement processes from requisition to purchase order issuance to ensure consistency and efficiency.

– Implement a centralized procurement system or software that automates routine tasks such as purchase requisition approvals, vendor selection, and purchase order generation.

– Utilize electronic catalogs and supplier portals to facilitate easy and transparent communication with vendors, reducing manual errors and processing time.

2. Establish Clear Policies and Procedures:

– Develop comprehensive procurement policies and procedures that outline approval workflows, spending limits, preferred suppliers, and contract terms.

– Educate employees on these policies to ensure compliance and minimize unauthorized purchases.

– Regularly review and update policies to reflect changes in regulations, market conditions, and business needs.

3. Vendor Management and Negotiation:

– Maintain a centralized vendor database with updated information on vendor performance, contracts, and pricing agreements.

– Regularly assess vendor performance based on criteria such as quality, delivery time, and pricing to identify opportunities for improvement or alternative suppliers.

– Negotiate favorable terms, discounts, and payment terms with vendors to reduce costs and optimize cash flow.

4. Optimize Invoice Processing:

– Automate invoice processing workflows to expedite invoice approval, reduce manual errors, and avoid late payments.

– Implement electronic invoicing and invoice matching systems to reconcile purchase orders, goods receipts, and invoices efficiently.

– Utilize invoice validation tools to identify discrepancies and exceptions early, allowing prompt resolution and preventing payment delays.

5. Enforce Controls and Compliance:

– Implement robust internal controls to prevent fraud, ensure compliance with regulatory requirements, and safeguard company assets.

– Segregate duties and establish approval hierarchies to prevent conflicts of interest and unauthorized purchases.

– Conduct periodic audits and reviews to assess compliance with procurement policies, identify weaknesses, and implement corrective actions.

6. Continuous Improvement and Analytics:

– Leverage data analytics tools to analyze procurement data, identify spending patterns, and uncover opportunities for cost savings and process optimization.

– Establish key performance indicators (KPIs) to measure procurement performance, such as procurement cycle time, cost savings, and supplier performance.

– Encourage feedback from stakeholders, including employees, vendors, and customers, to identify areas for improvement and implement best practices.

By implementing these tips, organizations can enhance efficiency, reduce costs, and mitigate risks throughout the procure-to-pay process.

Explore the P2P cycle! Click to understand.

What is Procure-to-pay software?

Procure-to-pay (P2P) software is a comprehensive solution designed to streamline and automate the entire procurement process within an organization, from requisitioning goods and services to making payments to suppliers.

1. Requisition Management: P2P software enables users to create, submit, and track purchase requisitions electronically. It allows for the consolidation of purchasing needs across departments, ensuring better control and visibility over procurement requests. Detailed descriptions of required items, quantities, and budget allocations can be included, facilitating informed decision-making.

2. Supplier Management: This software facilitates the management of supplier information, including onboarding, performance evaluation, and relationship management. It centralizes supplier data, such as contracts, pricing agreements, and compliance documents, to ensure that the organization is working with reliable and compliant vendors.

3. Purchase Order Processing: P2P systems automate the creation, approval, and distribution of purchase orders. Users can generate POs based on approved requisitions, with predefined approval workflows ensuring proper authorization channels are followed. This reduces the risk of errors and delays associated with manual processing while providing a clear audit trail.

4. Invoice Processing: P2P software streamlines the invoice approval process by digitizing incoming invoices, and matching them against corresponding purchase orders and receipts. Automated matching algorithms identify discrepancies and exceptions, flagging them for review by designated personnel. This minimizes the risk of overpayments, duplicate payments, and unauthorized purchases.

5. Payment Processing: Once invoices are approved, P2P systems facilitate the payment process by integrating with financial systems or third-party payment platforms. They support various payment methods, including electronic funds transfer (EFT), virtual cards, and traditional checks. Payment terms and discounts negotiated with suppliers can be enforced automatically, optimizing cash flow and reducing transaction costs.

6. Reporting and Analytics: P2P software provides comprehensive reporting and analytics capabilities, offering insights into procurement performance, spending patterns, and supplier relationships. Users can generate customizable reports and dashboards to monitor key metrics such as spend by category, supplier performance, and compliance with purchasing policies. These insights enable data-driven decision-making and continuous improvement in procurement processes.

Overall, procure-to-pay software plays a crucial role in driving efficiency, transparency, and compliance across the entire procurement lifecycle, ultimately helping organizations reduce costs, mitigate risks, and improve supplier relationships.

