- CASE STUDY: CROWDINVEST

CROWDINVEST

CROSS-BORDER INVESTMENTS

Build a cross-border crowd-investing and fundraising web platform for campaign creation, investor onboarding, deal discovery, and secure investing workflows

- Compliance-First Onboarding

- Deal Discovery + Data Room

- Secure Investing + Admin Controls

FinTech · Alternative Investments

Web Platform · Secure Workflows · Integrations

Launched Nov 2023

2,000+ Users (Investors)

COMPLIANCE & TRUST IN CROSS-BORDER INVESTING

Crowdinvest needed a compliant, trust-first platform for cross-border investing that keeps deal evaluation structured and governance transparent

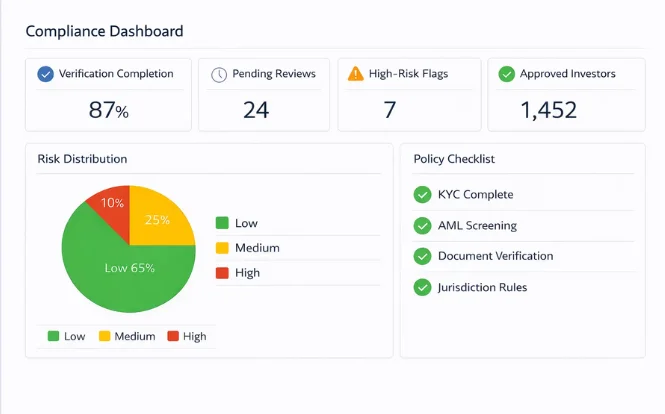

