Different loans for different needs.

Our cutting-edge solution includes advanced loan tracker software for efficient loan management. Elevate your lending operations for a swift and measurable return on investment.

The application procedure is easy and straightforward. We’re simply a phone call away if you’re experiencing problems applying for a loan.

Your application will be processed in a short duration if you provide all the necessary documents and meet the eligibility criteria.

It takes a about a day to disburse the loan amount once the loan application has been approved and the formalities have been completed.

You can obtain a top up loan at lower rate of interest and lesser processing fee, provided you have paid back the earlier loan amount in time.

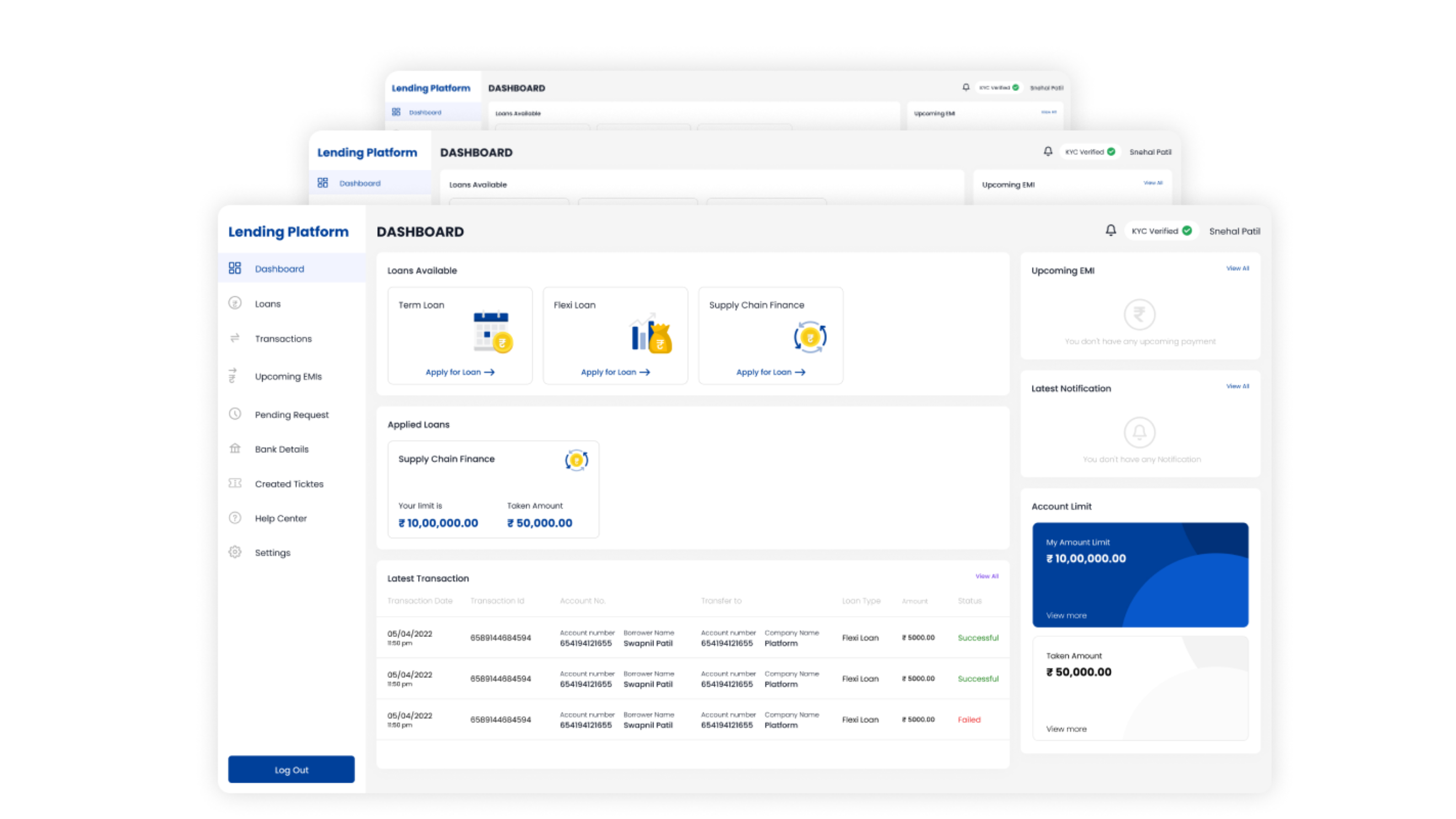

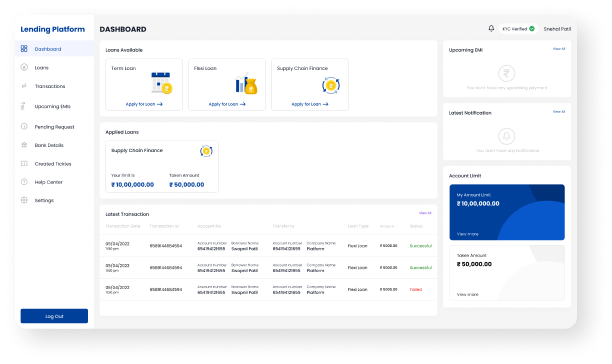

Track Loans Effortlessly - Monitor balances, interest rates, and payments in one place.

All Loans

View all loans stages

254

Term Loan

View all loans stages

85

Flexi Loans

View all loans stages

156

Supply Chain Finance

View all loans stages

13

Loans up to ₹20 lakh

Interest rates starting @9.9% p.a.

Instant disbursal

Leverage the incredible potential of AI technology to assess loan portfolios, automate debt collection, and gain invaluable data-driven insights with advanced loan processing software.

