Introduction

Three-way invoice matching is a process used in accounting and procurement to ensure that the amounts on supplier invoices match the amounts on purchase orders and receiving documents. In this process, the accounts payable team compares the details on the supplier invoice with the corresponding purchase order (PO) and the receiving report or goods receipt.

The goal is to verify that the goods or services were ordered, received, and invoiced for at the correct prices and quantities. If all three documents match, the invoice is considered valid and can be processed for payment. Three-way matching helps prevent overpayments, underpayments, and payment errors by providing a thorough verification process for all transactions. It also helps maintain accurate financial records and supports better decision-making regarding supplier relationships and inventory management.

What are the components of 3-way matching?

The components of 3-way matching are:

- Purchase Order (PO): The PO is a document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services. It serves as a contractual agreement between the buyer and seller.

- Receiving Report (or Goods Receipt): The receiving report is a document prepared by the receiving department to confirm that goods or services have been received as ordered. It includes details such as quantity received, condition of goods, and any discrepancies.

- Supplier Invoice: The supplier invoice is a document sent by the supplier to the buyer, requesting payment for goods or services provided. It includes details such as the quantity, price, and description of items, as well as payment terms.

During the 3-way matching process, these three components are compared to ensure that they all align. The goal is to verify that the goods or services were ordered, received, and invoiced for correctly. If there are any discrepancies, they must be resolved before the invoice can be approved for payment.

Optimize Your Accounting: Learn How 3-Way Invoice Matching Can Benefit Your Business!

What are the 3-way matching process?

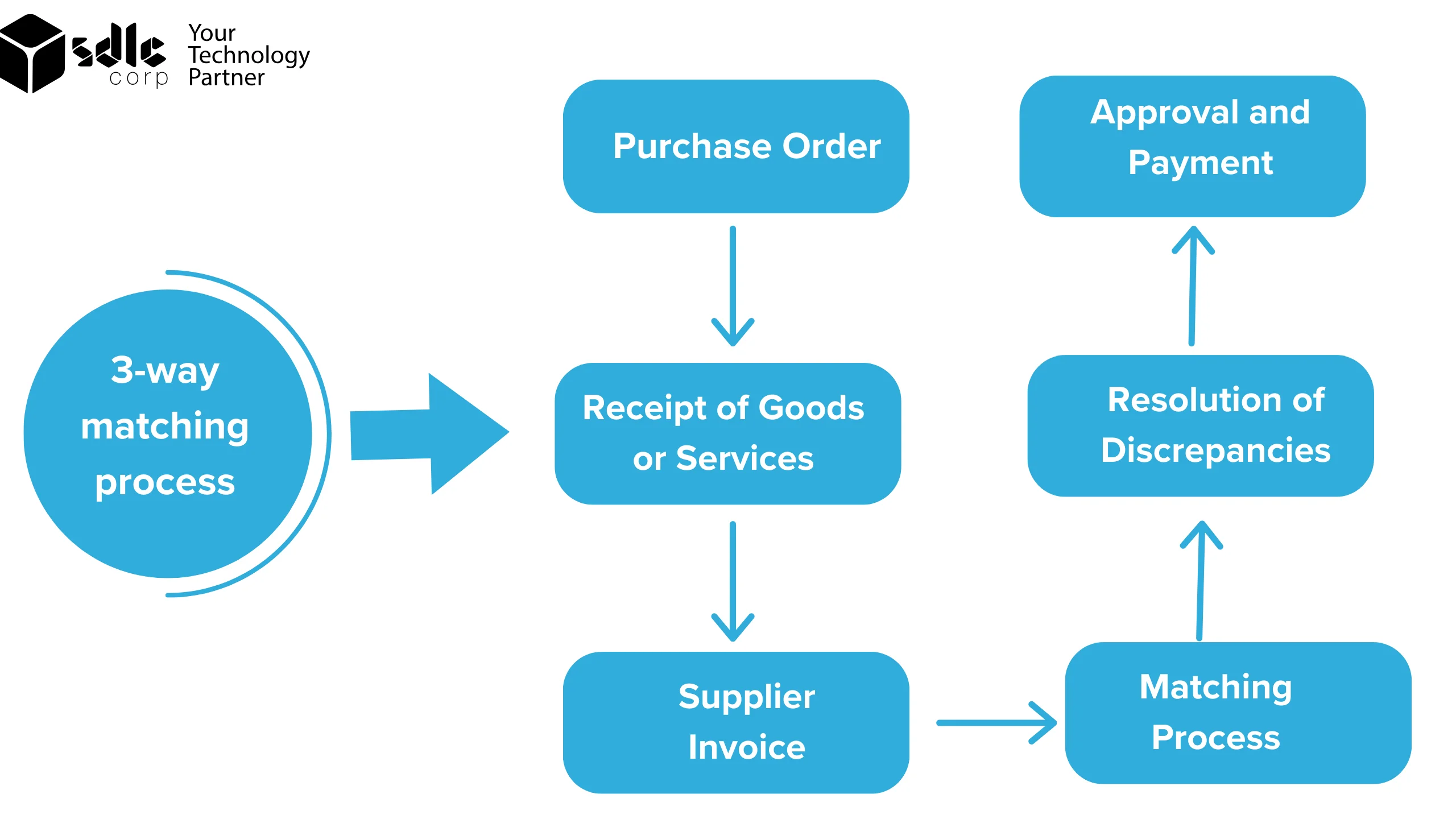

The 3-way matching process is a method used in accounting to ensure that the details on a supplier invoice match the corresponding purchase order and receiving report. Here’s how it works:

- Purchase Order (PO): The process begins with the creation of a purchase order (PO) that specifies the details of the goods or services being ordered, including quantities, prices, and terms.