- Compliance-ready onboarding and investor safeguards

- Structured deal discovery + documentation in one place

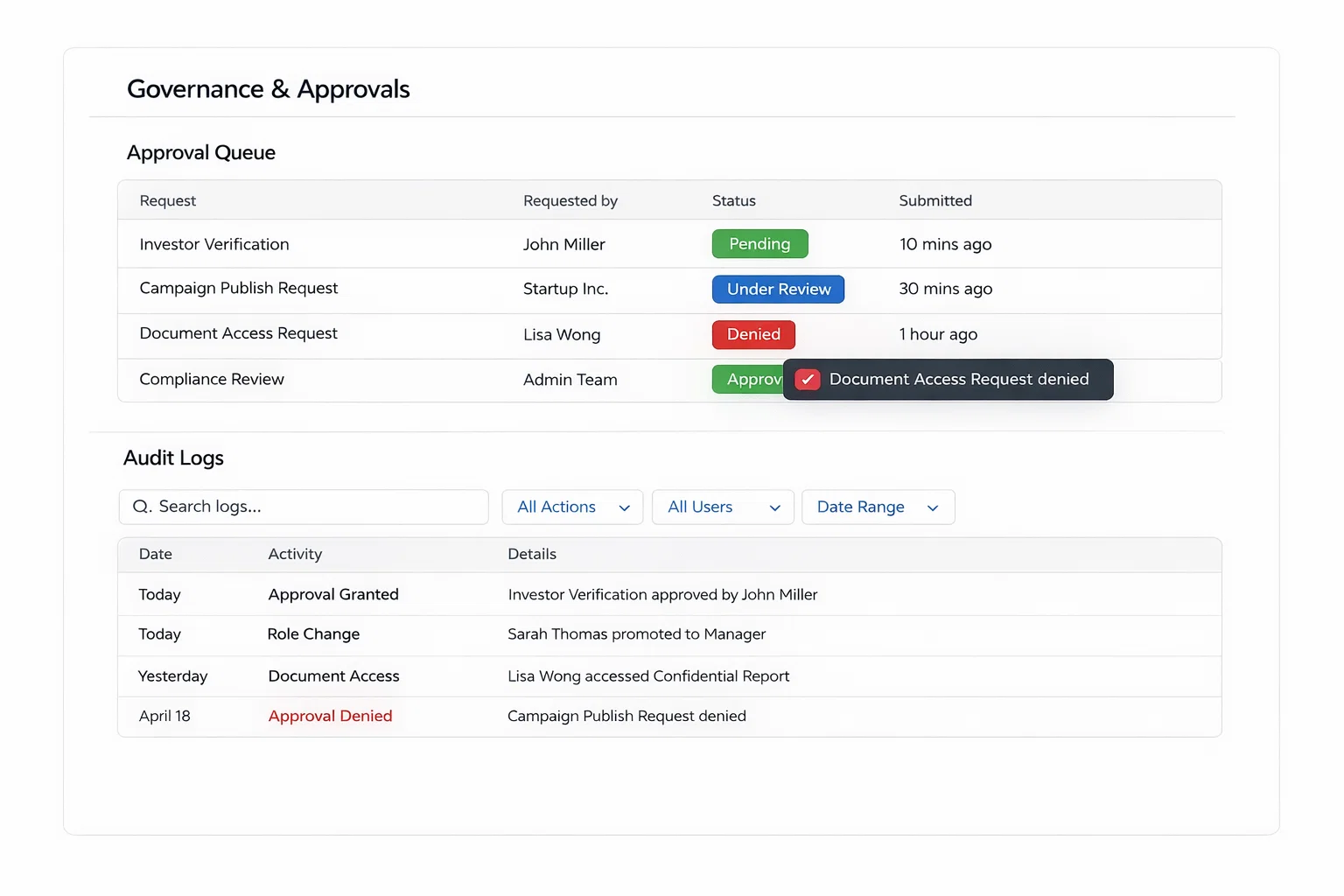

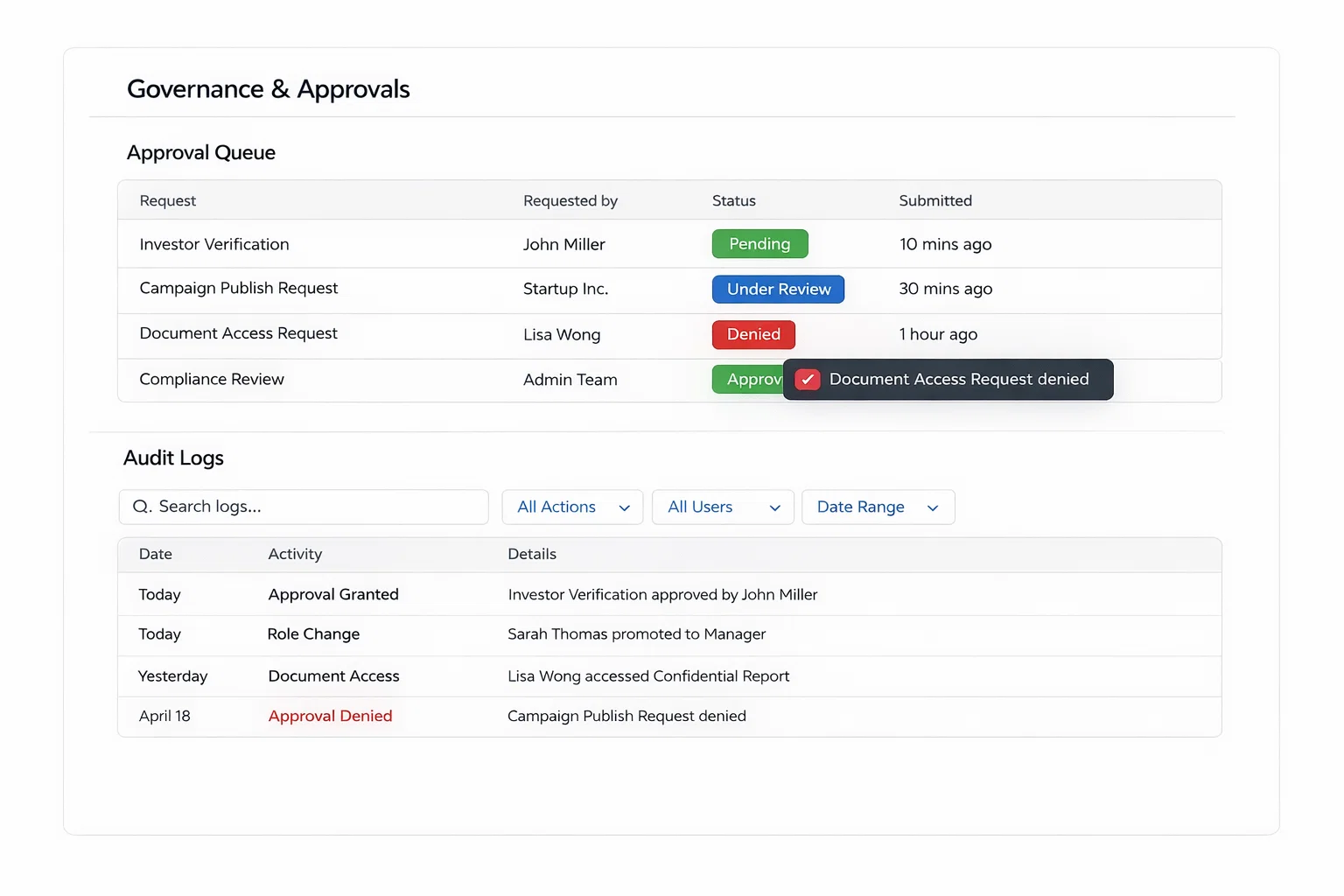

- Clear campaign governance, approvals, and audit-ready activity logs

2,000+

INVESTORS

5+

Countries

WEV3.0

smart-contract

Problem Mapping and Technical Response

Mapped cross-border investing end-to-end and built a compliance-ready, trust-first platform with structured workflows and admin oversight.

- Cross-Border Complexity

Multiple markets, stakeholders, and workflows need clarity.

- Compliance Readiness

Investor safeguards and disclosures must be handled carefully.