Automate underwriting with smart preapprovals. HES combined SaaS lending technology with AI to score incoming requests on the go. ML algorithms identify potentially delinquent borrowers based on historical data patterns.

Monitor issued loans using the SaaS lending platform. Efficiently manage borrower profiles and tailor lending workflows to your needs with a few clicks. Keep track of operations, transaction history, and signed contracts.

Regular EMI involves fixed monthly payments of principal and interest. Increasing EMI sees payments rise periodically, suiting income growth. Decreasing EMI features declining payments, accommodating reduced income.

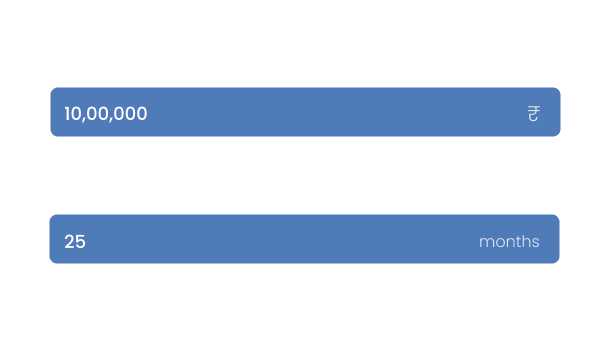

Create new loan products in a snap. Configure loan terms, set amount limits, and adjust interest rates with ease. Make customization a breeze and optimize the process for a seamless customer journey.

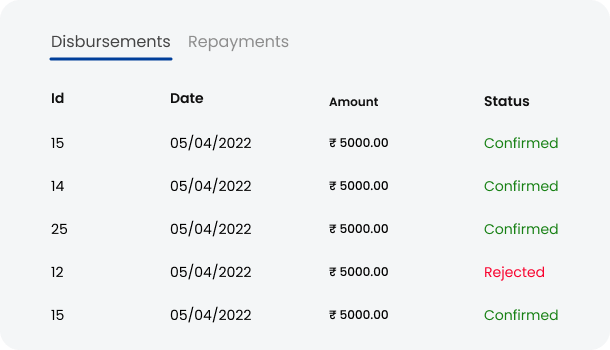

Track automatic disbursements, repayments, and daily transactions effortlessly with loan management software. Enjoy unified online access for streamlined management. Loan administration software makes the process seamless, allowing you to monitor and control disbursements and repayments with ease. With the ability to automate transactions, you can ensure accuracy and efficiency in your loan management.