- Receipt of Goods or Services: When the goods or services are received, the receiving department creates a receiving report or goods receipt to confirm the receipt of the items. This document includes details such as the quantity received and the condition of the goods.

- Supplier Invoice: The supplier then sends an invoice to the buyer for the goods or services provided. The invoice includes details such as the quantity, price, and description of the items, as well as any applicable taxes or discounts.

- Matching Process: The accounts Invoice payable team compares the details on the supplier invoice with those on the purchase order and receiving report. The goal is to ensure that the goods or services were ordered, received, and invoiced for correctly.

- Resolution of Discrepancies: If there are any discrepancies between the three documents, such as incorrect quantities or prices, the accounts payable team must resolve them with the supplier before the invoice can be approved for payment.

- Approval and Payment: Once the details on all three documents match and any discrepancies have been resolved, the invoice is approved for payment, and the supplier is paid accordingly.

The 3-way matching process helps ensure that the company pays the correct amount for the goods or services received, reducing the risk of overpayments or underpayments. It also helps maintain accurate financial records and supports better decision-making regarding supplier relationships and inventory management.

Why 3-way matching is important?

Three-way matching is important for several reasons:

- Accuracy: It helps ensure that the amounts on supplier invoices match the amounts on purchase orders and receiving documents, reducing the risk of overpayments or underpayments.

- Control: By comparing three separate documents, it establishes control over the accounts payable process, ensuring that all invoices are properly reviewed and approved before payment.

- Fraud Prevention: Three-way matching helps prevent fraud by identifying discrepancies or irregularities in invoices that may indicate fraudulent activity.

- Efficiency: While it may seem like an additional step, three-way matching can actually improve efficiency by streamlining the reconciliation process and reducing the likelihood of errors.

- Compliance: It helps ensure compliance with internal controls and external regulations by verifying the accuracy and completeness of financial transactions.

- Supplier Relationships: Timely and accurate payments can help maintain positive relationships with suppliers, leading to better terms and conditions for future transactions.

Overall, three-way matching is an important process that helps businesses maintain accurate financial records, prevent fraud, and ensure compliance with regulations.

Achieve Perfect Alignment: Explore the Power of 3-Way Invoice Matching Today!

What are the challenges of 3-way matching?

The challenges of 3-way matching include:

- Mismatched Information: Sometimes, the details on the invoice, purchase order, and receiving report may not match exactly, leading to discrepancies that must be resolved.

- Delayed Payments: Resolving discrepancies can take time, leading to delays in payment to suppliers.

- Complexity: Managing the 3-way matching process manually can be complex and time-consuming, especially for large volumes of invoices.

- Data Entry Errors: Manual data entry can lead to errors, such as incorrect quantities or prices, which can affect the matching process.

- Communication Issues: Poor communication between departments involved in the 3-way matching process can lead to misunderstandings and delays.

To address these challenges, businesses can:

- Implement Automation: Use software or tools that automate the 3-way matching process to reduce errors and streamline the reconciliation process.

- Improve Communication: Ensure that there is clear communication between the purchasing, receiving, and accounts payable departments to prevent misunderstandings.

- Train Staff: Provide training to staff involved in the 3-way matching process to ensure they understand the importance of accuracy and compliance.

- Regularly Review Processes: Regularly review and improve 3-way matching processes to identify and address any inefficiencies or issues.

- Use Electronic Data Interchange (EDI): Implementing an EDI system can help streamline the exchange of information between departments, reducing errors and delays.

Streamline Your Payment Process: Discover 3-Way Invoice Matching Now!

FAQs

1. What happens if there are discrepancies in 3-way matching?

- If there are discrepancies, such as incorrect quantities or prices, the accounts payable team must resolve them with the supplier before the invoice can be approved for payment.

2. How can automation help with 3-way matching?

Automation can streamline the 3-way matching process by reducing errors, improving efficiency, and saving time.

3. How often should 3-way matching be performed?

- 3-way matching should be performed regularly, such as monthly or quarterly, to ensure accuracy in the accounts payable process.

4. What is the difference between a proforma invoice and a regular invoice?

- If there are discrepancies, businesses should investigate and resolve them promptly with the supplier before approving the invoice for payment.

5. How does 3-way invoice matching contribute to better supplier relationships?

- Timely and accurate payments resulting from 3-way invoice matching can help maintain positive relationships with suppliers, leading to better terms and conditions for future transactions.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)