- Deal Evaluation Friction

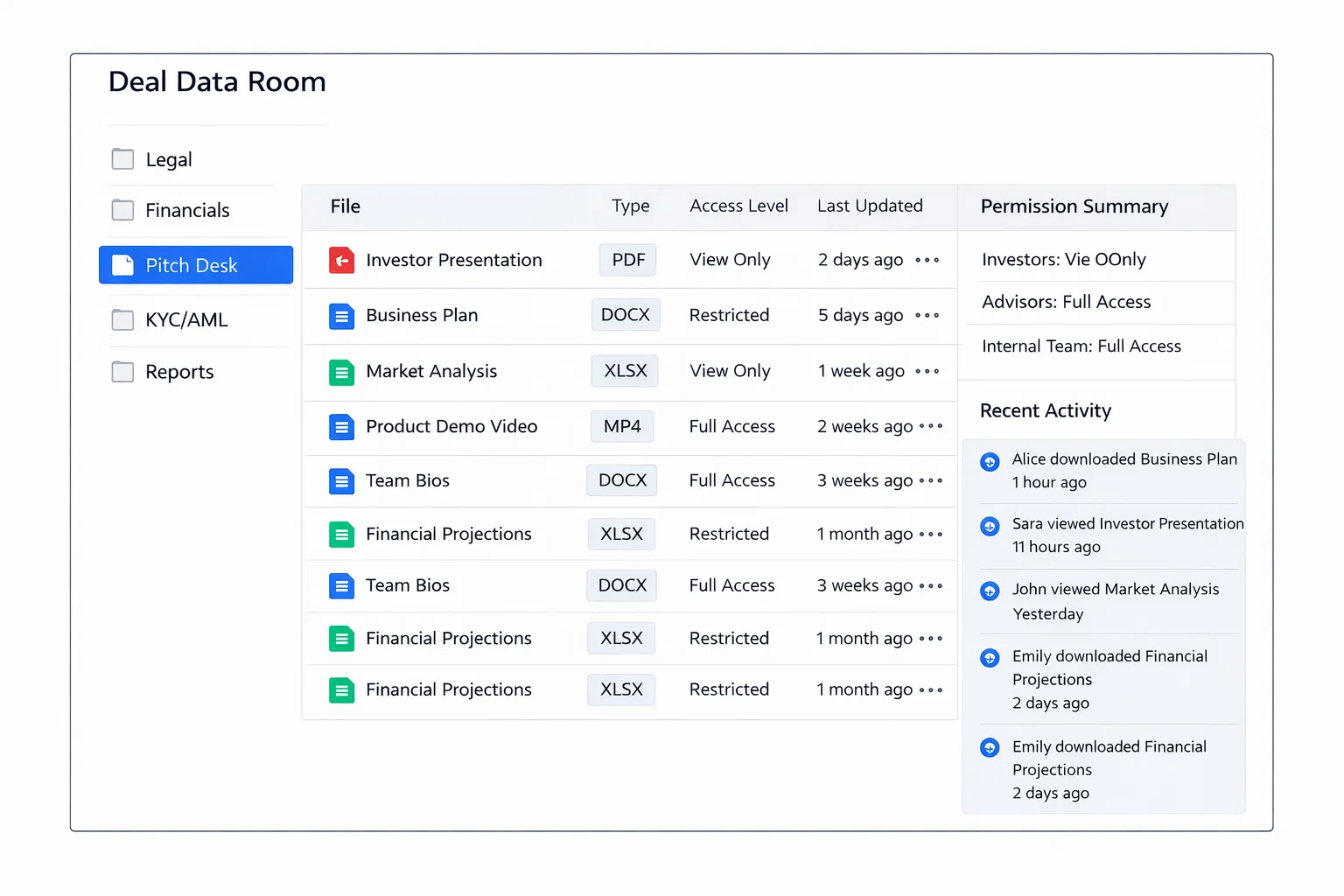

Deals need structured information and documentation.

- Governance Transparency

Ownership/SPV governance must remain clear as scale grows.

- Compliance-Ready Platform Design

Designed for regulated workflow readiness

- Structured Deal Room

Standardized deal discovery and documentation flow.

- Governance-First Architecture

SPV/cap-table governance modeled for transparency.