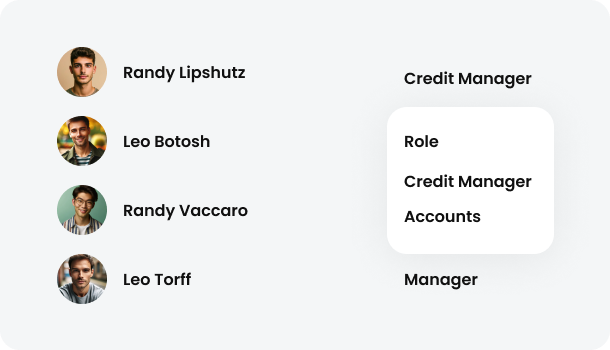

Enhance security with role-based user permissions in your loan processing software or online loan management software. Limit access to system functions based on specific user roles, ensuring a robust and controlled environment. This ensures that only authorized personnel have access to sensitive functionalities, thereby mitigating potential risks and maintaining a secure system.

Streamline loan origination with an e-signature. Our online lending software, considered the best CRM software for loan officers, reduces paperwork and eliminates physical office visits for added convenience and security. The platform also caters to private lenders with specialized features, making it an ideal private lender loan servicing software.

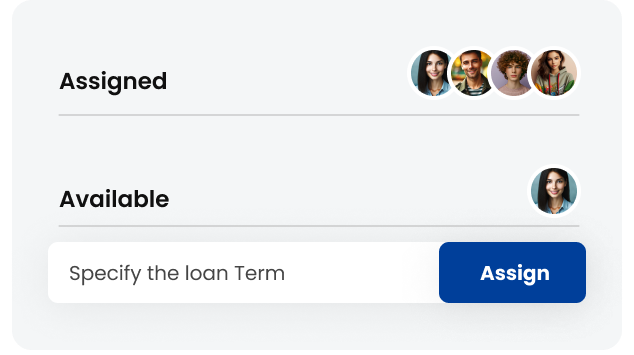

Synchronize loan officers’ work with the lending platform solution. The built-in task management module facilitates task allocation and performance monitoring for seamless operations. The end-to-end lending software ensures efficient workflow, while the commercial lending software empowers loan officers with comprehensive tools for effective decision-making.

“I’ve used several lending platforms in the past, but SDLC Corp stands out! The application process was seamless, and I got approved within hours. The interest rates were competitive, and the repayment options were flexible. The micro lending software provided by SDLC Corp made the entire process efficient and user-friendly. The customer service team was incredibly helpful, addressing all my queries promptly. I highly recommend SDLC Corp for a hassle-free and transparent lending experience, especially if you’re in need of small lending software or business lending software.”

“I needed a quick loan for unexpected medical expenses, and SDLC Corp exceeded my expectations. The user-friendly interface made the application process straightforward, thanks to their efficient lending and approval software. What impressed me the most was the speed at which my loan was approved and disbursed, a testament to their advanced small business lending software. The interest rates were reasonable, and I appreciated the clear terms and conditions facilitated by their reliable retail lending software. Overall, a reliable platform for anyone in need of fast and fair financing.”

“As a small business owner, finding a trustworthy lending platform is crucial. SDLC Corp not only provided the funding I needed for expansion but also offered personalized solutions tailored to my business needs. Their dedication to excellence is evident in their reputation as the best in class for loan origination software and overall loan management software. As a small business owner, having access to such reliable tools is invaluable for success.