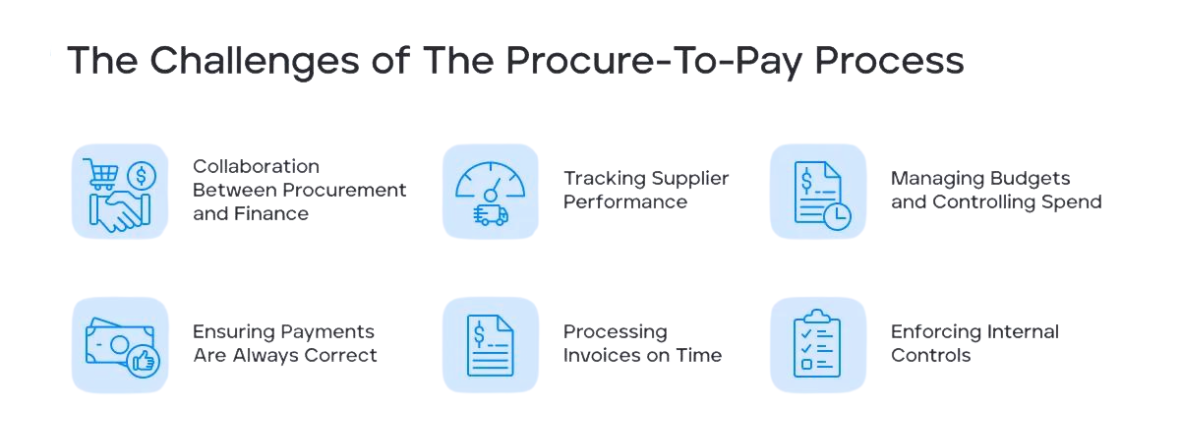

What are the challenges faced in the procure-to-pay process?

The procure-to-pay process involves several steps, from requisitioning goods or services to paying for them. Here are six detailed challenges commonly encountered in this process:

1. Fragmented Systems and Data Silos: Many organizations struggle with fragmented systems for procurement, invoicing, and payment. These systems often don’t communicate seamlessly, leading to data silos and inefficiencies. For example, purchase orders may not match invoices, leading to discrepancies and delays in payment approvals.

2. Manual Processes and Paperwork: Traditional procure-to-pay processes often rely heavily on manual tasks and paperwork. This can be time-consuming, error-prone, and resource-intensive. Manual data entry increases the risk of inaccuracies, while paper-based documentation can be easily misplaced or lost, causing delays and compliance issues.

3. Lack of Visibility and Control: Without proper visibility into the procure-to-pay process, organizations struggle to track spending, monitor supplier performance, and enforce compliance with procurement policies. This lack of visibility can lead to maverick spending, missed discounts, and increased risk of fraud or non-compliance with regulations.

4. Complex Approval Workflows: Procure-to-pay processes typically involve multiple stakeholders, each with their approval requirements and workflows. Managing these complex approval chains manually can be challenging, especially when approvals are delayed or bottlenecks occur. Delays in approvals can lead to late payments, strained supplier relationships, and missed opportunities for early payment discounts.

5. Supplier Management Challenges: Effective supplier management is crucial for a smooth procure-to-pay process. However, maintaining up-to-date supplier information, negotiating favorable terms, and managing supplier relationships can be challenging. Poor supplier management can result in suboptimal pricing, quality issues, and supply chain disruptions.

6. Compliance and Risk Management: Compliance with regulatory requirements and internal policies is essential in the procure-to-pay process. However, ensuring compliance across all stages of procurement, invoicing, and payment can be complex, especially in industries with stringent regulations. Failure to comply with regulations can result in financial penalties, reputational damage, and legal liabilities.

Addressing these challenges often requires a combination of process optimization, technology adoption, and stakeholder collaboration to streamline operations, enhance visibility, and improve efficiency in the procure-to-pay process.

What are some best practices for procure-to-pay?

Procure-to-pay (P2P) is a critical process for businesses, encompassing everything from sourcing suppliers to making payments. Here are six detailed descriptions of best practices within the P2P process:

1. Supplier Relationship Management: Establishing and maintaining strong relationships with suppliers is fundamental. This involves not only negotiating favorable terms but also collaborating closely with suppliers to improve processes and drive mutual benefits. Best practices include regular communication, sharing performance metrics, and addressing issues promptly to ensure a smooth flow of goods and services.

2. Streamlined Procurement Process: Implementing a streamlined procurement process helps to reduce inefficiencies and costs. This includes standardizing purchasing procedures, leveraging technology such as procurement software or e-procurement platforms, and automating routine tasks like purchase requisitions and approvals. By simplifying the process, organizations can improve accuracy, reduce cycle times, and enhance overall productivity.

3. Effective Contract Management: Proper contract management is crucial for ensuring compliance, managing risks, and optimizing supplier relationships. Best practices involve centralizing contract repositories, implementing robust contract lifecycle management systems, and conducting regular audits to monitor compliance and identify opportunities for cost savings or renegotiation. By proactively managing contracts, organizations can mitigate risks and maximize value from supplier agreements.

