FinTech Software Development Company

SDLC Corp is a fintech software development company helping banks, startups, and financial institutions launch reliable digital products faster. We design and develop secure apps for banking, payments, digital wallets, lending, trading, and more.

- End-to-end fintech software development services

- Compliance-ready architecture (PCI DSS, GDPR, AML, KYC, ISO 27001)

- High-performance, cloud-native systems

- Teams in India, serving clients across USA, Europe, and the Middle East

Brands We've Helped Transform

Why SDLC Corp Is the Right FinTech Partner

Financial platforms must deliver speed, accuracy, and strong user protection. Many teams struggle with legacy systems, compliance risks, and slow product cycles. SDLC Corp solves these challenges with proven custom software development and a clear software product development process.

We also combine mobile app development, web app development, and blockchain development to build flexible, future-ready products.

- Launch fintech products faster with reusable architecture

- Improve security and compliance from day one

- Reduce manual steps through smart automation and RPA / automation

- Scale systems with cloud-powered performance

- Deliver a smooth experience across all platforms

FinTech Software Development Services by SDLC Corp

We provide full fintech software development services covering idea validation, design, development, testing, compliance, and support.

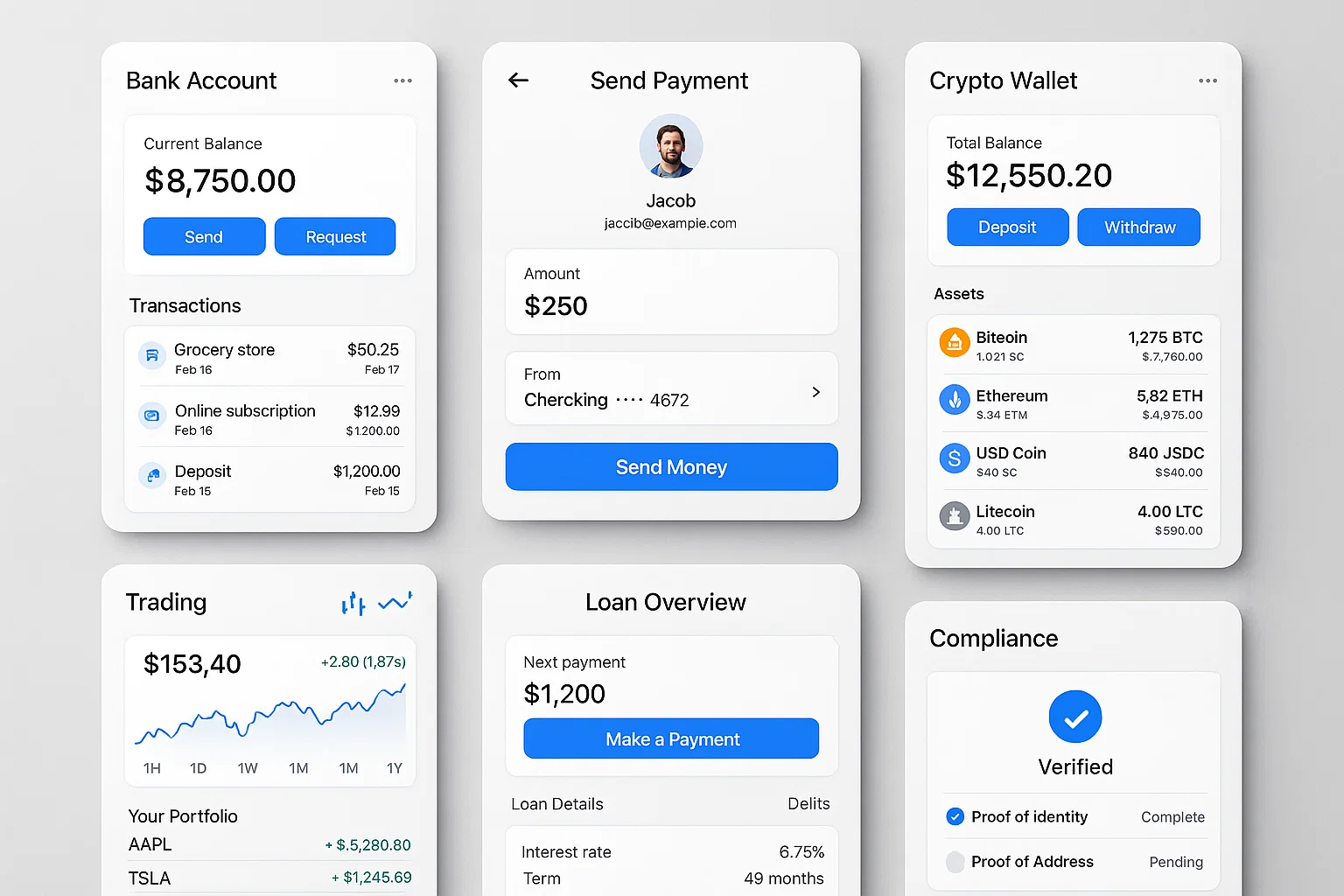

Digital Banking Software

Our digital banking platforms include account setup, onboarding, KYC flows, transfers, and dashboards. Built using our strong AI and ML services, we automate tasks like fraud checks and user insights.