- Scalable Foundation

Modular architecture designed for growth, reporting, and future integrations

CROSS-BORDER INVESTING & FUNDRAISING PLATFORM

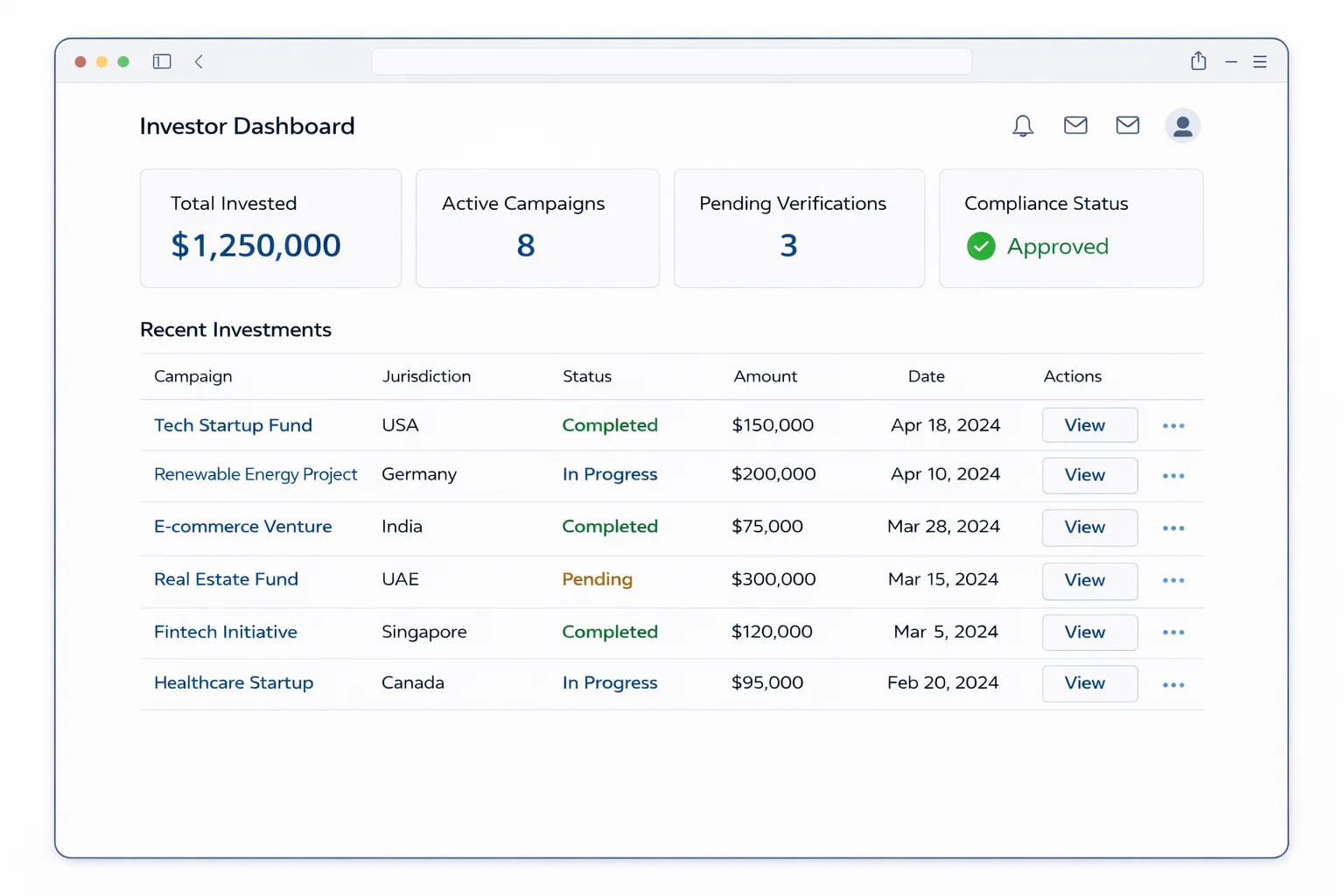

- Investor Experience

- Invest with confidence

- Cross-border access to opportunities

- Clear, trust-first experience

- Fundraising Experience

- Fundraise with a structured approach

- Connect with a global investor community

- Blockchain-Enabled Foundation

- Campaign Creation

- Investor Onboarding

- Admin Dashboard & Controls

- Trust & Credibility

Layer

- Featured recognitions & logos

- Investor education content

- Clear Invest / Fundraise CTAs

DELIVERING MEASURABLE BUSINESS OUTCOMES

CrowdInvest needed measurable trust signals for cross-border investing—clear onboarding status, governed deal execution, and reliable production operations. We shipped a structured workflow that improves transparency for investors and control for admins.

| METRIC | BEFORE | AFTER |

|---|---|---|

| Investor Community | Limited visibility into onboarding status and live opportunities. | 2,000+ Investor Community with structured onboarding and discovery. |

| Platform Actions | Deal execution steps were fragmented across approvals and documents. | Invest + Fundraise workflow with governed actions end-to-end. |

