Introduction

The banking and insurance sectors are rapidly evolving under pressure from rising customer expectations, stricter regulations, and competition from digital-first players. Customers now expect instant, personalized, and seamless experiences beyond what traditional call centers and email support can deliver.

To stay competitive, financial institutions are turning to AI-powered chatbots and virtual assistants built with advanced AI development services that use NLP, machine learning, and automation to provide real-time support, reduce operational costs, and scale customer engagement efficiently.

Industry & Reach

Multinational financial services provider with 10M+ customers and 200+ branches.

Services

Retail and corporate banking, insurance, loans, investments, and wealth management.

Digital Presence

Strong online platforms but struggled with seamless, personalized service.

Strategies

Used AI chatbots to cut waits, link systems, and personalize service.

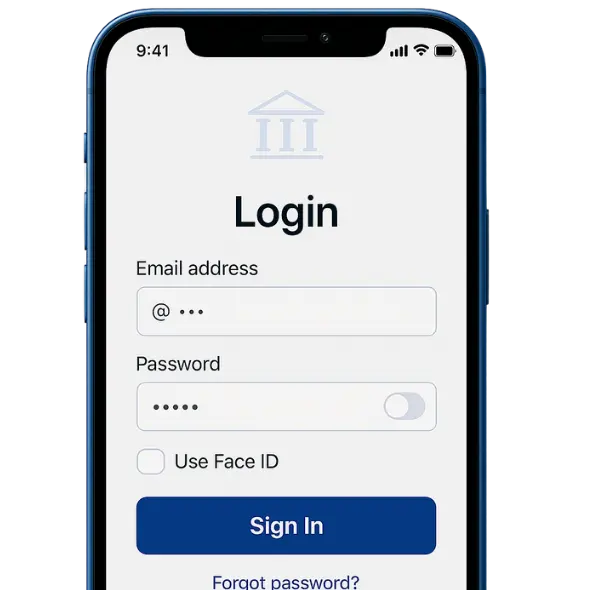

Secure Login

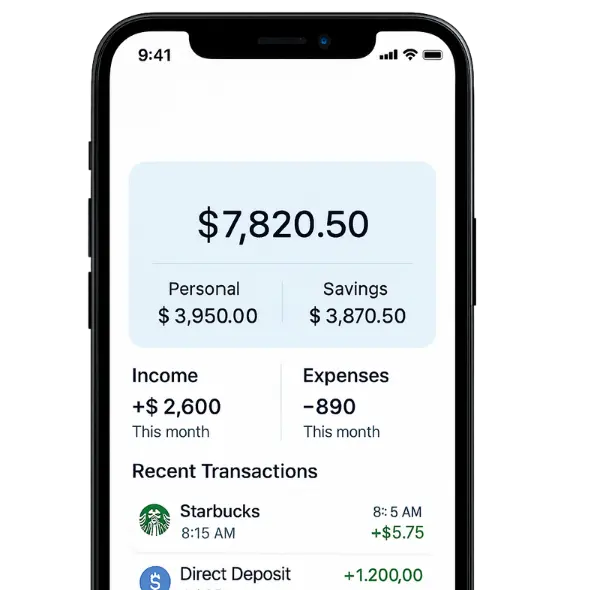

Account Overview

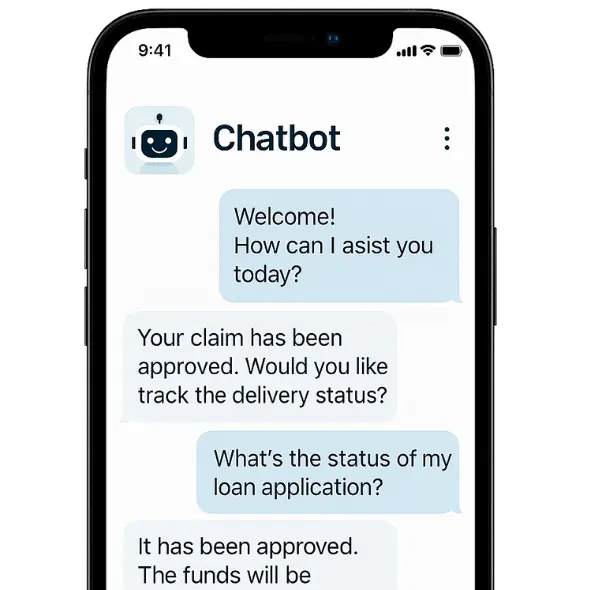

AI Chatbot Support

Insights

Project Objectives

Executives required a unified dashboard to track service performance, compliance, and AI impact. We defined four key KPIs with green-goal thresholds, enabling rapid action whenever metrics turned red to optimize workflows and customer experiences.

The initiative was designed to achieve a balance between customer satisfaction, operational efficiency, and compliance:

Deliver round-the-clock multilingual support across all channels, including apps, websites, and messaging platforms.

Automate high-volume workflows such as claim status updates, policy renewals, and loan inquiries.

Reduce call center operating costs by 30–40% while improving response times.

Create a personalized engagement experience powered by AI-driven analytics.

Ensure strict adherence to KYC, AML, and GDPR requirements for secure data handling.

Project Challenges

The project faced major hurdles, including high inquiry volumes, legacy system silos, and strict compliance needs. Limited personalization and employee resistance added to the challenge of driving AI adoption.

High Inquiry Volume

The company handled 2+ million customer interactions per month, overwhelming support teams.

Legacy System Barriers

CRM, insurance databases, and banking systems were siloed, limiting integration.