Mobile Banking App Development

As a leading fintech app development company, we deliver secure mobile apps with real-time insights, QR payments, and secure messaging. These apps align with your mobile app development roadmap.

Digital Wallet & Payment App Development

We build multi-currency wallets, P2P transfers, merchant payments, and subscription billing. Our FinTech solutions also support POS, QR, and NFC flows.

Lending and BNPL Platforms

We automate loan origination, scoring, approvals, and repayments. Our systems integrate with KYC/AML vendors and fit your IT consulting services strategy.

Trading & Investment Platforms

We create platforms for real-time trading, robo-advisory, analytics, and order execution using modern AI in FinTech capabilities.

InsurTech & Policy Management

We craft insurance systems for policy management and claims, with strong integrations and data transparency.

RegTech & Compliance

Our RegTech tools automate compliance and monitoring. You can explore more on your site through compliance and security articles and our FinTech blog.

Cross-Industry Expertise

We also deliver finance-friendly systems for healthcare software development and Logistics software development when workflows overlap with payment, identity, or risk processes.

Technical Foundation, Architecture & Security

Search engines value real technical depth. SDLC Corp builds fintech products using the best technology stack and secure development patterns.

Our FinTech Development Process

SDLC Corp follows a complete software product development process that supports clarity and speed.

Discovery & Consulting

We study your goals and plan the roadmap using our structured IT consulting services.

UX/UI Design

We design workflows that simplify complex financial tasks.

Architecture

We define modules, integrations, data flows, and user roles.

Development

Our team builds frontend, backend, mobile, and APIs while following best practices from DevOps and CI/CD services.

QA & Testing

We run strict performance, security, regression, and functional tests using our QA and testing services.

Launch & Scaling

We deploy on cloud or on-prem and tune the system for stable, high-volume operations.

What Our Clients Say About SDLC Corp

SDLC Corp built a stable and secure digital banking system for us. The workflow is smooth, and compliance is handled well

Overall Satisfaction

Our payment app runs faster and more reliably now. SDLC Corp improved security and fixed our gateway issues.

Overall Satisfaction

SDLC Corp improved our lending flow and reduced approval time. The system is easy to manage and scale.

Overall Satisfaction

Start Your FinTech Project with SDLC Corp

Build a secure and scalable financial product with a team that understands banking, payments, lending, and compliance. Share your requirements, and we’ll guide you with clear steps and a reliable plan.

Our Blog Series for Logistics

Stay informed with clear and practical insights on fintech, digital banking, payments, compliance, AI, and financial software. These articles help you understand the technology behind modern finance and the impact it brings to businesses.

Frequently asked questions

1. What does a FinTech software development company do?

A fintech software development company builds digital products for banking, payments, lending, trading, insurance, and financial operations. This includes mobile apps, web platforms, APIs, automation tools, and compliance systems.

2. What FinTech solutions does SDLC Corp develop?

We build digital banking platforms, mobile banking apps, digital wallets, payment apps, lending and BNPL systems, trading platforms, InsurTech solutions, and RegTech tools. We also create custom modules and integrate with third-party services.

3. How secure are your FinTech applications?

We follow strong security practices: encryption, tokenization, MFA, role-based access, and fraud monitoring. Our work aligns with PCI DSS, GDPR, AML, KYC, ISO 27001, and PSD2 standards.

4. How long does it take to develop a FinTech product?

A basic MVP usually takes a few weeks to a few months. A full platform with complex flows, compliance rules, and multiple integrations can take several months. The exact timeline depends on your feature list and platform needs.

5. How much does FinTech software development cost?

Cost depends on scope, modules, compliance, integrations, and platforms (web, iOS, Android). MVPs cost less. Full systems with banks, payment gateways, and AML/KYC checks cost more. We share a clear estimate after understanding your requirements.

6. Can SDLC Corp integrate banking APIs and payment gateways?

Yes. We work with banks, payment gateways, KYC vendors, CRM tools, and core financial systems. Our API-first approach makes integration fast and stable.

7. Do you handle compliance and regulatory requirements?

Yes. We build systems that follow local and global regulations. We support AML, KYC, PSD2, GDPR, PCI DSS, ISO 27001, and other regional rules. Our team also sets up alerts, audit logs, and risk engines.

8. Do you provide post-launch support and updates?

Yes. We offer maintenance, monitoring, improvements, and version updates. We also support new integrations, regulatory changes, and scaling needs.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)