4. Strategic Sourcing: Strategic sourcing involves identifying the most suitable suppliers and negotiating favorable terms to achieve cost savings and enhance quality. Best practices include conducting thorough supplier evaluations, leveraging market intelligence to identify opportunities, and implementing strategic sourcing methodologies such as category management or total cost of ownership (TCO) analysis. By taking a strategic approach to sourcing, organizations can optimize their supplier base and drive bottom-line results.

5. Efficient Invoice Processing: Efficient invoice processing is essential for timely payments and maintaining positive supplier relationships. Best practices include automating invoice capture and processing, implementing invoice validation controls to prevent errors or discrepancies, and adopting electronic invoicing (e-invoicing) to streamline the entire invoicing process. By reducing manual intervention and accelerating invoice processing cycles, organizations can improve cash flow and avoid late payment penalties.

6. Continuous Improvement and Performance Measurement: Continuous improvement is key to optimizing the P2P process over time. Best practices include establishing key performance indicators (KPIs) to measure process efficiency, conducting regular performance reviews to identify areas for improvement, and leveraging data analytics to gain insights into spending patterns and supplier performance. By fostering a culture of continuous improvement and accountability, organizations can drive operational excellence and achieve long-term success in their P2P operations.

By implementing these best practices, organizations can enhance efficiency, reduce costs, mitigate risks, and build stronger supplier relationships within the procure-to-pay process.

What are some leading P2P solutions?

A leading P2P (Procure-to-Pay) solution is a comprehensive platform designed to streamline and optimize the entire procurement process within an organization. Here are six detailed descriptions highlighting its key features and benefits:

1. Efficient Procurement Management: The P2P solution facilitates efficient procurement management by providing a centralized platform for requesting, approving, and managing purchase orders. It automates manual processes, reducing the time and effort required for procurement tasks, such as vendor selection, negotiation, and purchase requisition.

2. End-to-end Visibility: One of the standout features of a leading P2P solution is its ability to offer end-to-end visibility into the procurement process. Users can track the status of purchase orders, monitor spending in real-time, and generate detailed reports for analysis. This transparency enables better decision-making and cost control throughout the procurement lifecycle.

3. Supplier Relationship Management: The solution enables organizations to strengthen relationships with their suppliers by providing tools for supplier onboarding, performance evaluation, and collaboration. It facilitates communication between buyers and suppliers, streamlining interactions and fostering strategic partnerships for mutual benefit.

4. Compliance and Risk Management: Compliance with internal policies and external regulations is crucial in procurement. A leading P2P solution includes robust compliance and risk management features, such as approval workflows, budget controls, and audit trails. These features help mitigate risks associated with non-compliance and ensure adherence to procurement policies and regulations.

5. Integration Capabilities: Seamless integration with other enterprise systems, such as ERP (Enterprise Resource Planning) and accounting software, is essential for optimizing the procurement process. A leading P2P solution offers flexible integration capabilities, allowing data to flow seamlessly between different systems. This integration eliminates data silos, improves data accuracy, and enhances overall process efficiency.

6. Scalability and Customization: As organizations grow and evolve, their procurement needs may change. A leading P2P solution is scalable and customizable, capable of adapting to the unique requirements of different industries and organizations of varying sizes. Whether it’s adding new features, configuring workflows, or accommodating increased transaction volumes, the solution can scale alongside the organization’s growth trajectory.

A leading P2P solution offers efficient procurement management, end-to-end visibility, supplier relationship management, compliance and risk management, integration capabilities, and scalability and customization options. By leveraging these features, organizations can streamline their procurement processes, reduce costs, mitigate risks, and drive overall business success.

What are the benefits of the procure-to-pay process?

1. Cost Savings and Efficiency: Implementing a P2P system streamlines the entire procurement process, from requisition to payment. By automating repetitive tasks like purchase order creation, invoice processing, and payment approvals, companies can significantly reduce operational costs and improve efficiency. Additionally, P2P systems often enable organizations to negotiate better terms with suppliers, take advantage of discounts for prompt payment, and eliminate late payment fees, further contributing to cost savings.

2. Improved Spend Visibility and Control: A P2P system provides organizations with greater visibility into their spending patterns and enables better control over expenditures. Through centralized procurement data and reporting functionalities, businesses can track purchases in real-time, identify areas of overspending or non-compliance, and implement cost-saving strategies. This enhanced visibility allows for more informed decision-making and helps mitigate financial risks associated with unauthorized or off-contract purchases.

3. Enhanced Compliance and Risk Management: Compliance with internal policies, industry regulations, and supplier contracts is crucial for organizations to avoid legal penalties, reputational damage, and financial losses. P2P systems enforce compliance by standardizing procurement processes, enforcing approval workflows, and flagging any deviations from established protocols. Moreover, these systems often integrate risk assessment tools that evaluate supplier performance, financial stability, and regulatory adherence, reducing the likelihood of disruptions or compliance breaches.

