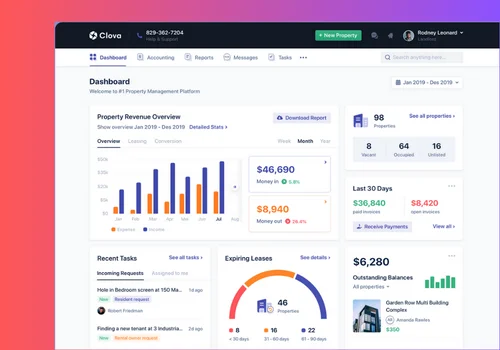

Understanding the Power of Real Estate Analytics

Welcome to the future of real estate intelligence. At SDLCCorp, we understand the dynamic nature of the real estate industry and the critical importance of making informed decisions in a rapidly evolving market. That’s why we’re proud to introduce our Real Estate Analytics platform, designed to revolutionize how you approach property management, investment strategies, and client engagement.

Whether you’re a seasoned investor, property manager, or real estate professional, our platform is your gateway to unlocking new opportunities and achieving tremendous success in real estate.Join us as we embark on a journey of innovation, discovery, and growth with Real Estate Analytics by SDLCCorp. Let’s transform your vision into reality and elevate your real estate ventures.