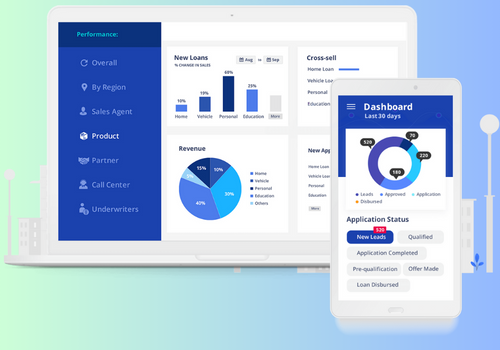

Overview Of lending analytics

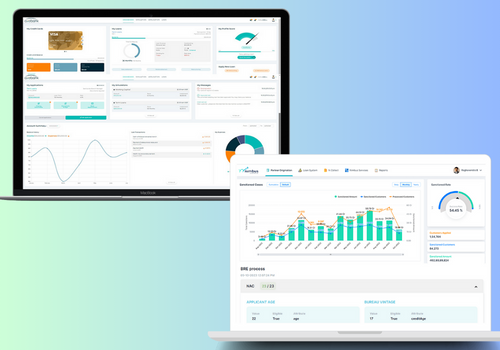

In today’s fast-paced lending landscape, data is power. Our platform offers a comprehensive suite of analytical tools designed to revolutionize the way you approach lending. Whether you’re a financial institution, lender, or borrower, Lending Analytics provides invaluable insights to optimize lending strategies, minimize risks, and drive profitability.

With our user-friendly interface and robust analytics capabilities, you’ll gain the competitive edge you need to thrive in the ever-changing world of finance. Welcome to a smarter, more efficient approach to lending with Lending Analytics.