4. Supplier Relationship Management: Effective supplier management is essential for securing favorable terms, maintaining product quality, and ensuring timely deliveries. P2P systems facilitate better communication and collaboration between buyers and suppliers by providing a centralized platform for order placement, invoicing, and dispute resolution. Through features such as vendor performance evaluations, feedback mechanisms, and contract management tools, organizations can cultivate stronger relationships with their suppliers, leading to improved reliability, transparency, and innovation.

5. Time Savings and Process Standardization: Manual procurement processes are often time-consuming, error-prone, and fragmented across different departments or locations. By automating routine tasks and standardizing workflows, P2P systems enable employees to focus on value-added activities and strategic initiatives. Time savings are achieved through features such as electronic requisitioning, automated invoice matching, and electronic payments, which eliminate the need for manual data entry and paperwork. Moreover, process standardization ensures consistency, reduces cycle times, and facilitates scalability as businesses grow or expand into new markets.

6. Data-driven Decision Making and Continuous Improvement: P2P systems generate a wealth of data related to procurement activities, supplier performance, and spending trends. Analyzing this data provides valuable insights that enable organizations to make informed decisions, identify opportunities for cost optimization, and drive continuous process improvement. By leveraging analytics tools and reporting capabilities, companies can track key performance indicators (KPIs), monitor compliance metrics, and implement strategies to enhance operational efficiency and financial performance over time.

These benefits collectively contribute to the strategic objectives of organizations, supporting their goals of reducing costs, mitigating risks, and optimizing procurement processes to drive long-term competitiveness and sustainability.

Conclusion

In conclusion, the Procure-to-Pay (P2P) process, often referred to as the 3P cycle, encompasses a series of interconnected steps that facilitate efficient procurement, invoice processing, and payment within an organization. Through the seamless integration of purchasing, accounts payable, and finance functions, the P2P process streamlines operations, enhances visibility, and enables better control over expenditures.

By automating manual tasks, standardizing workflows, and enforcing compliance measures, organizations can realize significant benefits such as cost savings, improved spend visibility, and enhanced supplier relationships. The P2P process fosters collaboration between buyers and suppliers, driving mutual success through transparent communication, streamlined transactions, and effective risk management.

Within the P2P process, the accounts payable function plays a pivotal role in managing supplier invoices, reconciling payments, and ensuring timely disbursements. Accounts payable process flows typically involve invoice receipt and validation, three-way matching of invoices, purchase orders, and receipts, approval routing, and final payment execution. By leveraging technology solutions such as electronic invoicing, workflow automation, and data analytics, organizations can optimize their accounts payable processes for greater efficiency, accuracy, and control.

FAQs

1. What is the Procure-to-Pay (P2P) process, and how does it work?

The Procure-to-Pay process encompasses all steps involved in acquiring goods or services, from the initial requisition to final payment. It typically includes stages such as requisitioning, sourcing, purchasing, receiving, invoicing, and payment. Organizations follow a standardized workflow where purchase requests are approved, purchase orders are issued, goods are received and inspected, invoices are matched with purchase orders and receipts, and payments are processed.

2. What are the key benefits of implementing a Procure-to-Pay system?

Implementing a Procure-to-Pay system offers numerous benefits, including cost savings through process efficiency, improved spend visibility and control, enhanced compliance and risk management, better supplier relationship management, and time savings through automation and standardization. Additionally, it facilitates data-driven decision-making and continuous process improvement.

3. What are the main challenges associated with the Procure-to-Pay process?

Despite its benefits, the Procure-to-Pay process can pose several challenges, such as fragmented processes and systems, lack of integration between procurement and finance functions, compliance issues, supplier management complexities, and resistance to change among employees. Data quality issues, maverick spending, and inefficiencies in invoice processing and payment reconciliation are also common challenges that organizations face.

4. How can organizations ensure compliance and mitigate risks in the Procure-to-Pay process?

To ensure compliance and mitigate risks, organizations should establish robust internal controls, implement policies and procedures that adhere to regulatory requirements and industry standards, conduct regular audits of procurement activities, and enforce segregation of duties. Leveraging technology solutions such as P2P systems can also help automate compliance checks, monitor supplier performance, and detect fraudulent activities or unauthorized transactions.

5. What are some best practices for optimizing the Procure-to-Pay process?

Optimizing the Procure-to-Pay process involves adopting best practices such as centralizing procurement operations, standardizing workflows and approval processes, leveraging e-procurement solutions for electronic requisitioning and purchase order management, implementing supplier relationship management strategies, and embracing continuous process improvement initiatives. Additionally, organizations should prioritize data accuracy, invest in employee training, and foster collaboration between procurement, finance, and other relevant departments to drive efficiency and effectiveness.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)