Compliance Complexity

Strict regulatory requirements demanded secure authentication, encryption, and audit trails.

Lack of Personalization

Digital channels offered generic responses, frustrating digitally savvy customers.

Employee Resistance

Teams feared automation would reduce headcount, requiring thoughtful change management.

Solutions

The company deployed a custom AI-powered chatbot and virtual assistant platform to streamline workflows, enhance personalization, and deliver enterprise-grade security. The solution was designed to integrate seamlessly with existing systems while providing a scalable foundation for future AI initiatives.

Key components included:

Conversational AI with NLP: Advanced language models enabled natural, context-aware conversations in multiple languages.

Omnichannel Deployment: The assistant was integrated into mobile apps, websites, WhatsApp, and IVR systems.

Workflow Automation: Automated claim initiation, loan eligibility checks, and payment reminders reduced manual workloads.

System Integration: APIs connected CRM, banking, and insurance platforms for real-time updates.

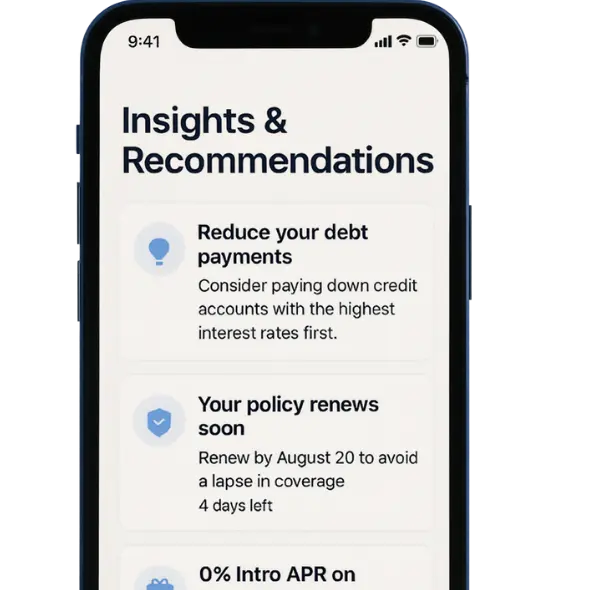

Personalized Recommendations: AI-powered analytics enabled tailored cross-sell and upsell offers.

Enterprise Security: Multi-factor authentication, encryption, and audit logs ensured regulatory compliance.

Development Process

The project followed an agile six-phase approach, from identifying use cases to full deployment, ensuring seamless integration and continuous improvement.

Discovery & Research

Stakeholder workshops identified high-value use cases that could deliver maximum ROI.

Design & Prototyping

Conversation flows and UI/UX elements were designed for intuitive customer experiences.

Technology Selection

A scalable AI platform with integrated NLP, analytics, and automation capabilities was chosen.

Full Deployment & Training

Organization-wide rollout included employee training to position AI as a support tool, not a replacement.

Pilot & Testing

The assistant was soft-launched to a small user group for feedback and iterative improvement.

Integration & Development

APIs were developed to connect siloed systems, ensuring seamless data flow.

Development Process

The project followed an agile six-phase approach, from identifying use cases to full deployment, ensuring seamless integration and continuous improvement.

Discovery & Research

Stakeholder workshops identified high-value use cases that could deliver maximum ROI.

Design & Prototyping

Conversation flows and UI/UX elements were designed for intuitive customer experiences.

Technology Selection

A scalable AI platform with integrated NLP, analytics, and automation capabilities was chosen.

Full Deployment & Training

Organization-wide rollout included employee training to position AI as a support tool, not a replacement.

Pilot & Testing

The assistant was soft-launched to a small user group for feedback and iterative improvement.

Integration & Development

APIs were developed to connect siloed systems, ensuring seamless data flow.

Insights From Our AI Consulting Company Experts

Stay updated with the latest trends, insights, and real‑world AI use cases. Our expert‑written blogs cover everything from machine learning, automation, and agentic AI to strategic AI consulting, implementation best practices, and the role of an AI strategist in enterprise success.

Increase Lead Conversions by

30%

Empower Your Banking & Insurance Teams Now!

Results Achieved

Within a year, the chatbot delivered transformative results:

- 40% decrease in call center volume, saving millions in operational costs.

- 50% reduction in claim processing time—from 7 days to 3 days.

- 30% increase in lead conversion rates due to targeted recommendations.

- 95% intent recognition accuracy, enabling the assistant to handle 1.5M+ monthly interactions autonomously.

- 24/7 multilingual availability, improving accessibility for global customers.

- 25% NPS improvement, reflecting stronger trust and satisfaction.

Our Clients’ Experience With Us

From startups to global enterprises, we’ve helped businesses unlock real value through AI and digital innovation. Here’s what our clients say about partnering with us. Their success stories, our collaboration with an expert AI consultant, and the impact we’ve achieved together.

SDLC CORP guided our team through an AI discovery sprint, mapped key use cases, fixed messy data, and delivered a clear step-by-step roadmap. Thanks to their work, executives now green-light projects faster and engineers move from idea to pilot without delays.

Overall Satisfaction

We hired SDLC CORP’s AI consultancy to automate document review with NLP. They built and trained a model in weeks, plugged it into our workflow, and walked staff through daily use. The system now flags errors on its own and cut processing time by more than half.

Overall Satisfaction

SDLC CORP audited our machine-learning models for bias and drift, added explainability tools, and set up alert dashboards. Compliance audits now finish sooner, regulators like the clarity, and our data science team trusts model performance day to day.

Overall Satisfaction

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)