Contact Us

Let's Talk About Your Project

Loan origination software is a crucial component in the lending app development process, designed to streamline and automate the loan application and approval processes. This software helps financial institutions, including micro and small lending businesses, manage the entire loan origination lifecycle efficiently. It encompasses tasks such as application processing, underwriting, credit checks, and documentation management.

Loan servicing software is essential for managing loans after they have been approved and disbursed. This software is an integral part of money lending app development and helps in handling tasks like payment processing, interest calculations, and customer communication. It ensures that loans are serviced effectively throughout their lifecycle.

To create a money lending app with interest, you need to start by developing a user-friendly interface for borrowers to apply for loans. Incorporate features for online applications, document uploads, and credit checks. Implement a robust backend system for risk assessment and interest rate calculation based on the borrower’s creditworthiness. Ensure compliance with lending regulations and provide a secure payment gateway for repayment.

Creating a money lending app involves several key steps. Begin by defining the target audience and determining the types of loans to offer. Invest in a reliable loan origination and servicing software, ensuring it caters to micro, small, and business lending. Implement strong security measures to protect sensitive financial data. Lastly, focus on a user-friendly design for a seamless borrowing experience.

Money lending apps work by providing a digital platform for borrowers to apply for loans and lenders to evaluate and approve loan requests. The lending origination software is used to process applications, perform credit checks, and determine interest rates. Once approved, the loan servicing software takes over to manage repayments, interest calculations, and customer communication. Money lending apps operate as intermediaries, connecting borrowers with lenders in a streamlined and efficient manner.

A: Typically, you can apply for a loan through the platform by creating an account, filling out an application form, providing necessary information, and submitting any required documentation. The process may vary among platforms, but it generally involves creating a profile, specifying the loan amount, and completing an application form.

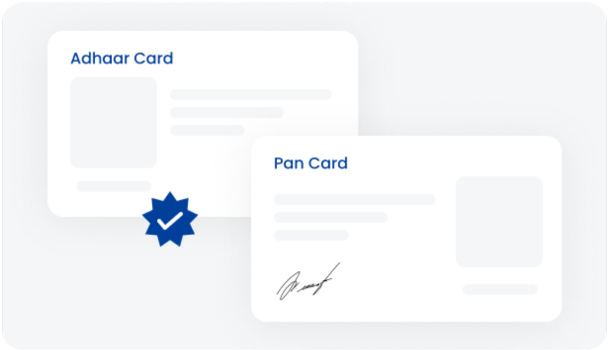

A: The required documents often include identification proof (such as a driver’s license or passport), proof of income (pay stubs, tax returns), bank statements, and sometimes additional documents based on the specific loan type or lender’s requirements.

A: Loan approval and interest rates are influenced by various factors, including credit score, income stability, employment history, debt-to-income ratio, loan amount, and the lender’s policies. A higher credit score and lower debt-to-income ratio often lead to better rates and higher chances of approval.

A: The loan approval and disbursement process typically takes anywhere from a few days to several weeks, depending on the type of loan, lender efficiency, and the complexity of the application. Factors such as required documentation, credit history, and underwriting procedures contribute to the overall timeline.

A: Many lending platforms provide an interface where applicants can log in to track the status of their loan applications. This feature allows applicants to see where they are in the approval process and if any additional information or steps are required.

A: Lenders might impose prepayment penalties or additional fees for paying off a loan early. It’s essential to review the terms and conditions of the loan to understand any potential penalties or fees associated with early repayment.

A: Lending platforms typically use encryption technologies and robust security measures to safeguard users’ personal and financial data. They might also have privacy policies outlining how they collect, use, and protect users’ information. Reviewing these policies can provide insights into data protection measures.

Dubai:

Unit No: 729, DMCC Business Centre

Level No 1, Jewellery & Gemplex 3

Dubai, United Arab Emirates

Australia:

India:

Qatar:

B-ring road zone 25, Bin Dirham Plaza building 113, Street 220, 5th floor office 510

Doha, Qatar