| Credibility | Trust relied on static info with weak operational proof. | Partners + recognitions with audit-ready governance signals. |

2,000+

Investor Community

20+ admin actions

Secure Role-Based Access

5+

COUNTRIES COVERED

99.9%

High Availability Architecture

Explore Our Other Case Studies

SDLC CORP builds reliable systems with strong architecture, clean integrations, and proven results.

- Transworld

AI Document Processing for Transworld Logistics

We delivered a complete AI document processing platform for Transworld Logistics—automating invoice extraction, validation, and ERP-ready outputs with secure, audit-ready workflows.

- UX + full-stack build

- Campaign & investor workflows

- Admin dashboard + payments

- 91%

Reduction In Processing Time - 98%

Lower Error Rate

- Artyfact Ltd

End-to-End GameFi Platform

We built Artyfact’s complete web ecosystem to support its AI-driven Play-and-Earn gaming experience.

- UX + full-stack development

- Subscription & ticket modules

- Secure payments + launch-ready setup

- 99.9%

Uptime Ready - <2s

Page Load Speed - <300ms

API Response

- Contact Us

Let’s Talk About Your Product

What happens next?

- We review your requirements

- Strategy call with experts

- Clear roadmap & estimate

- NDA Protected

- Enterprise Grade Delivery

- Global Clients